US inflation hits a near-40 year high

US inflation pressures continue to intensify and broaden across the economy. “Transitory” is dead and the Federal Reserve will take a more assertively hawkish stance at next week's FOMC meeting

| 6.8% |

Annual rate of US inflation |

Record breakers...

US headline inflation has risen 0.8%MoM, leaving the annual rate at 6.8%, the highest since March 1982. Core (ex-food and energy prices) increased 0.5%MoM so its annual inflation rate is now 4.9% – the highest since October 1984. This is exactly in line with market predictions, but there were certainly fears we could have seen a 7%+ figure today.

Annual rates of US inflation

Big rises in key components

In terms of the usual suspects as the key inflation drivers, we saw housing rise 0.5%MoM with the key rental components gaining 0.4%MoM in a lagged response to surging home prices and the impact on city rents as people returned to the office. Used car prices then rose 2.5%MoM due to the dearth of new vehicles, which themselves increased 1.1%. We then had hotels and air travel rise 2.9% and 4.7%MoM respectively due to bumper Thanksgiving holiday plans relative to last year. Food prices rose 0.7%MoM while there was a solid 1.3% jump in clothing. The weakest components were recreation (-0.2%), education (0.0% and medical care (0.2%).

Used car prices have much more upside

Price pressures broaden and intensify

Further increases are likely in the annual rates, especially core, which will likely get up to 6% YoY and we expect to see price pressures continue to broaden out across the country. The National Federation of Independent Businesses shows the highest proportion of companies since the beginning of the 1980s were raising their prices over the past three months and the highest proportion ever expect to raise prices over the next three months.

NFIB survey highlights the breadth of price increases across American companies

Fed forced into action

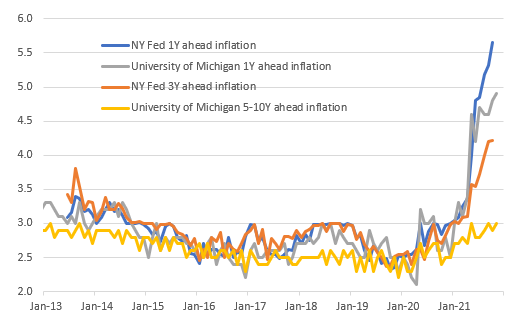

The concern at the Fed will be that high inflation today can fuel expectations of higher inflation tomorrow and the day after that and so on. This can then feed through into wage demands and in an environment of decent corporate pricing power we see those costs post onto customers. The Fed will be keen to avoid this (or be seen willing to tolerate it), hence our expectations for a faster taper next week, with the programme concluding in February. We also expect them to signal the prospect of two rate hikes in their “dot plot”, up from the one they currently have.

Inflation expectations continue to climb

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article