US housing recession is already here

Rising mortgage rates and a lack of affordability are prompting a steep drop-off in demand for housing. At the same time inventory for sale is on the rise. A combination of falling transactions and prices will intensify the recessionary forces the US economy is facing

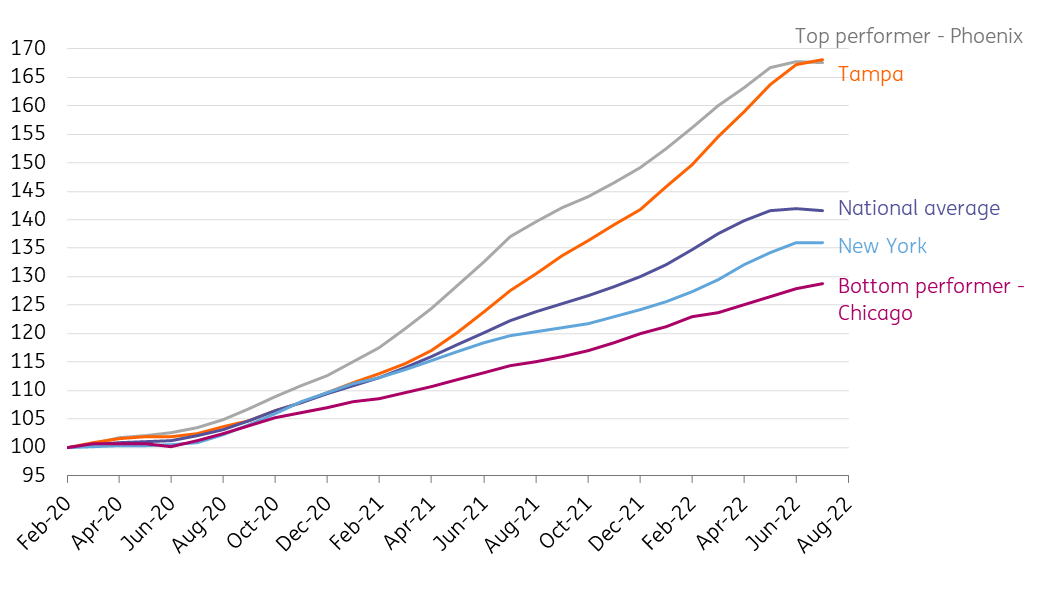

The stimulus-fueled surge in prices looks to be over

House prices nationally have increased more than 40% since the start of the pandemic as massive fiscal and monetary stimulus fueled demand for homes. Working from home has also opened more opportunities of where to live, yet at the same time, supply was limited with new construction slow to catch up.

Some hot spots in the south and west of the US have experienced prices gains of more than 60%, but even the weaker performers in the north and east of the country have seen price rises in excess of 25%. However, the demand momentum appears to be rapidly fading with affordability, amidst record prices and rising borrowing costs, the key issue. Supply is picking up too with a July month-on-month fall in prices, the first in over ten years, likely to be the start of many.

S&P Case Shiller Home price indices Feb 2020 = 100

Affordability is stretched to the limit

Rapidly rising house prices are typically associated with larger mortgage borrowing. The average new mortgage taken out for a home purchase did rise to $450,000 between January and April, but this has subsequently declined to a $413,000 average for May-September 2022, not that far above the $403,000 average for the whole of 2021. This indicates homeowner equity has been rising significantly as a proportion of the funds used to make a home purchase.

Yet the challenges for first-time buyers to save for a deposit are mounting, especially with surging inflation squeezing spending (and saving) power. Falling equity markets and tumbling bond prices are further hampering new buyers’ ability to build enough for the required deposit. Homeowners looking to trade up are in a better position, already partially owning an asset whose price is moving in the same direction, but it certainly isn’t easy.

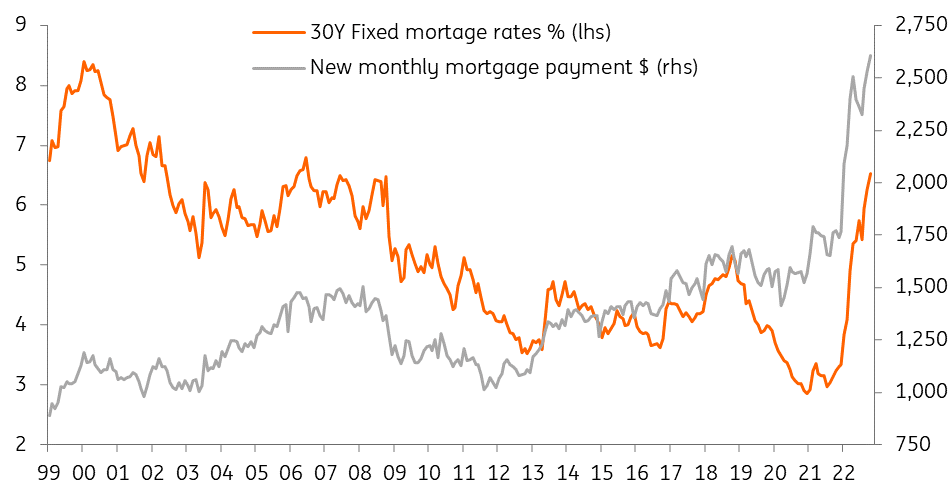

The typical 30Y fixed mortgage rate has risen from below 3% in November 2021 to 6.52% as of last week

Then there is the cost of financing a mortgage. The Federal Reserve has been raising interest rates swiftly since March as inflation continued to surprise to the upside. We expect them to raise the Fed funds target range to 4.25-4.5% by year-end from the current 3-3.25% level. This increasingly hawkish message from the Federal Reserve has resulted in longer dated Treasury yields moving sharply higher, which in turn has been the catalyst for the typical 30Y fixed mortgage rate rising from below 3% in November 2021 to 6.52% as of last week.

The combination of higher borrowing at higher interest rates means that the monthly payment on a new 30Y fixed rate mortgage at the prevailing average mortgage size and the prevailing mortgage interest rate has risen rapidly. It was $1,550 per month at the start of the pandemic when the typical mortgage size was $350,000 at 3.4% fixed for 30 years. Today it is over $2,600 based on a 30Y fixed rate mortgage for $411,700 at 6.52%.

On an annual basis this equates to 43% of the median pre-tax household income. By point of reference the typical new annual mortgage payments for a home purchase equated to 26% of median incomes in the fourth quarter of 2019 and 37% at the peak of the housing bubble in 2006.

30Y fixed rate mortgage rates and new monthly mortgage payments ($)

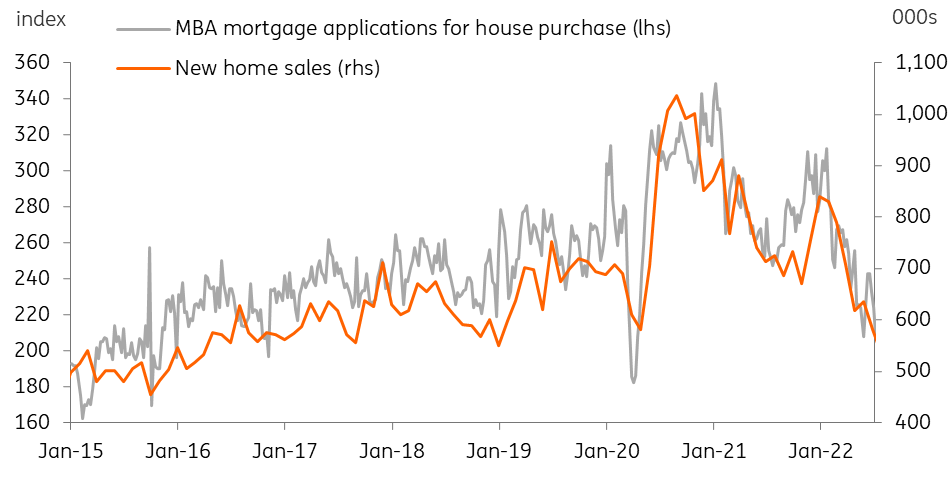

Demand is capitulating and transactions are slowing

With fewer people able to raise the money required for a deposit given inflation and financial asset price falls and then fewer people still who can afford the required monthly mortgage payments, it is little surprise that mortgage applications for home purchases have fallen more than 30% year to date. This is already translating into falling new home sales, although it must be said that the appetite of cash buyers has declined at similar rates with the proportion of cash-only transactions for new homes holding steady at 30%.

Admittedly, the new home sales number did jump 29% MoM in August as the chart below shows. It may be a late wave of buyers trying to beat the hike in interest rates or buyers taking advantage of discounts from builders since year-on-year new home price growth slowed to just 8% YoY, the slowest increase since November 2020. This could be the case of institutional investors who pay cash and are interested in taking advantage of high rents to get a financial return. However, we don’t see this as sustainable as institutional investors would normally account for only 10-15% of home sales with individual buyers by far and away the main driver of housing activity, Moreover, local governments have been pushing back against corporate landlords in many states – favouring policies to promote home ownership – while falling prices may also make the metrics less attractive for investors.

Mortgage applications for home purchases and new home sales

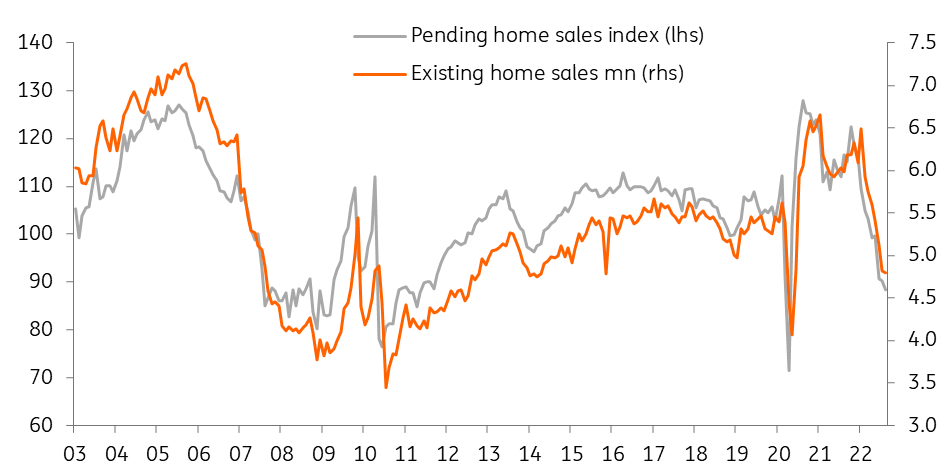

Existing home sales, which account for a greater proportion of total sales are following a similar pattern, with transactions down 26% since last November. Aside from the initial dislocation caused by the pandemic, this is the weakest transaction number since 2012 and is on a par with where we were following the bursting of the 2005/06 housing bubble.

Pending and existing home sales

Supply is on the rise

New residential construction was slow to respond to the pick-up in demand in 2020 with Covid restrictions limiting activity in the initial phase of the pandemic. Next came surging commodity costs while a lack of available workers created challenges and put-up costs. Housing starts and building permits did eventually accelerate, hitting 16-year highs at the start of 2022.

Housing starts and building permits

However, the National Association of Homebuilders Builders’ sentiment index has fallen for nine straight months as the plunge in demand combined with elevated costs to create a challenging environment. They are then faced with the problem that the slowdown in sales at a time of strong construction means that the inventory of new homes for sale has risen 64% since the third quarter of 2020. Builders are not typically in a financial position to keep their homes unoccupied, hence why prices are coming under pressure as they look to sell inventory.

Inventories of new homes

The story isn’t as dramatic in the market for existing homes, although inventory for sale has risen 50% since February to 1.28 million homes with it set to take 3.2 months to clear the backlog of homes for sale at the current rate of transactions. This is up from 1.6 months in January, but we remain below the 5.4-month average of the past 20 years.

Where this supply of existing homes is coming from is not exactly clear. With rents having risen rapidly we are unlikely to be seeing many people switching from home ownership to the private rental market while low unemployment and mortgage defaults don’t point to forced sellers. It may well be that with prices having risen so rapidly we are starting to see people who have investment properties looking to sell or there may be some people looking to downsize to smaller cheaper homes. Then of course there could be people looking to sell their home to give themselves more flexibility as future cash buyers in a weakening market.

The Fed wants a correction

So far, we have only had one monthly fall in house prices but with more supply coming on the market at a time when demand is weakening rapidly implies that prices fall further. Fed Chair Jerome Powell accepted as much in the press conference following the latest 75bp rate hike on September 21st. He warned that “we probably in the housing market have to go through a correction”, adding that “there was a big imbalance between supply and demand, and housing prices were going up at an unsustainably fast level. So, the deceleration in housing prices that we’re seeing should help bring prices more closely in line with rents and other housing market fundamentals – and that’s a good thing”.

The Federal Reserve’s forecasts indicated interest rates will be raised further with policy held in restrictive territory to constrain inflation, so there is likely to be more pain ahead for the housing market. With the US 10Y within touching distance of 4% and likely to break above we should be braced for the 30Y fixed rate mortage to soon approach 7%.

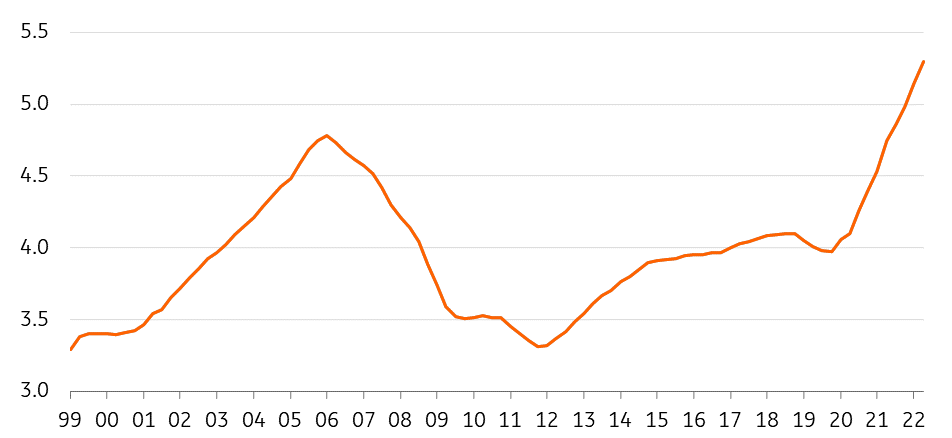

Housing valuations look very stretched right now. The median price for an existing home is 5.3 times the median level of household incomes, higher than even at the peak of the housing boom of the mid-2000s. To get us back to the long-run average house price-to-income ratio of around 4 on a three-year horizon would imply prices falling peak-to-trough by around 20% while assuming nominal incomes rise 3% in each year.

Ratio of existing home prices to median household income

Recessionary forces are intensifying

Falling transactions and falling home prices will intensify the recessionary forces buffeting the US economy. Weaker housing transactions leads to weaker activity elsewhere with construction at the forefront. On a GDP basis, residential fixed investment accounted for 4.7% of all economic output over the past 12 months. Back in the previous housing boom in 2005/06 it peaked at 6.7% before dropping below 2.5% in 2010/11 during which time the volume of residential investment output fell 59%.

There will be knock-on effects for realtors, mortgage brokers and real estate lawyers, together with movers and packers. Then there is the strong correlation between the performance of the housing market and key retail sales components such as furniture and home furnishings, electric appliances and building supplies as people look to upgrade and refresh in a new home.

Aside from the direct spending consequences, rising interest rates in an environment of falling home prices are never a good combination for consumer sentiment and will add to the chances of a retrenchment in broader consumer spending.

Negative equity and financial risks are lower than in the Global Financial Crisis

Undoubtedly many people who have bought over the past 18 months will be exposed to the risk that the value of their home falls below what they paid and may, in some cases, erode all of the equity they have in their home. In such an instance we have to expect that some homeowners cease servicing their loans, particularly if the US economy does enter a downturn and unemployment starts to rise. This will result in banks becoming more reluctant to lend with lending standards tightening, exacerbating the strains in the housing market.

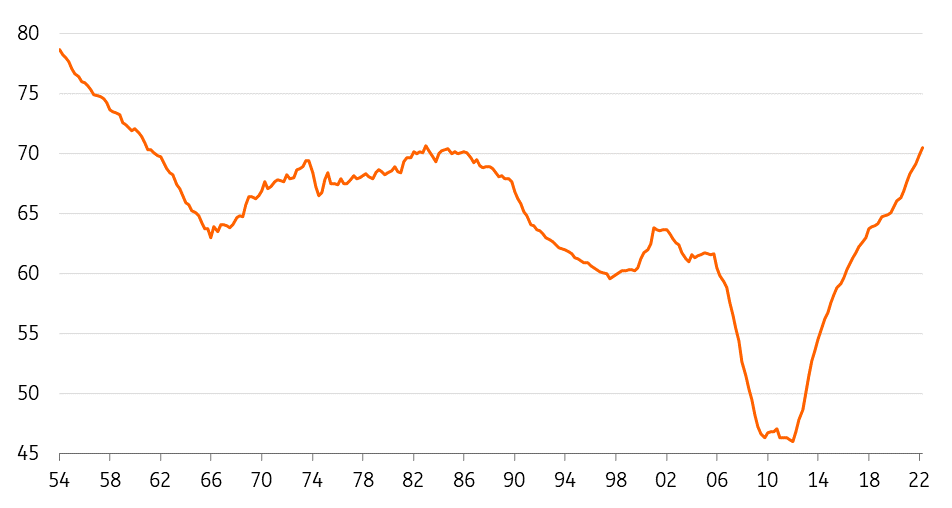

However, the broader risks appear to be small. Household balance sheets are in a healthy shape with household assets having doubled to $163tn since their pre-Global Financial Crisis peak while liabilities have risen less than $5tn over the same period to stand at $19tn. Moreover, the proportion of equity that homeowners have in their property is 70.5%, the highest since 1983, while in 2005/06 it was only 62%.

Homeowners' equity in real estate as a proportion of household real estate value

With financial regulations having been tightened significantly since the Global Financial Crisis the risk of catastrophic loan losses and major strains on the US financial system, even under a scenario of 20%+ price falls appears small. Furthermore, with the labour market in a strong position with two job vacancies currently available for every single unemployed American, we remain confident that businesses will be reluctant to implement major job losses, fearing that a swift economic rebound could mean firms having to hire back staff at much higher wage rates amid intense competition.

Housing downturn opens the door to lower inflation and lower interest rates

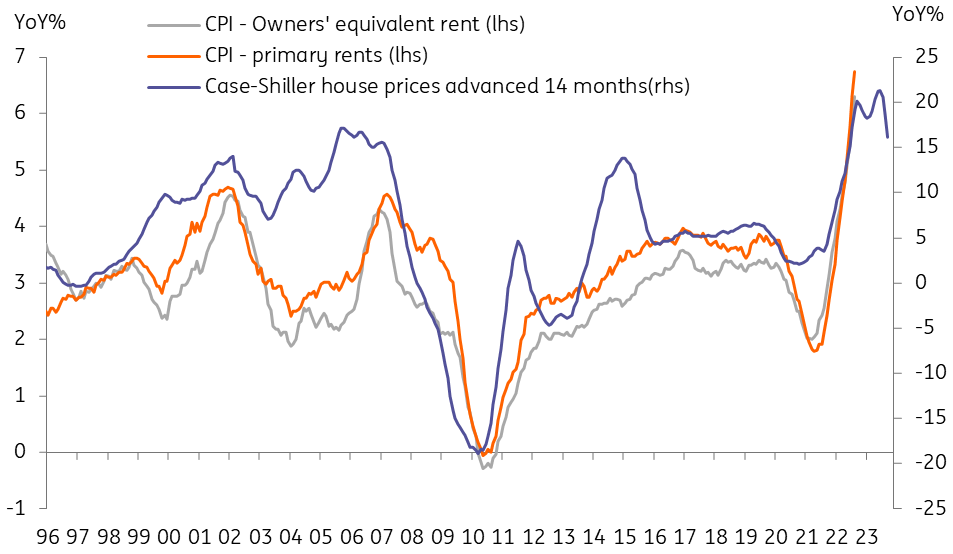

A housing market downturn will weaken the US growth story, but it is also important to remember it will dampen inflation too. Shelter is the largest component of CPI with a one-third weighting via the primary and owners’ equivalent rent components. As the chart below shows there is a lag of 12-16 months between movements in house prices and the shelter components of CPI – rents are typically only changed once a month is one reason.

US house prices suggest a turning point in shelter components of CPI

It suggests we may be soon getting to a turning point in the annual rate of change in these key CPI rent components, which if so, can meaningfully depress consumer price inflation through 2023 and likely contribute to getting the US inflation rate back towards 2% by the end of 2023. While the Federal Reserve is downplaying the possibility, we are firmly of the view that interest rate cuts will be on the table in the second half of 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article