US: Greater challenges to come for the hardy consumer

The economy looks set to rebound sharply in the second quarter as the resilient consumer continues to spend and businesses remain in expansion mode. However, there are challenges to come as interest rates rise, the dollar remains firm, and geopolitics and supply chain strains show little sign of imminently helping the growth or inflation outlooks

Second quarter growth returns with a bang

The US economy contracted an annualised 1.5% in the first quarter, but we wouldn’t read too much into this. Inventory and trade data have been swinging around wildly over the past year and it was these two components that dragged activity lower in the first three months of the year. Strip them out and the underlying domestic demand story in the economy is much stronger with consumer spending and business capital expenditure showing meaningful improvements.

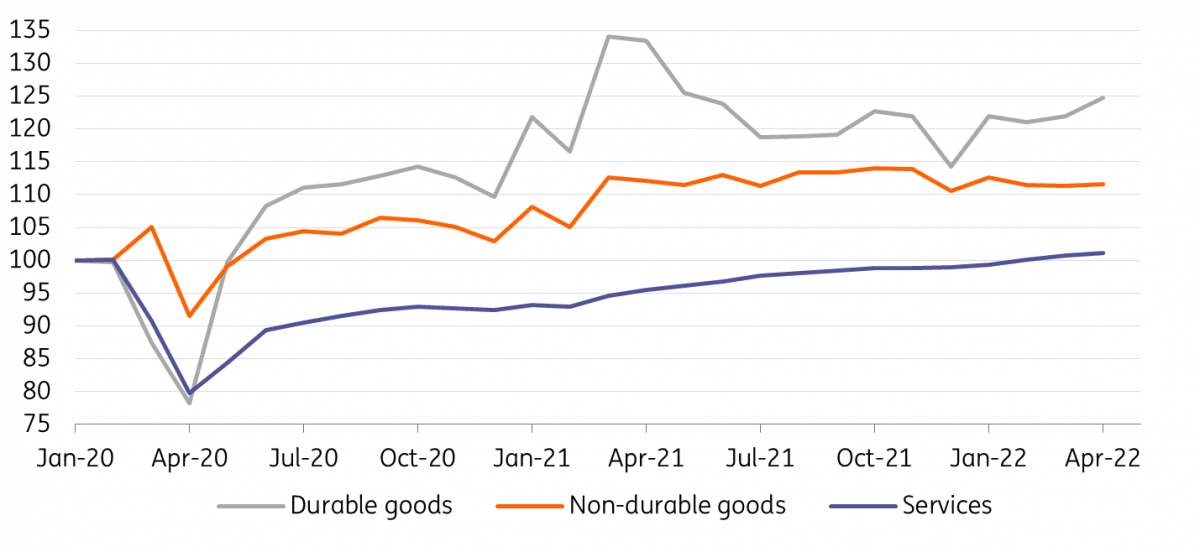

Consumer spending and investment will also be important growth drivers in the second quarter with monthly data suggesting that while incomes are not keeping pace with the rising cost of living, households are prepared to run down some of their accumulated savings to maintain their lifestyles. People movement data and high-frequency restaurant dining and air passenger numbers also suggest strong spending. At the same time, strong durable goods orders and record-high job vacancies indicate that businesses remain in expansion mode. Inventories are likely to be far less of a drag on 2Q growth, while early trade numbers for April suggest net trade could actually add to GDP growth in the current quarter.

Consumer spending breakdown continues to show goods outperforming (Feb 2020 = 100)

Fed to continue hiking to 3%

We are now forecasting the economy to expand 4.5% annualised in the second quarter, and with the labour market continuing to tighten and inflation pressures remaining intense, the Federal Reserve has advised that 50bp interest rate increases at both the June and July Federal Open Market Committee (FOMC) meetings will likely be required. What happens thereafter is less certain. Some FOMC members have suggested they could continue hiking by 50bp until inflation is under control. Others have hinted they could vote in favour of a pause as early as September, fearing that to tighten too hard, too fast could risk unnecessary economic harm.

The squeeze on real incomes is already a headwind while a strong dollar will also contribute to a slowing economy. A clear concern in the market is that in this environment, aggressive action from the Fed could be the catalyst for a more pronounced slowdown that could tip an economy into recession. We certainly acknowledge that risk and would put around a 40% chance on that happening over the next 18 months, but it is not yet our base case given the strong fundamental underpinnings of the labour market and household savings.

Inflation is likely to remain the Fed’s focus in the next few months. To get inflation to fall quickly we need to see geopolitical tensions ease to get energy prices lower, improved supply chains to get products more freely available (and cheaper), and a big increase in labour supply to limit wage pressures. Unfortunately, none are likely to happen soon with Russia’s invasion of Ukraine continuing, China’s zero-Covid strategy showing little sign of softening, and businesses struggling to find workers at a time when vacancies are at record highs. Consequently, we continue to see the Fed funds rate moving up to 3%, but our previous call for a 50bp hike in September now looks more challenging and we have changed that to a forecast of a 25bp hike.

Housing transactions are slowing in response to falling mortgage demand as rates rise

Slowdown risks for later in the year

In terms of growth later in the year, the housing market remains our main concern with mortgage demand falling sharply as mortgage rates rise. This is already translating into weaker transactions, and with more inventory coming onto the market we see the risk of price falls in the coming quarters. This will eventually mean weaker construction activity and it will be a drag on correlated retail activity, particularly for furniture, home furnishings, and household appliances.

We believe this will contribute to inflation slowing through the year and certainly next year when we could see it get close to target by year-end. A weaker housing market is a very important story given it will eventually mean lower CPI contributions from primary rents and owners’ equivalent rent, which account for a third of the inflation basket. On top of this, used car prices with their 4% weighting in the index are now falling and could also help to drag inflation lower quite quickly.

A move from 'restrictive' Fed policy to 'neutral' is on the cards for late 2023

If we can also see some marginal improvements in supply chains and energy markets over the next 12 months this will ease some of the global price pressures, while a weaker US growth story will make it more challenging for businesses to maintain their profit margins and a squeeze here can also contribute to slowing inflation.

If the Fed does see evidence of “clear and convincing” declines in inflation over the next 18 months, it is likely to be a cue for the Fed to start to relax its monetary stance and we expect to see the Fed moving policy out of restrictive territory to a more neutral footing before the end of 2023. The Fed never leaves policy ”tight” for long with the average duration between the last rate hike in a cycle and the first rate cut only around seven to eight months over the past 50 years.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 June 2022

ING Monthly: Searching for the silver lining This bundle contains 16 Articles