US inflation points to 25 basis point Fed moves from now on

US inflation shows price pressures are easing, yet in an environment of a strong jobs market, the Federal Reserve will be wary of calling the top in interest rates. A 25bp hike in February is likely with a further 25bp in March. Inflation will slow even more meaningfully in 2Q though, with the prospects for 2H rate cuts looking strong as recession bites hard

Inflation clearly slowing

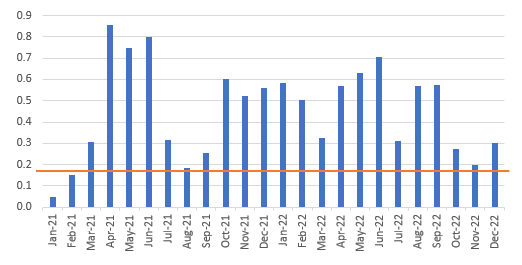

December US CPI has come in exactly in line with expectations at -0.1%MoM/6.5%YoY for headline and 0.3%MoM/5.7YoY for core. The deceleration continues after headline had peaked at 9.1% year-on-year in June and core at 6.6% YoY in September. We still aren’t below the 0.17% month-on-month threshold that over time would get us to the Fed’s 2% YoY target, but the last three months of data are a notable step down from the 0.5-0.6% MoM average seen through the second and third quarters of 2022, giving the Fed justification to raise rates by 25bp from now on.

Core MoM inflation readings and the key 0.17% MoM threshold to get to 2%

Shelter remain the main upside influence, but that will soon change

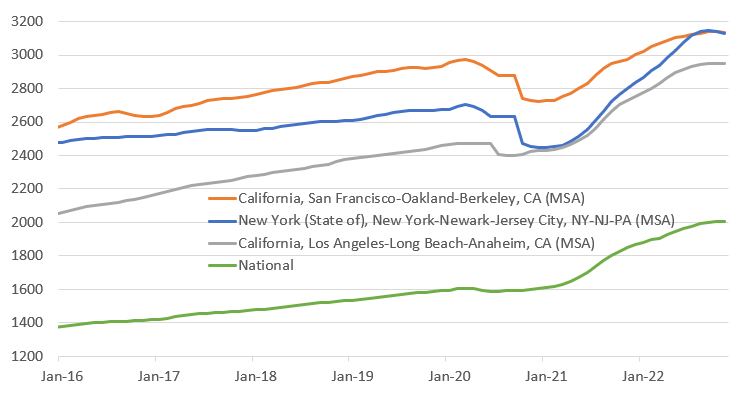

Shelter remains strong at 0.8% MoM, but with house prices having fallen through the second half of 2022 and rents now topping out nationally, that will slow rapidly from the second quarter of this year onwards. New (-0.1% MoM) and used vehicles (2.5%) are falling and that will intensify in the months ahead as demand falters and production continues to rise thanks to improved supply chains. Medical care (+0.1%) will also remain depressed by the BLS medical insurance cost calculations through to September having risen 0.4-0.8% MoM pretty consistently through 2022.

Zillow observed monthly rents $

The Fed has emphasised services ex shelter given the importance of wage costs in what remains a tight jobs market. The story here looks fine too with airline fares falling and recreation rising just 0.2% MoM with education/communication up 0.1% MoM. Apparel was the strongest component outside housing, rising 0.5%.

As such it looks as though housing is the main issue keeping core CPI above that important 0.17% threshold. That will soon change so we believe there is enough here for the Fed to opt for a 25bp hike in February – Fed voter Pat Harker suggested such a move “will be appropriate going forward” immediately after the release. Nonetheless, given the strength of the jobs market, officials will remain cautious and likely heavily hint at a further 25bp hike in March.

5% Fed funds top by March

We think that will mark the top for rates (5% Fed funds ceiling) with housing, vehicles, medical and weak corporate pricing power allowing inflation to moderate more significantly through the second quarter. In this regard, the National Federation of Independent Business produces a series for the proportion of businesses expecting to raise their prices over the coming quarter. It is collapsing as worries about the economy intensify. The chart below points to core inflation (both PCE deflator and core CPI) dropping to somewhere between 2-3% YoY by late summer.

NFIB survey points to steep decline in core inflation pressures over the summer

But meaningful rate cuts in the second half are our base case

With both the manufacturing and service sector ISMs in contraction territory, the National Federation of Independent Business optimism survey below the low point hit in the pandemic and the Conference Board’s measure of CEO confidence at its weakest level since the depths of the Global Financial Crisis the prospects for the economy are not looking good.

As such we are strongly of the view that with inflation slowing rapidly and recession looking inevitable the second half will witness meaningful rate cuts, possibly as much as 100bp.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article