US inflation - a dip before three?

Lower US inflation may help calm markets, but this drop will be temporary. Three percent inflation looks possible by summer

Energy will drag on inflation - but this is just a blip

One of the factors cited for the recent correction in global equity prices has been a delayed realisation that inflation pressures are rising and that we may see monetary policy “normalised” more quickly than thought. This has been a global story. The recent spike in US wage growth received a lot of the blame, but there have been other reasons too, such as stronger European growth.

Markets have since calmed and may take more comfort if, as we suspect, consumer price inflation actually moves lower. Wednesday's CPI release is likely to see annual core inflation (excluding food and energy) dip modestly from 1.8% to 1.7% while headline CPI could drop to 1.9% from 2.1%.

| 1.9% |

Forecast for January inflation

|

The drop is mainly because energy prices rose more modestly in January 2018 than they did in January 2017, so it is primarily a statistical effect than anything meaningful. We also saw an outsized increase in transportation in early 2017 that we don’t expect to be repeated this year.

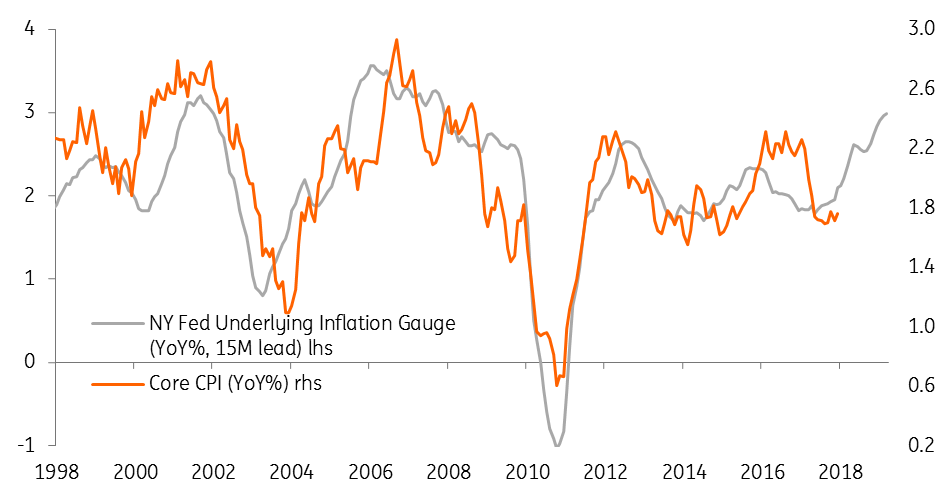

These declines are likely to be only temporary though. We believe headline inflation will be back above 2% in February and could hit 3% in June. Core inflation is also likely to rise sharply and be back above 2% as early as March. The factors behind this include rising oil prices, dollar weakness pushing up import costs, distortions relating to cell phone data plan charges dropping out of the annual comparison and slight increases in healthcare and housing costs. Note too that the New York Fed’s underlying inflation gauge, which is actually a predictive model using both data and market indicators, is producing numbers similar to our own forecasts.

NY Fed model points to higher core inflation

Rising wage growth and core inflation adds upside risk to our Fed rate hike call

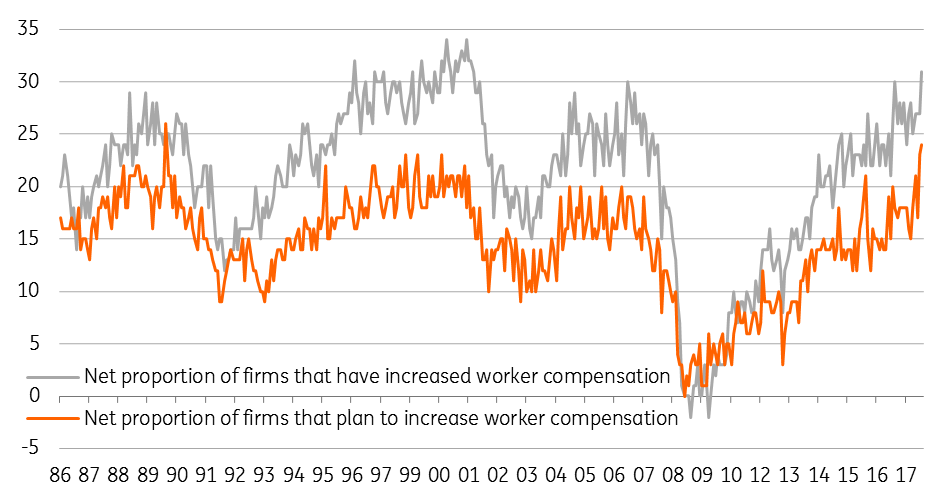

We also have to remember that the strength in economic activity is adding to price pressures. There is very little slack in the economy with the recent jump in wage growth likely to be an early warning sign. We suspect wages will rise further. The National Federation of Independent Businesses' survey showed that the net proportion of small businesses raising worker compensation is at its highest since 2000 while the net proportion of firms planning to raise worker pay has not been higher since 1989.

Given strong consumer demand, corporates have decent pricing power and are likely to pass these higher costs on through their prices. So while there might be some respite for markets this week with a subdued inflation reading, it is unlikely to last. Indeed, we still see more upside risks to our forecast for three Federal Reserve rate hikes this year.

NFIB survey suggest pay is on the rise at fastest rate for more than a decade

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article