US: Hope from housing

While we see little chance of a V-shaped recovery overall for the US economy, today's mortgage applications data offers clear hope that the housing sector can bounce back vigorously

Housing: From laggard to leader

Throughout 2016-18 the US housing market was one of the more disappointing aspects of the US economy, not helped by a significant increase in borrowing costs.

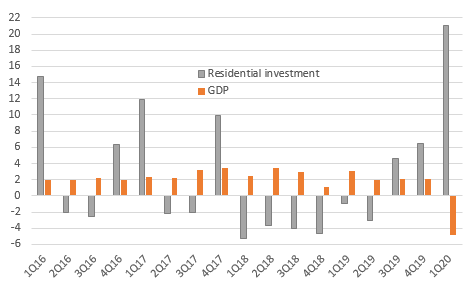

While home prices were generally moving higher, the number of transactions fell and residential investment was a drag on the economy, contracting in ten out of the 13 quarters between 2Q16 and 2Q19.

As home sales started growing again, residential investment bounced back sharply, recording annualised gains of 4.6% in 3Q19, 6.5% in 4Q19 and an astonishing 21% in 1Q20.

The situation started to turn in late 2018 with mortgage rates being dragged lower by the decline in Treasury yields. Financial markets were worried about the potential economic impact of the US-China trade tensions, which prompted talk of Federal Reserve interest rate cuts and they duly materialised in the second half of 2019. Nonetheless, the domestic economy proved to be resilient. The unemployment rate fell to its lowest level since the 1960s and housing demand started to pick up.

As home sales started growing again, residential investment bounced back sharply, recording annualised gains of 4.6% in 3Q19, 6.5% in 4Q19 and an astonishing 21% in 1Q20.

Residential investment & GDP growth (QoQ% annualised)

But Covid-19 has prompted a sizeable dip

Unfortunately, the Covid-19 pandemic brought optimism in the sector crashing down once again. Mortgage applications plunged in the wake of the lockdown measures with transactions being pulled. For first time buyers, deposits that were invested in equities were hit hard and a general sense of panic made buyers more cautious.

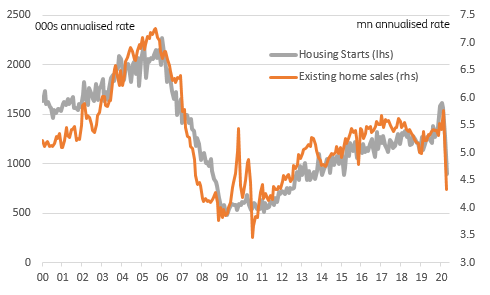

Existing home sales fell 25% between February and April, but new home sales proved to be a little more resilient, falling 16% over the same period – but actually recording a 0.6%MoM rise for April!

Housing starts - a measure of construction activity have fallen 43% over the same period, giving a clear indication that residential investment will be a major drag on economic activity in 2Q20.

Existing home sales & housing starts

Mortgage approvals offer major encouragement

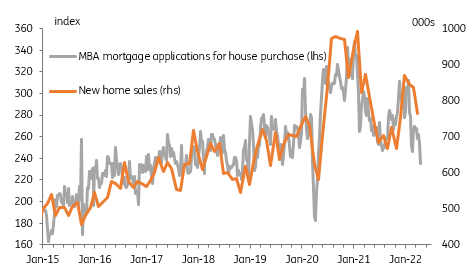

Nonetheless, there is some hope that this will be a temporary (but admittedly very large) setback and that the housing market can bounce back vigorously.

Today's data shows the US has recorded six consecutive weekly increases in mortgage applications for home purchases and the US is now well above the levels averaged through 2018 and 2019 - as the chart below shows, you can't get much more V-shaped than that.

Given that nearly 40 million Americans have filed a new unemployment claim over the past nine weeks this recovery is remarkable.

One explanation is that the average home buyer in the US is 47 years old, as reported by the National Association of Realtors. The more affluent, slightly older workers are being less impacted by job losses than younger workers employed in retail and hospitality, for example. The rebound in equities may also have calmed any nervousness about making a potential purchase of a new primary home or vacation home, while aggressive Federal Reserve action has eased financial market tensions with credit continuing to flow and mortgage rates falling to new lows.

Mortgage approvals for home purchase & mortgage interest rates

The housing market could kick-start the recovery process

The average age of a first-time buyer is 33 and the economic uncertainty and potential fear over employment prospects mean that this first part of a housing market transaction chain remains the weakest link. The implication is that housing transactions probably won’t rebound as aggressively or as quickly as the mortgage application for home purchase series has. Nonetheless, as the economy re-opens and people return to work, consumer confidence should rise so are hopeful of improved housing activity numbers for May and especially June and July.

This is important because a strong housing market will support construction and employment in the sector. Housing transactions are also strongly correlated to retail sales – as people move to a new home they typically also spend more on furniture and home furnishings, garden equipment and as building supplies such as a new paint job and a bit of home improvement.

While social distancing constraints, consumer caution and the legacy of 40 million unemployed Americans will mean the economy takes time to return to “normality”, it is at least encouraging that one key sector looks set to make an early positive contribution to growth.

With the Fed signalling, monetary policy will remain extremely accommodative for a prolonged period and credit conditions looking in decent shape, favourable financing conditions should continue. As employment starts to rise again this should all provide a decent platform for the housing market and associated sectors.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article