US housing market exhibits more signs of slowdown

Housing affordability is even more strained as prices continue to rise and mortgage rates surge. This is prompting a slowdown in transactions and with more supply likely coming to the market in coming quarters the chances of a housing slowdown is growing. This in turn could be the catalyst for the Fed to re-appraise the outlook for interest rates in 2023

Past the peak on housing transactions?

We are seeing more evidence to suggest that US housing market activity may have peaked. March US existing home sales topped out in January 2021 at 6.65mn and then there was a second slightly lower peak 6.49mn in January this year as massive fiscal and monetary stimulus supported demand while working from home flexibility opened up more options for where to live.

However, today’s report shows that in March existing home sales dropped to an annualised 5.77mn level. With affordability a huge issue in terms of both home prices and monthly mortgage payments we expect to see a further moderation in the number of transaction in the months and quarters ahead. In turn, this could also feed through into lower prices and weaker household sentiment and potentially be a catalyst for a change in stance from the Federal Reserve further down the line.

Existing and new home sales (annualised rates)

Affordability is constraining demand

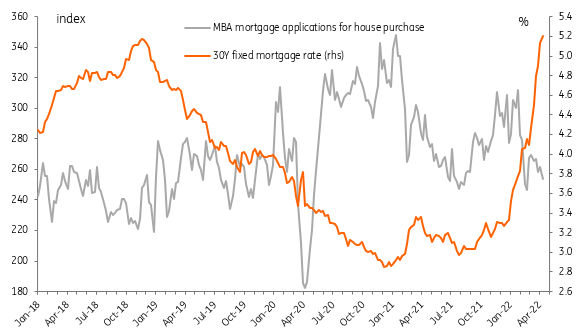

House prices nationally have increased by more than 30% since the start of the pandemic, making it more challenging to save for a deposit, and with surging inflation throughout the economy, real incomes are being squeezed and confidence has been suffering. On top of this, today’s mortgage application numbers for home purchases fell again in response to mortgage rates hitting 12-and-a-half year highs.

The typical contracted rate for a 30Y fixed rate mortgage has risen from 3.3% at the start of the year to 5.2% as of last week according to the Mortgage Bankers Association. The MBA reported that the average mortgage size of a home purchase was $453,800 last week so the surge in mortgage rates have meant monthly payments jumping by $505 versus had the loan been taken out at the beginning of the year ($2,492/month versus $1,987/month). Given the move higher in market rates, we expect mortgage borrowing costs to rise further in coming weeks.

US mortgage rates & mortgage applications for home purchases

Excess demand to become excess supply?

This means we may soon start moving from an environment of excess demand in the housing market where inventory levels got down to record lows, to one potentially that is moving into better balance. The months of supply of housing available for sale also ticked higher and stands now at 2 months worth of transactions, up from 1.6 months in January.

Remember too that existing home sales are counted when contracts close versus pending home sales and new home sales, which count when contracts are initially signed. Consequently the spike up in mortgage rates over the past two months are yet to really hit existing home sales and are going to be seen first in those pending and new home sales numbers, which are out next week.

At the same time housing construction continues apace with housing starts and building permits now at levels last seen in 2006. Should demand continue to fall and supply continue to rise the prospect of excess supply becoming an issues, leading to outright price falls, could start to come on the radar.

Housing starts and building permits

Housing downturn could dampen the Fed's enthusiasm for rate hikes

While this in itself is not especially concerning from a household balance sheet perspective with household liabilities looking low by historical standards, it can feed through into further falls in consumer confidence and weaken consumer spending, while also putting the brakes on new residential construction. Consequently, this is a sector we are keeping a watchful eye on and if we do indeed see the housing market start to wobble it could be a factor that limits the scale of Fed policy tightening and could be a catalyst for actual rate cuts again in late 2023.

Housing is not only important from an activity perspective. The sector also carries more than 30% of the weighting of the consumer price inflation basket via primary rents and owners’ equivalent rent. Should home prices stabilise and potentially even fall, this can quickly translate into lower inflation readings. This would give the Fed more flexibility to respond with interest rate cuts if they do indeed end up hiking so much that the economy starts to weaken.

And possibly be a catalyst for rate cuts in 2H 2023

For now we continue to look for 50 basis point Federal Reserve interest rate increases at the May, June and July Federal Open Market Committee meetings, and once the proposed quantitative tightening gets up to speed we think it will then move to 25bp hikes. We expect an interest rate peak in the first quarter of 2023 at 3%, but the average period between the last Fed hike in a cycle and the first rate cut has only been eight months over the past 50 years. Given this history and the prospect of weaker economic activity in 2023, we are forecasting 50bp of rate cuts before year-end 2023 as the Fed finds itself needing to move to a more neutral footing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article