US inflation continues to run too hot, but there are glimmers of hope

Another 0.4% MoM print for core CPI means that inflation is still running far too hot for the Federal Reserve to relax. Nonetheless, there are some signs that service sector price pressures are moderating so a June Fed pause look likely. With corporate pricing power flagging and shelter costs topping out, we could see core CPI in the 2-3% range by year-end

Inflation is tracking too high, but that could soon change

So both the headline and core US CPI month-on-month prints came in at 0.4% in April, as expected. Favourable rounding means that the annual rate of headline inflation slows to 4.9% from 5% (consensus 5%), while the annual rate of core inflation drops to 5.5% from 5.6% as predicted. Remember we peaked at 9.1% for headline inflation in June last year and 6.6% for core inflation in September, so we continue to move in the right direction. However, MoM CPI prints of 0.4% are well above the 0.17% MoM rate we need to average over time to bring the annual rate of inflation down to 2%, hence the Fed won’t be incentivised to sound dovish just yet.

Nonetheless, the encouraging story in the details is that services ex-energy, ex-housing appears to be softening with used cars the biggest upside driver of MoM inflation (rising 4.4% MoM). The Fed has made a big play of focusing on the services ex-energy and housing as this is where the tight labour market could keep upward pressure on wages and it is in these sorts of services where that is most likely to feed through into pricing. A quick number crunch suggests it came in at around the 0.2% MoM rate, which as mentioned previously, is a key metric that would allow the Fed to relax more about inflation.

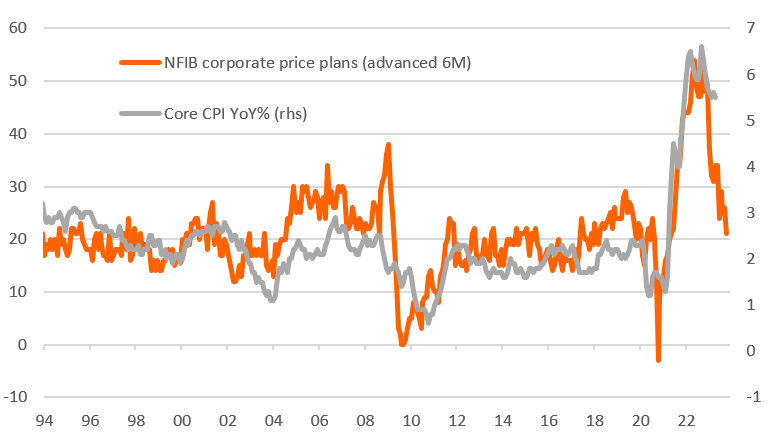

Weakening corporate pricing power points to core CPI returning to 2.5% by year-end

Slowing shelter and weakening corporate pricing power to be the big themes in the second half of 2023

In terms of the outlook, while we don't think the Fed will need to see 2% annual inflation achieved before considering rate cuts, we do need to be consistently hitting 0.2% or 0.1% MoM. That is possible, we think, late in the third quarter into the fourth quarter given the clear topping out in housing rents, which should be increasingly reflected in the shelter CPI components as we head into the third quarter (shelter is over 40% of the core CPI basket), and weakening corporate pricing power.

Indeed, yesterday's National Federation of Independent Business survey of price plans for US businesses recorded another sharp slowdown – a five-point decline in the proportion of companies expecting to raise prices in the coming three months, with the index back at historical long-run averages – with the index consistent with core CPI dropping to around 2.5% year-on-year by year-end. That may be a little optimistic, but if unemployment is starting to rise at the same time as 0.2% MoM core CPI prints, the Fed's dual mandate of price stability and maximum employment can justify moving interest rates lower from restrictive levels.

If, as we fear, the combination of lagged effects of 500bp of Fed rate hikes and significantly reduced credit availability, as highlighted by the Fed’s Senior Loan Officers’ survey on Monday, do slow the economy sharply and unemployment starts to rise, the momentum will increasingly swing towards rate cuts. Right now markets are pricing a 25bp cut as soon as September. That may be a little early, but we think November and December are looking decent bets for the Fed moving policy to a more neutral setting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article