US inflation: Follow the core

US headline inflation was depressed by the plunge in energy prices, but we should be focusing on the core rate, which will be pushed higher by rising labour costs in the months ahead

Goods versus services

Headline inflation for December was, as widely expected, dragged lower by the plunge in gasoline prices seen through the fourth quarter. It fell 0.1% month-on-month in December, leaving the annual rate of US inflation at 1.9%, the lowest since August 2017. However, the core rate, which excludes the volatile food and energy components, has risen 0.2% MoM and 2.2% year-on-year, and remains above the Federal Reserve’s medium-term target.

In terms of the big categories, energy prices fell 3.5% MoM because of those gasoline price declines, which in turn contributed to a 2% MoM drop in transportation costs, while tobacco prices fell 0.4% MoM. Contributing on the upside, food posted a relatively hefty 0.4% MoM rise, while recreation jumped 0.6% MoM (sewing machines up 7.1% MoM and sporting goods up 4%!!) and medical care was up 0.3%.

US headline inflation (YoY%)

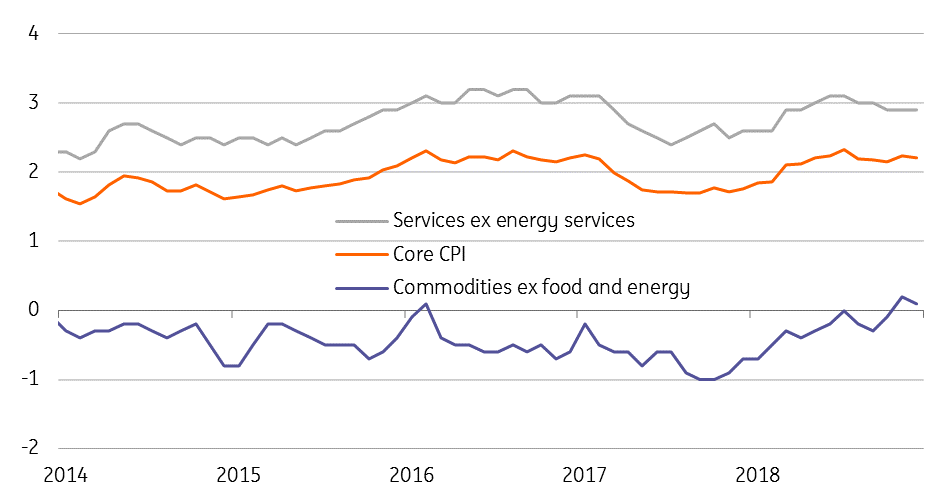

The divergence between goods and service sector inflation continues thanks largely to the energy story, but it does too when we exclude that key component. Goods prices ex- food/energy (0.1% YoY) have to a certain extent been depressed by the strong dollar, but the shrinking amount of spare capacity in the economy means it has been grinding higher. Meanwhile, prices of services ex-energy (2.9% YoY) are being pushed higher by wage growth, given that labour is a major cost input and the competition for workers is intense.

Core inflation (YoY%)

Labour market pressure to push core inflation higher

The US economy does face more economic headwinds this year, but the strength in the jobs market provides strong underpinning while the 68 cent/gallon plunge in gasoline prices is an annualised $100 billion boost to household cashflows. As such, we expect consumer demand to remain firm this year and that gives businesses the pricing power to pass on higher costs.

Given the US economy is dominated by the service sector and the biggest cost input is labour, wage developments will be a significant driver of core inflation. With the National Federation of Independent Business reporting that 39% of firms can’t fill the vacancies they currently have- an all-time high- we suspect wage inflation will continue to push higher this year. Likewise, non-wage benefits (vacations days, signing bonuses and health and pension benefits) will also add to business costs. As such we see core inflation continuing to push higher, rising above 2.5% this summer.

The Fed isn't finished…

Fears over trade policy continue to dominate financial market sentiment, but if progress can be made in the China-US talks that extend the current tariff ceasefire (or possibly even see a resolution) then there is scope for a re-pricing of the outlook for Federal Reserve policy. We agree that there is likely to be a “pause” in 1Q19, but with growth looking respectable – above 2% - and where core inflation will soon be up above 2.5%, we believe the Fed will hike interest rates again in the summer.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article