US inflation at a 40-year high and the only way is up

Consumer price inflation hit a new 40 year high and will soon get close to 9% as businesses' surging commodity and labour costs get passed onto consumers. The Russia/Ukraine situation creates uncertainty, but the US economy has strong momentum and looks resilient. We look for six 25bp fed funds rate hikes this year

| 7.9% |

US inflation rateFebruary |

US CPI hits 7.9%

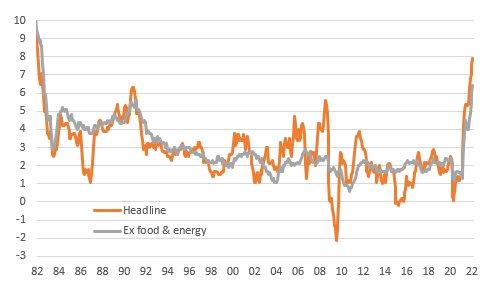

The US consumer price index rose 0.8%MoM in February, which leaves the annual rate of inflation at 7.9%, a new 40 year high. Food rose 1%MoM% and energy was up 3.5%MoM so stripping this out this gives core inflation of 0.5%MoM/6.4%YoY. All this is exactly in line with market expectations.

US annual inflation rates over the past 40 years (YoY%)

Inflation caused by strong demand and supply constraints

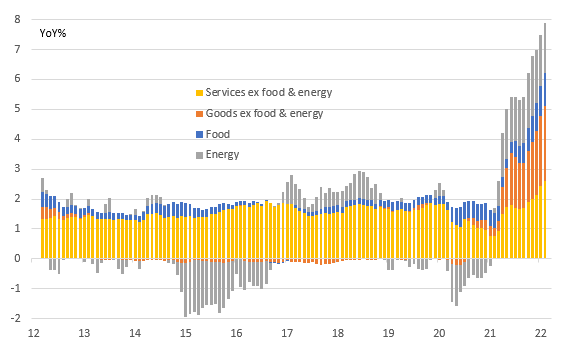

The details show broad-based price pressures with housing shelter costs up 0.5%MoM, recreation and clothing both up 0.7%MoM with “other goods & services” up 1.1%MoM. Once again education (0.0%MoM) and medical care (0.2%) were on the softer end of the range, but this month they were joined by new vehicle prices (+0.3%) and used vehicles (-0.2%). These transport components have been a key factor pushing annual inflation higher since the pandemic struck and the annual rates of 12.4% and 41.2% are still huge, but it could hint that some improvements in supply chains are starting to take the heat out of the market.

While supply chains strains and labour shortages are a key story behind inflation, we also have to remember that strong stimulus supported demand is also a reason. As the chart below shows, goods price inflation is incredibly strong and the fact retail sales are currently 24% higher than they were in February 2020 underscores that point.

Contributions to headline annual inflation (YoY%)

Corporate pricing power is huge

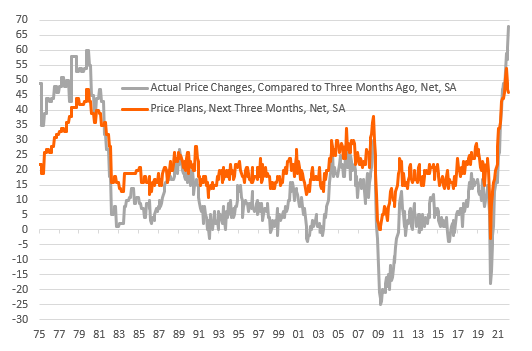

In this strong demand environment, corporate pricing power is at multi-decade highs so cost increases that businesses are experiencing can be passed onto customers. The chart below shows that the National Federation of Independent Businesses reported the broadest range of companies are raising their prices – a net 68% hiked them last month and we remain close to the record for the proportion of companies expecting to raise them further in the coming three months. Inflation is going to remain way above 2% throughout the year.

NFIB survey shows the broadest range of companies are able to raise their prices

Inflation rapidly heading towards 9%

In the near term, inflation will head even higher. The surge in gasoline prices to $4.25/gallon from the February average of $3.50 will be enough to push headline inflation above 8.5% in March. Additionally, the rising cost of labour and agricultural and metal commodities will inevitably translate into higher input costs for businesses. In a strong corporate pricing environment as highlighted by the NFIB chart, it will get passed onto consumers in the coming months so we cannot rule out inflation hitting 9%.

This will erode spending power and is likely to translate into weaker consumer activity than otherwise would have been the case. Nonetheless, the economy does have strong momentum and is creating jobs in significant numbers. Given there are more than 1.7 vacancies for every unemployed person in America, corporates are clearly desperate to hire and are prepared to raise wages to get workers so incomes will continue to grow.

Six rate hikes for 2022 despite Russia

In this environment, the Fed has clearly indicated they will raise the fed funds rate 25bp next week with a series of rate rises likely despite the uncertainty caused by Russia’s invasion of Ukraine. We wouldn’t be surprised to see maybe two FOMC members vote for 50bp. It is obviously difficult to call how the geopolitical backdrop will evolve, but our central case is for five additional 25bp rate hikes this year, taking the fed funds range to 1.5-1.75% by year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 March 2022

A global power struggle This bundle contains 9 Articles