US jobs: Don’t believe the hype

Another big upside surprise for payrolls of 4.8mn while the unemployment rate plunges to 11.1%. Great news, but it doesn't tell the whole story. 31.5mn people are claiming unemployment benefits and employment is still 15 million lower than February. Moreover, with states dialling back on re-openings the July jobs report could be far more sobering

| 4.8mn |

June increase in US payrolls |

Payrolls power on

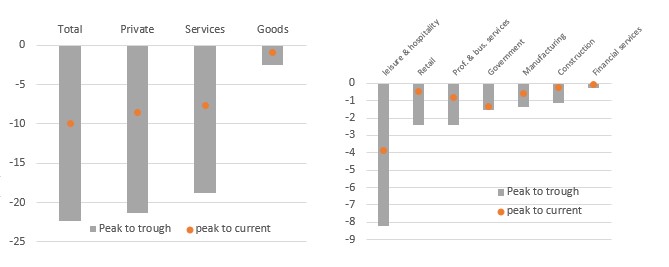

The June jobs report showed payrolls rose 4.8mn, well above the 3.23mn consensus figure while May’s payrolls gain was revised up to 2.699mn from 2.51mn. Fantastic. It shows how the re-openings have allowed businesses to get into gear and bring workers back. Leisure and hospitality was the biggest contributor, jumping 2.088mn, with retail up 740k, but there were gains everywhere including 903k for trade and transport and 568k for education and healthcare.

Payrolls change since 1940 and the level of employment 2000 onwards

Ignore the unemployment rate and wage data

The household survey shows the unemployment rate dropping further to 11.1% from 13.3%, having peaked at 14.7%. But that is not the true state of affairs and it isn’t just down to confusion over how to fill out the response form. If you dig into the jobless claims report you find that the total number of people claiming unemployment benefits in all programs rose 916.7k in the week of 13 June (coincidentally the week of the June jobs report data collection), taking the total number of claimants to 31.49mn. This is nearly double the 17.75mn “officially” unemployed based in the jobs report. Remember you have to be actively looking for work to be classified as “officially” unemployed, but you don't need to do so in order to claim benefits right now – hence the 11.1% figure is grossly understating the true picture

Rounding out the numbers we have average hourly earnings falling 1.2% month on month, which again reflects the distortions when you don’t mix-adjust the data. Millions of relatively low-paid people now earning a wage will automatically drag down the average hourly earnings rate so this number should be ignored – just like the unemployment rate.

July jobs jitters?

Even after today’s strong payrolls growth we have to remember that total employment is still 14.66mn lower than it was in February. So far extended unemployment benefits, including the US$600 per week Federal boost, are supporting incomes, but there are questions as to what happens after 31 July when this is currently scheduled to end?

Moreover, we are becoming nervous about the July jobs figure, which could disappoint markets. Today’s initial claims (1.425mn versus 1.35mn consensus) and continuing claims (19.29mn versus 19mn consensus) are remaining sticky with the initial claims figure, even today with the re-openings, more than double the worst weekly reading of any period during the Global Financial Crisis.

Meanwhile, the Homebase data report suggests the small business sector has been shedding jobs since 18 June. One possible explanation is that many small businesses that took advantage of the loan forgiveness aspect of the Paycheck Protection Program have exhausted the money. In this regard, the National Federation of Independent Businesses reported 14% of members that took advantage of the scheme are expecting to fire staff in coming weeks given demand has not returned to pre-Covid levels.

Homebase: Hourly employees that day vs. the median for that day of the week for the period Jan 4, 2020 – Jan 31, 2020 (% difference)

Structural issues suggest a long road to recovery

The bigger issue is that the spike in Covid-19 cases means several states are announcing renewed containment measures with others delaying their phased re-opening. Many businesses (leisure and hospitality in particular) may take the view that it simply isn’t viable for them to stay open, which will only add to the problems in the jobs market.

Furthermore, given the downturn in global economic activity, many manufacturing and professional service firms may also not need as many staff as they face up to the new economic environment of weaker corporate profits and higher debt levels. This is before we consider the longer term structural issues facing specific sectors such as transport, retail, commercial real estate, hospitality. So, while today’s jobs report gives a good headline, there are huge headwinds which mean a full recovery in the jobs market is a very long way off.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 July 2020

Reopening vs resurgence This bundle contains 8 Articles