US inflation has peaked, but it will be a long slow descent

US inflation has slowed marginally in April thanks to a fall in used car prices and gasoline. Fed rate hikes will bring demand into better balance with supply, but in the absence of major improvements in supply chains, labour shortages and geopolitical tensions the descent back to the 2% target will be slow

| 8.3% |

Annual rate of inflation for April 2022 |

Inflation finally slows

In the immediate aftermath of the pandemic amid plunging energy, air fare and hotel prices, inflation bottomed at 0.1% year-on-year in May 2020 and has been on a rapid climbed to 8.5% ever since. Today though, the annual rate of US consumer price inflation has slowed from 8.5% in March to 8.3% in April. The core rate, which excludes food and energy prices slowed marginally more to stand at 6.2% versus 6.5% in March.

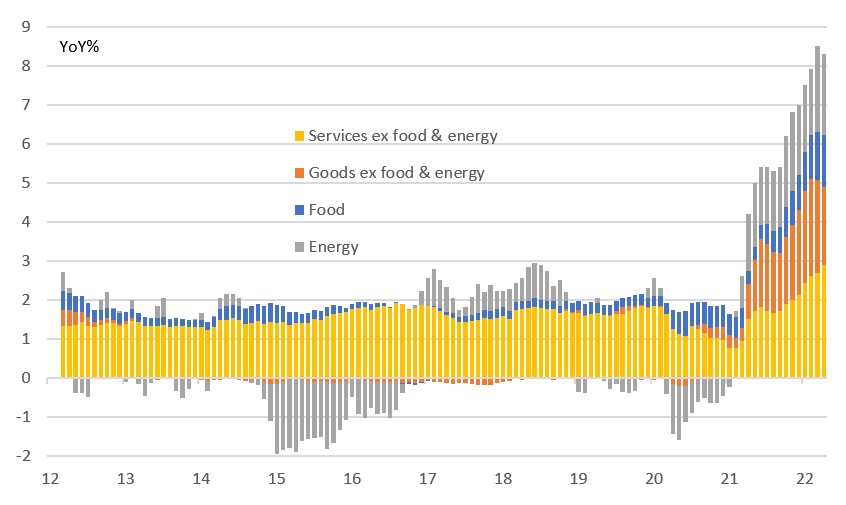

While this was in line with our forecasts, the market had been looking for a larger moderation with consensus forecasts of 8.1% for headline CPI and 6.0% for core. The details show energy prices fell 2.7% month-on-month on lower gasoline costs, but this will be fully reversed next month given gasoline is back at all-time highs. Used car prices fell 0.4% MoM, not as much as hoped given the Mannheim car auction data, while apparel fell 0.8% after a strong series of price hikes. Everything else was firm though with food prices rising 0.9% MoM, new vehicles up 1.1% and primary rents (0.6% MoM) and owners' equivalent rent up 0.5% MoM. Airline fares jumped another 18.6% MoM! The chart below shows the contributions and clearly shows there is a moderation in core goods prices (orange bars), but this is being offset to a large extent by the service sector (yellow).

Contributions to annual US inflation

Past the peak?

We think that March 2022 will have marked the peak for annual inflation. Mannheim used car auction prices are down 6.4% over the past three months so used vehicle prices should fall further and they have quite a heavy weight of 4.1% of the total basket of goods and services within CPI. The shift in consumer demand from goods, whose availability has been significantly impacted by supply chain issues, towards services should also contribute to a gradual moderation in the rate of inflation. Nonetheless, we remain nervous about the impact from gasoline and the growing price pressures within services.

Moreover, substantial declines in the annual rate of inflation are unlikely to materialise until there are significant improvements in geopolitical tensions (that would get energy prices lower), supply chain strains and labour market shortages. Unfortunately, there is little sign of any of this happening anytime soon – The Russia-Ukraine conflict shows no end in sight, Chinese lockdowns will continue to impact the global economy while last Friday’s jobs report showed a decline in the labour force participation rate leaving the economy with 1.9 job vacancies for every unemployed person in America.

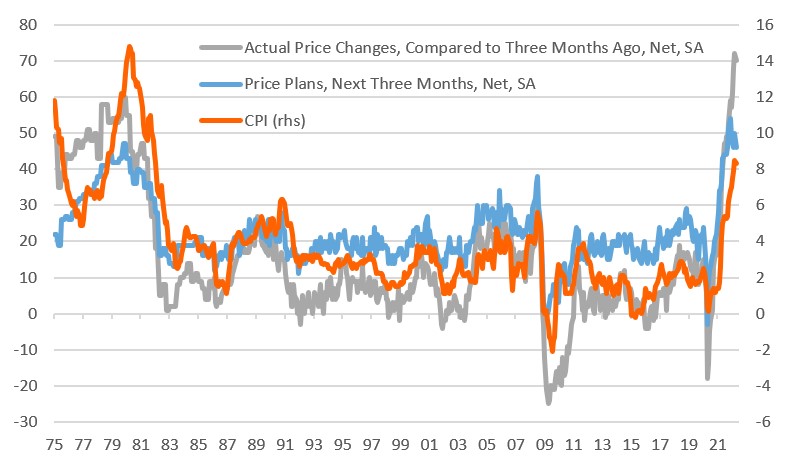

At the moment consumer demand is firm and businesses have pricing power, meaning that they can pass higher costs onto their customers. This was highlighted by yesterday’s National Federation of Independent Businesses survey reporting that a net 70% of small businesses raised prices over the past three months, with a net 46% expecting to raise prices further. We haven’t seen this sort of pricing power for the small business sector before and we doubt it is any weaker for larger firms.

NFIB survey shows firms can continue to pass higher costs onto customers

Housing will make inflation especially sticky

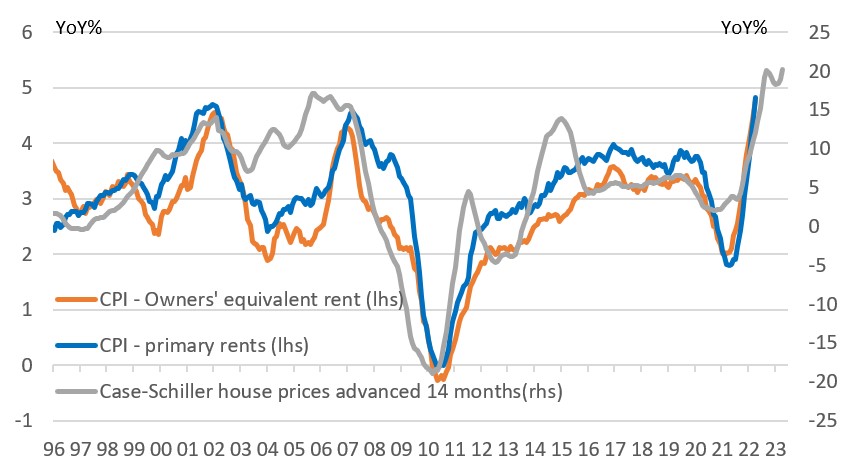

Furthermore, the housing market remains red hot and this feeds through into primary rents and owners’ equivalent rent (OER) components of inflation with a lag of around 12-18 months. Rent contracts are typically only changed once a year when your contract is renewed so it takes time to feed through while OER is a based on a survey question for what you would rent the house you own out for. Homeowners may not necessarily closely follow the month-to-month changes in the housing market so there is a delayed response. As the chart below shows, the housing components, accounting for more than 30% of the CPI basket, are not likely to turn lower soon.

No reason to expect an imminent turn in rent components

Fed has a lot more work to do

This situation intensifies the pressure on the Fed to hike interest rates. The central bank wants to take some of the heat out of the economy and bring demand back into better balance with the supply capacity of the US economy. This potentially means aggressive rate hikes and the risks of a marked slowdown/recession.

This message was re-affirmed by several officials over the past couple of days and we look for 50bp rate hikes at the upcoming June, July and September FOMC meetings. With the Fed running down its balance sheet we expect the Fed to revert back to 25bp from November onwards with the target rate peaking at 3.25% in early 2023.

Even with this Fed action and hopefully some improvements in the supply side story we have doubts that CPI will get back to 2% target before the end of 2023.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more