US: In defiance of markets

Despite the ongoing uncertainty, the US economy continues to prove the doubters wrong. 1Q GDP outperformed, jobs growth remains strong, consumer optimism is high and wages are rising. The case for rate cuts remains weak in our view

Never underestimate the US economy

We have long talked about the intensifying headwinds to growth that the US faces this year. These include the fading support from fiscal stimulus, the lagged effects of higher interest rates and the stronger dollar together with uncertainty caused by trade protectionism amidst a weakening global growth story. However, you should never underestimate the US economy and yet again it proved the doubters wrong by posting 3.2% annualised growth in Q1.

The naysayers continue to look for the negatives

This is a remarkably strong performance since as recently as early March there were analysts suggesting a negative quarter was possible given the gloom surrounding the global economy and the fallout from the Dec-Jan government shutdown. The naysayers continue to look for the negatives though and highlighted the fact that inventory building contributed 0.65 percentage points of the 3.2% total growth with trade adding an extra 1 percentage point to growth.

This relates to the aborted tariff hike on Chinese imports that was scheduled to come in on January 1st. US businesses ramped up imports in the latter part of 2018 to beat the proposed tariff hike and correspondingly cut orders for the start of 2019. As such imports fell in 1Q while exports held up. Of course, the tariff hike wasn’t implemented so imports are likely to rise back in the second and third quarters. Inventories have swung around for the same reason and we agree that both of these components will become drags on overall growth.

Nonetheless, the domestic demand story is very positive. The jobs market remains strong with another 263,000 jobs created in April and unemployment dropping to 3.6% - a 50 year low. The lack of available workers with the right skill sets is an increasing challenge for companies with the National Federation for Independent Businesses reporting that 38% of its members have vacancies they cannot fill.

Wage are responding to the tight jobs market

Consumer spending could rebound strongly

This demand-supply imbalance in the jobs market is boosting pay to some extent, but not by quite as much as we had expected. Pay rose 0.2%MoM, that’s 3.2%YoY in April, but given the competition for workers, we expect pay to continue grinding higher. It is important to remember that businesses are increasingly using non-wage benefits to attract and retain staff with increased vacation days, improved pension and healthcare packages and signing bonuses being used according to the latest Federal Reserve Beige Book.

Consumer spending should make a significant contribution to 2Q GDP growth

With workers feeling secure in their jobs and receiving pay rises and improved packages it isn’t surprising to see consumer confidence rising once again. Equity markets are close to all-time highs and the plunge in mortgage rates also helps. The one negative is the recent rebound in gasoline prices, which is a highly noticeable hit to household cash-flow. Nonetheless, real incomes overall are rising and this should keep consumer spending supported. Indeed we wouldn’t be surprised to see consumer spending rebound by 3.5% after the modest 1.2% growth rate recorded in Q1.

We are also a little more optimistic about residential investment in the second half of the year. This component has been a drag on overall growth for five consecutive quarters, but the plunge in mortgage rates has prompted a surge in mortgage applications and is starting to be seen in housing transactions.

Mortgage applications surge as rates plunge

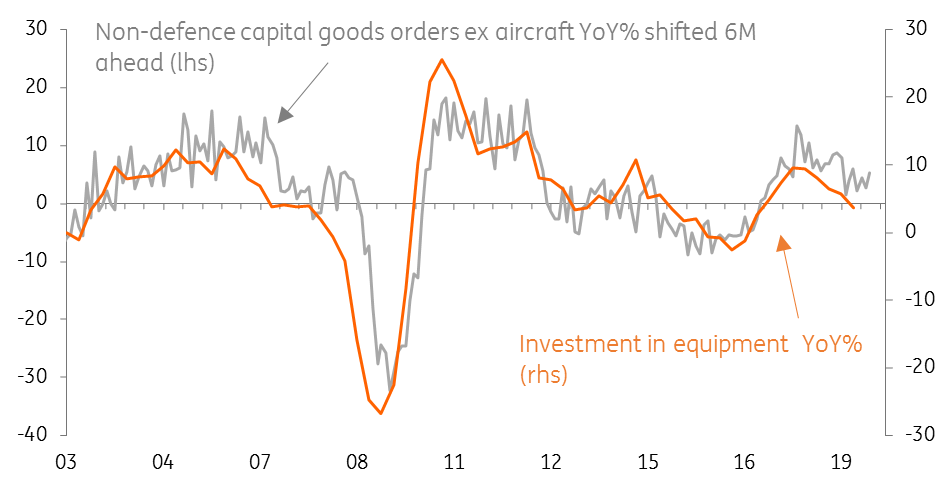

The news on the corporate sector has been a little more mixed with the ISM surveys moving lower, but they remaining firmly in growth territory. That said the core durable goods orders numbers have been moving higher recently, pointing to an improving outlook for investment.

The outlook for investment is improving

Trade is a key issue

Trade remains a key issue for corporate America and equity markets, particularly now that President Trump has upped the ante with an increased level of tariffs on Chinese goods. However talks continue and while there may not be any imminent breakthrough, we think a deal will most likely be agreed that will see them removed together with a more general easing of tensions in Q3.

Both sides would be hurt economically by tariff hikes. China admittedly more so, but US equity markets would likely suffer too, just as we saw through late 2018. A weaker economy, deteriorating sentiment and plunging stock prices would play into the hands of President Trump's opponents as he seeks reelection. We see this more as a way to try to force China into last-minute concessions, rather than something more long-lasting and economically-damaging. Nonetheless, tensions could get worse before they get better, given the President is set to decide on whether to proceed with tariffs on foreign car imports.

The combination of the much stronger 1Q GDP growth and the robust domestic story, offset by the impact of renewed trade tensions on balance leaves us with a slightly stronger 2019 full-year growth forecast of 2.5% (vs 2.4% previously). We have kept our 2020 and 2021 forecasts unchanged.

We see no reason for the Fed to cut rates this year

As for inflation, we think the market is being a little too relaxed regarding the prospect of a pick-up. Rising labour costs in the form of both wages and other benefits could be passed onto consumers while higher energy price will feed through into other components. Gasoline prices have jumped 30% from $2.23/gallon in mid-January to $2.88 today and this will soon start to be felt in transport fares and distribution costs.

We think the bond market is too negative and we expect the Fed to keep rates unchanged in 2019

For now, the market is of the mindset that inflation will remain low, growth will slow and the Fed will need to respond by cutting interest rates later this year. We disagree. Given the decent activity story, the improvement in financial conditions and the prospect of rising inflation we see little reason for the Federal Reserve to cut interest rates – assuming of course that the trade tensions are resolved before too long.

The political angle

As for politics, it is early days in the 2020 presidential election race, but competition for the Democrat candidature is certainly hotting up with Joe Biden officially entering, but we are still a long way from the November 3rd 2020 polling day.

In our recent note ‘US Politics Watch: Presidential election 2020 and beyond’ report we highlighted what we felt were the five key swing states that will determine who wins the Presidency - all of which went to President Trump in 2016. Of course, economic performance is not the only factor that determines how people vote, but looking at the numbers for these key swing states, Michigan, Wisconsin, Pennsylvania, Florida and Arizona, it gives Donald Trump a strong platform for his re-election campaign.

All have recorded faster growth than the median state and all have experienced strong jobs markets. As such a challenger may need to focus more of their initial campaigning on healthcare, environment policy, regulation of big tech and identity politics to convince the electorate that political change is required.

This article forms part of our Monthly Economic Update which you can find here

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

May Monthly UpdateDownload

Download article

10 May 2019

May economic update: Just when things were looking up This bundle contains 9 Articles