US: Inflation – the ball is rolling

US producer price inflation has jumped to a 10-year high. Business surveys suggest pipeline price pressures continue to build with some surveys suggesting a greater ability to pass higher costs onto consumers. This will add to the upside risks for CPI in coming months and increasingly points to earlier Federal Reserve policy action

PPI surges as pipeline price pressure builds

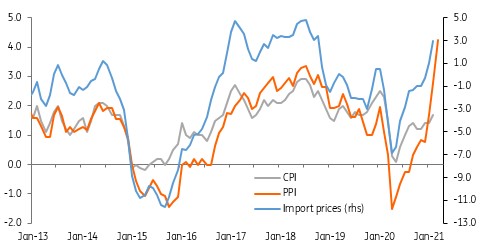

After quite a delay the Bureau for Labour Statistics reported that US PPI jumped 1% month-on-month to leave the annual headline rate at 4.2% – the highest since September 2011. This was well ahead of the consensus forecast of 0.5% MoM and while fuel costs did contribute significantly there is evidence of broadening price pressures.

Core – ex food and energy prices – rose 0.7% MoM versus the 0.2% consensus forecast, which pushes the annual rate up to 3.1%, matching the highest figure since February 2011. With commodity prices and import prices continuing to surge and ISM manufacturing and services prices paid both at their highest level since 2008 there are increasing pipeline price pressures.

At the same time the ISM reports that customer inventories are at record lows and order books are full. The implication is that manufacturers potentially have the sort of pricing power we haven’t seen in years. With greater scope to pass these price rises on to customers the obvious implication is that risks are increasingly moving in the direction of higher CPI readings.

US import prices, PPI and CPI (YoY%)

Upside risk for CPI and Fed rate hikes

Next week’s CPI is going to rise sharply. We expect it to jump from 1.7% to 2.4% year-on-year, but it is likely to get close to 4% over the summer as prices in a vibrant, re-opened, stimulus fuelled economy contrast starkly with those of twelve months before when the economy was largely in lockdown.

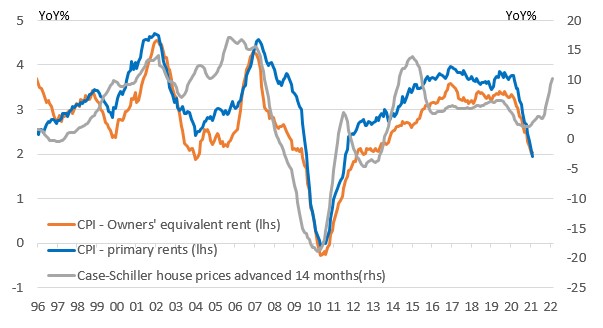

The Fed believe that inflation will then moderate, but we think that pandemic-related scarring and supply constraints will keep inflation elevated for longer than they do – as underlined by today's PPI figure. We also think that the housing components will be an increasingly important story over the next twelve months.

Primary rents and owners’ equivalent rent account for a third of the CPI basket of goods and services. Movements in these components tend to lag 12-18 months below house price developments, as the chart below shows, which means that the housing components may well be the story to watch through the second half of this year.

If these components do swing higher, as we suspect, this means inflation could stay closer to 3% for much of the next couple of years and in an environment of strong growth and rapid job creation it adds to our sense that risks are increasingly skewed towards a late 2022 rate hike rather than 2024 as the Fed currently favours.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article