US growth slumps again as recession fears mount

The US economy contracted for a second consecutive quarter – a technical recession – as inventory rundowns and a plunge in residential construction offset decent trade figures and rising consumer spending. Officials will say this isn't a 'real' recession, but with the squeeze on households intensifying, it is only going to be a matter of time

US in technical recession

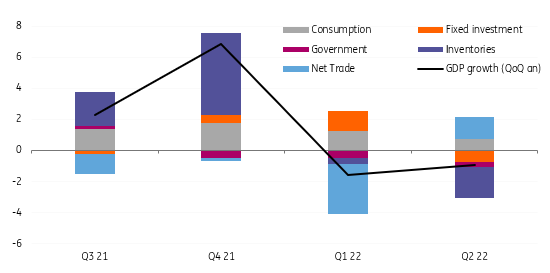

So we have technical recession in the US with 2Q GDP contracting at a 0.9% annualised rate after a 1.6% annualised drop in the first quarter. The consensus had been expecting growth of 0.4%. The main reason was a big unwind in inventories which knocked two percentage points off the headline growth rate while residential investment contracted 14% annualised (subtracting 0.7pp off headline growth).

We also saw weakness in business capex (non-residential fixed investment fell 0.1%) and consumer spending growth slowed to just 1%. The only good news in this report is the rebound in net trade which contributed +1.4 percentage points to the headline growth rate.

Contributions to US GDP growth

The 'real' pain is still to come

While this is a technical recession, the Fed is correct to say we aren't in a "real" recession yet since unemployment is still falling and consumers are still spending, but it appears to be only a matter of time. We are hopeful of a decent rebound in 3Q GDP of the order of 2% given ongoing improvements in the trade numbers and a rebound in the inventory contribution, but once again this will mask what is happening in domestic demand.

Consumers remain under real pressure as inflation puts the squeeze on spending power while the plunge in equity markets is another factor weighing on sentiment. We are starting to see a drift lower in some of the people movement data such as Google mobility tracking around retail and recreation, OpenTable restaurant dining numbers and also the TSA airport security check numbers. Residential investment is set to become an increasing drag on activity as housebuilders react to falling transactions and a deteriorating outlook while corporate capex is set to slow as companies worry more about recession risks.

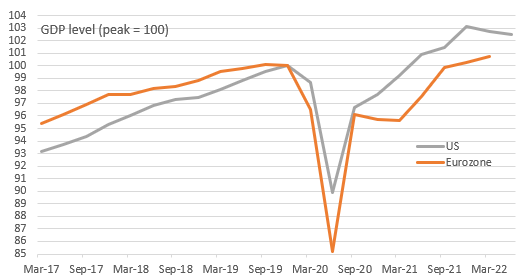

US real GDP levels versus Eurozone

Hikes for now, but rate cuts will be the 2023 story

With interest rates continuing to rise, the dollar providing more of a headwind and credit spreads widening out recessionary forces are undoubtedly intensifying. Should the housing market topple over and prices start to fall this will add to the pessimism.

For now though, the focus is inflation and the Federal Reserve has made it clear it is prepared to sacrifice growth to get inflation back to target. But by having delayed tightening for too long they are playing catch-up and may well end up having to reverse course next year. Historically the gap between the last rate hike and the first rate cut is six months. It could happen even more quickly this time around.

US budget deal

There are a lot of headlines, quite rightly, surrounding the apparent agreement between holdout Senator Joe Manchin and his Democrat Senate colleagues surrounding money for climate change investment programs, prescription drug charges and extending healthcare subsidies. Listed as a $400bn spending commitment over the next ten years this will be more than fully funded by $739bn of tax revenue gains, most notably through a 15% minimum corporate tax rate and greater IRS enforcement.

The assumption is that this will meet the criteria to be voted on under budget reconciliation rules, so only a simple majority in the Senate would be required. We assume this should pass given Vice President Kamala Harris has the deciding vote in the 50-50 split Senate – the Republicans will likely unanimously vote against given the proximity to mid-term elections and the potential lift passing the bill would give the Democrats. The one stumbling block could come from Arizona Democrat Kyrsten Sinema who has stood in the way of previous proposals, but we suspect she will fall in line with the House Democrats broadly backing the proposals.

It sounds impressive, but the important point is that this will be spread over 10 years and will barely move the needle in terms of its immediate growth implications. Nonetheless, the prescription drug charges are an important story that will limit the upside for inflation – finally a bit of good news for the Fed.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article