US housing market flashing more warning signals

Recent US data has pointed to a 2Q growth rebound, but the medium-term outlook is tougher as higher borrowing costs bite. The housing market is looking increasingly vulnerable with a price correction possible. This would weaken confidence but would contribute to inflation falling more rapidly and allow the Fed to move to a more neutral position

Housing market is vulnerable to rising rates

House prices nationally have increased 35% since the start of the pandemic as massive fiscal and monetary stimulus, coupled with working from home opening up more options for where to live, fuelled demand for homes. At the same time, supply has been severely limited with construction slow to catch up.

However, the rapid rise in house prices makes it more challenging to save for a deposit, and thanks to surging inflation, real incomes are being squeezed and confidence has been suffering. On top of this, the latest housing data shows that this sector is the most vulnerable to the rising rates environment with the growing prospect of a slowdown and potential correction in coming quarters.

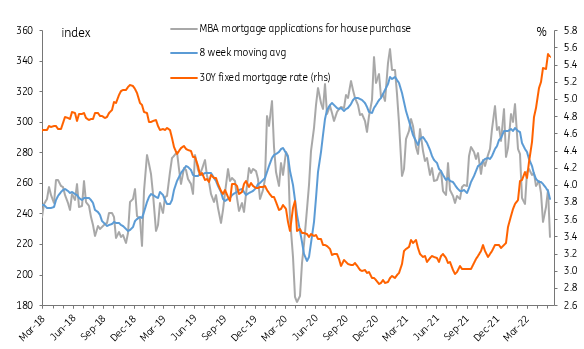

Mortgage applications are plunging as borrowing costs surge

Home sales look set to fall as mortgage applications collapse

Yesterday's NAHB home builder sentiment fell much more than expected on lower prospective buyer traffic. This has been underscored by this morning's MBS mortgage application numbers for a home purchase. It reported an 11.9% drop in the past week (-35% from the Jan 2021 peak) as rising mortgage rates bite hard in an environment where affordability is a massive issue. This suggests new home sales dropping below an annualised 600k in the next month or two versus 1mn in early 2021.

New home sales set to drop sharply as buyer interest dries up

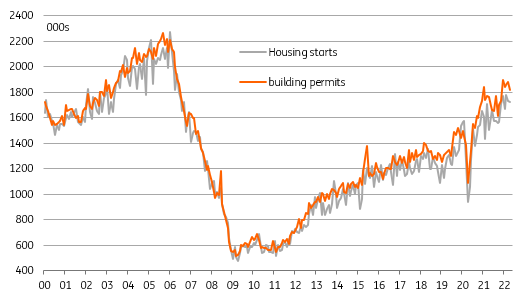

Supply keeps coming

We have also had housing starts and building permits data which fell in April, but both remain in a strong upward channel and point to more housing supply hitting the market later this year at a time when demand is potentially dropping off quite quickly. Hence our belief that the rapid price appreciation of housing could quickly flatten out and possibly reverse.

Housing starts and building permits still trending higher

Bad news for activity, but good news for broader inflation

On the negative side, this will hurt consumer sentiment as raising interest rates in a deteriorating housing market environment is never a good story. It would also weaken construction activity with a lag and hurt employment prospects in the industry which accounts for 4% of GDP in total.

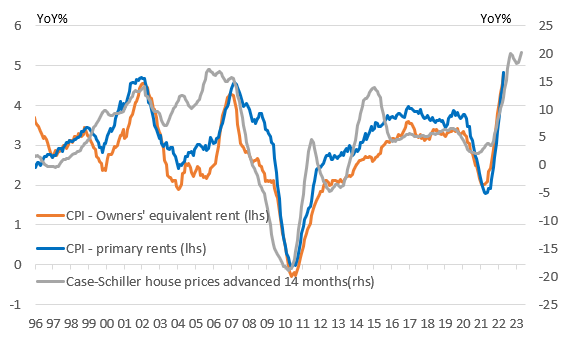

Falling house prices would get inflation lower more quickly

However, there is a silver lining of sorts. House prices lead housing rental CPI components by 12-16 months and given their 33% weight in CPI and 40% weight in core CPI it would contribute to sharply lower CPI in late 2023. If the Fed factors this into its thinking, it would mean interest rates may not need to rise as far as some fear (the calls for 5-6% Fed funds for example) and would allow the central bank to reverse course and cut rates back to neutral more quickly, helping to prevent a broader and deeper economic downturn.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article