US housing: Hopes for a turnaround?

Amidst the government shutdown, third-party housing numbers are one of the few data sets we are still receiving. Existing home sales offer further warning signals, but elsewhere, we may be seeing signs of stabilisation and even a potential recovery

A stall becomes a slowdown…

A healthy housing market normally equates to a healthy economy. Rising housing transactions are typically associated with rising residential construction activity and retail sales – particularly in furniture and furnishing components, as well as the building materials and garden equipment sector. However, over the past 12 months, we have seen a clear slowing in both existing and new home sales with the stock of unsold supply on the market picking up, too. For new homes, it currently stands at an eight-year high of 7.4 months of sales. Tuesday's steep fall in existing home sales for December to 4.99 million annualised - the lowest since the November 2015 blip - means that it now takes an average 46 days to sell a property.

House prices have tentatively started to respond to this with the national annual rate of inflation slowing to 5% in October versus a peak of 6.8% seen in March last year. The slowdown appears particularly pronounced in cities that have experienced construction booms in recent years, such as the major West Coast cities. This has led to fears that a weakening housing market could become another headwind for the US economy, prompting slower economic activity and a more cautious approach to interest rate hikes from the Federal Reserve.

US home sales and US S&P Case-Schiller house price inflation (3M annualised)

In one sense, the fact that the relationship between residential construction and GDP growth has broken down offers some comfort that we shouldn’t necessarily brace for a broader economic downturn - the former slowing while GDP growth has accelerated. But this is not something that we expect to last for a prolonged period given housing’s important feedback into broader activity and confidence.

GDP growth and residential investment (YoY%)

What’s caused it?

President Trump’s tax bill from last year has likely been a significant factor behind this development. Income tax cuts equivalent to $900 per household have helped support consumer spending and therefore GDP, but there were also changes to the tax benefits of home ownership that have created headwinds for housing.

The tax reforms resulted in state and local property tax deductions being capped at $10,000 while mortgage interest deductions have been limited, too. The standard deduction has been doubled so the net result is that people looking to buy in expensive housing markets in states that have high property taxes are going to be less well off. This clearly weakens the incentive for home ownership in these markets and again explains why coastal cities are seeing more of an underperformance versus the national average.

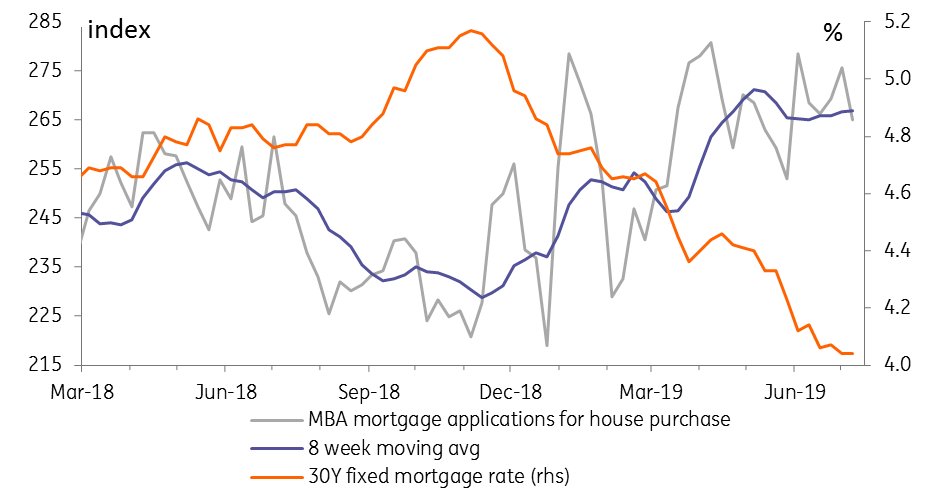

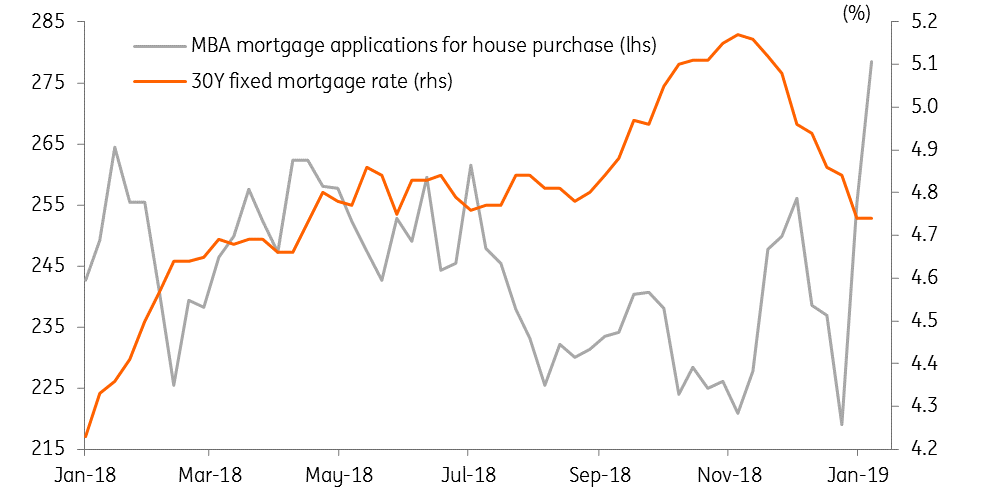

The other key factor behind the slowing in residential property has been the rise in mortgage rates over the past twelve months. The 30Y contracted fixed rate mortgage peaked at 5.2% in early November, nearly 100 basis points above where it started the year. There was a particularly sharp increase during 3Q18, driven higher by rises in Treasury yields over the period. This too hurt affordability with mortgage applications for home purchases falling sharply over the July-November period.

Mortgage rates & mortgage applications

Coming back to life?

Despite this gloom, we see some signs that the prospects for the housing market may be getting a little brighter as we start 2019. The equity market correction in late 2018- as fears mounted over US economic prospects- helped drive Treasury yields lower with mortgage rates now responding. This 40 basis point drop in borrowing costs seems to have sparked renewed life into the housing market with mortgage applications for home purchase surging in early January.

Indeed, consumer fundamentals remain in great shape with unemployment at a 49-year low while wages are rising faster than the cost of living. In fact, we think wage growth can continue on its upward trajectory given that demand for workers outstrips supply.

We regularly mention the National Federation of Independent Businesses survey in this regard. It is reporting that the proportion of firms that can’t fill their current vacancies is at all-time highs – the survey goes back over 40 years! At the same time, the latest Federal Reserve Beige Book reported that “all Districts noted that labour markets were tight and that firms were struggling to find workers at any skill level”. It added that “wages grew throughout the country… across skill levels, and numerous Districts highlighted rising entry-level wages as firms sought to attract and retain workers and as new minimum wage laws came into effect”.

We also have to consider the plunge in gasoline prices from $2.92/gallon in October to $2.25 currently. This works out as an annualised saving of nearly $100 billion for US households.

As such, consumers have cash in their pockets and while consumer confidence has dipped a little in response to equity market weakness and perhaps the government shutdown, it remains high by historical standards. So, from a demand perspective, the outlook seems to be reasonable.

We will get mortgage approvals numbers for the week of 18 January tomorrow and given lower mortgage rates at a time when the Federal Reserve’s Senior Loan Officers report suggests lending standards remain relatively loose, there seems little constraint from the supply side. Demand should also look OK given healthy consumer cashflows, decent confidence and perhaps too, a fading shock from last years’ housing tax changes, which may be tempting cautious buyers to return to the market.

But there are still risks…

We will need to follow the data closely in coming months to see if we can breathe a sigh of relief on housing, but either way, we know the US faces tougher challenges in 2019, which could still translate into softer housing demand. The lagged effects of higher interest rates and a strong dollar will weigh on activity while the weaker external environment coupled with uncertainty on trade policy and the imposition of additional protectionist measure are risks.

The prolonged government shutdown is also a growing threat as it becomes increasingly apparent that private sector business is being restrained by it, with contractors not being paid, business permits and travel visas not being issued and queues at airport security lines growing.

This suggests to us that the Federal Reserve will likely leave interest rates unchanged this quarter, but a tight labour market and a buoyant domestic consumer sector still justify tighter monetary policy later in the year. We will become increasingly optimistic if a way can be found through the US-China trade impasse.

The pace of rate hikes will be more modest than in 2018 with just two 25 basis point hikes foreseen, but this scenario of strong consumer fundamentals and gradual interest rate increases we believe will be bearable for the residential property market. Nonetheless a turnaround in residential investment may take longer to materialise.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article