US inflation: a long way to the top

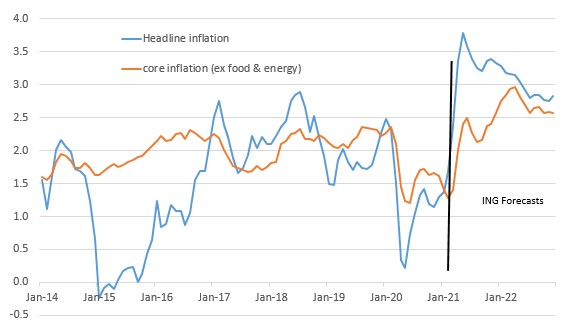

Headline US inflation has risen from 0.2% year-on-year last May to 1.7% today, but it is barely half-way to the 3.5-4% area where we see it peaking. While officials remain broadly relaxed, we believe inflation could remain elevated through next year, potentially triggering the Fed into earlier action on interest rates than they are currently signalling

| 1.7% |

February headline annual inflation |

Headline rises 1.7% YoY, but core inflation is more benign

Headline consumer price inflation rose 0.4% month-on-month or 1.7% year-on-year, which was in line with market expectations as higher gasoline prices pushed the energy component up 3.9% MoM. However, the core rate, which excludes the volatile food and energy components was a tenth softer than expected, rising only 0.1% MoM or 1.3% YoY.

This lower than expected outcome is seemingly due to a 0.7% MoM fall in apparel prices and a third consecutive 0.9% MoM decline in used car and truck prices. Most other components experienced price rises in a 0.1%-0.3% range, although recreation jumped 0.6%, which could reflect optimism on the reopening of the economy.

The softer core outcome is likely to be what the market focuses on and it should help to ease some of the bond market anxieties about inflation, but we suspect it will only be a temporary respite.

Inflation: the real climb starts now

Inflation has been gradually rising since 2Q20, but there will be a step change in March and April with the economy in a very different position to what it was 12 months before.

With improved distribution efforts the US is vaccinating nearly three million people a day and with hospitalisation numbers dropping, governors are reopening their states. This will gather momentum through the second quarter now that President Biden has assured us that enough vaccines will be available for all American adults by the end of May.

Consequently, headline inflation is set to hit 3% in April as prices in a vibrant, reopened, supply constrained economy contrast starkly with those of 12 months before when the situation looked dire.

Add in rising commodity, energy prices and freight costs that are still working their way through into CPI we expect to see inflation rise above 3.5% in May and June, possibly briefly touching 4%.

US annual inflation with ING forecasts

The key question: How long will it last?

Federal Reserve Chair Jerome Powell, and his predecessor, current Treasury Secretary Janet Yellen, don’t think it will be sustainable and we agree that 4% inflation isn’t sustainable. For that we would need to see considerable wage inflation coming through very quickly, which doesn’t seem likely when there are 9.5 million fewer people in work than before the pandemic.

That said, we are a little less relaxed than Jerome Powell who only last week suggested that high inflation readings will be “transitory” and the notion of “deeply ingrained” low inflation will not fade fast. We are of the view that inflation could stay in a 2.5-3.5% range for the next couple of years which, if correct, implies more upward pressure on longer dated Treasury yields.

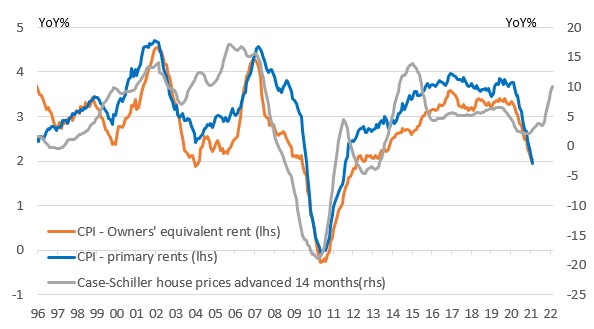

Strong growth, more pricing power… and watch out for housing costs

Our more bearish inflation forecast is likely due to our significantly higher than consensus GDP prediction of 6.5% for 2021 and 4.7% for 2022 and our sense there will be lingering supply issues that improve corporate pricing power. It is also heavily influenced by the one-third weighting of housing-related items within the inflation basket.

A reopening economy that is benefiting from pent-up demand, a much improved household balance sheet, a $1.9tn fiscal stimulus coming after nearly $4tn last year and likely followed up by a $3tn+ Build Back Better infrastructure programme plus ongoing support from monetary policy, to us, suggests vigorous growth. It also likely means that the economy will be able to recover all of the lost jobs due to the pandemic well before the end of 2022.

This strong demand will then crash into initial supply constraints in many industries – think restaurants and bars that have gone out of business, airlines that have laid off pilots, companies needing to rework office space, hotels that need to train staff etc. That supply capacity cannot be rebuilt overnight and this means more corporate pricing power that will keep inflation higher for longer.

A prolonged period of rising energy and commodity prices won’t help either. Note that the NFIB (National Federation of Independent Buisness) survey suggested that a net 34% of small businesses have plans to hike prices in the next three months, matching figures not seen since briefly in the summer of 2008. You then have to go back to the late 1970s to find a higher proportion of companies looking to raise prices.

Rising house prices will translate into higher CPI housing inflation

Then there is the heavy weight of housing within the basket of goods and services. Primary housing rents and owners’ equivalent rent account for a third of the inflation basket. As the chart above shows, official house price changes tend to lead these housing components by around 14 months. Consequently, we strongly suspect that these housing components will turn higher soon and contribute positively to inflation for a significant period.

The labour market is in a very different position to 2010

A final point to consider when looking at medium-term US CPI risks is that while there is significant spare capacity on the basis of employment being down 9.5 million on February 2020, employers don’t seem to be experiencing it.

The same NFIB small business survey showed that a record 40% of American small businesses had job openings they couldn’t fill. With Federal unemployment benefits being uprated to $300/week (as part of the $1.9tn stimulus) and extended out to September, on top of state benefits that average $347 per week, this could mean employers increasingly have to raise wages to try and fill positions.

This is a very different labour market to what we saw as we emerged from the Global Financial Crisis over 10 years ago and again suggests inflation moves higher for longer.

NFIB survey suggests rising prices and a lack of available labour = higher wages

Forcing the Fed's hand

While the Federal Reserve remains relaxed, the bond market is understandably less confident that inflation will stick rigidly to 2% over the medium term. The prospect of inflation staying higher for longer argues for upward moves higher in longer-dated Treasury yields – 2% is an obvious next target, particularly if we start to hear some movement on QE tapering.

We also think this backdrop means it will be increasingly difficult for the Fed to argue that they will be leaving rates on hold until 2024. This is likely to remain the implication from next week’s updated Fed dot plot diagram, but we would not be surprised to see a few Fed officials start to move that forward into 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article