US government shutdown: Feeling the strains

The longest ever government shutdown is causing financial strain for the 800,000 workers directly affected and is creating headwinds for the broader US economy. This only heightens the likelihood of a 1Q pause from the Federal Reserve

Blame the Wall

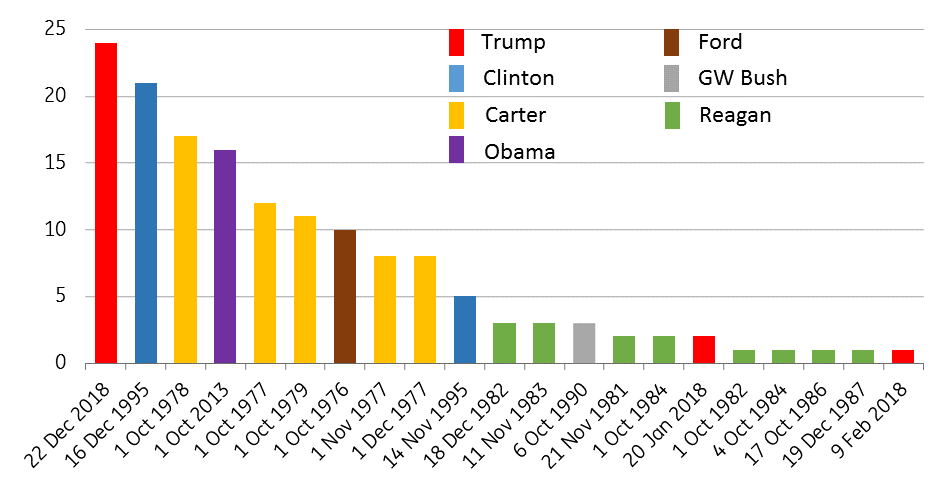

We are currently in the fourth week of what is now the longest US government shutdown on record. This stems from an impasse over President Trump’s request for $5.7 billion to fund the construction of a security wall along the border with Mexico, a key pledge from his 2016 campaign. With funding not forthcoming, President Trump declared on December 20 that he would refuse to sign the 2019 budget unless money for the wall was included. On December 21st the House of Representatives voted in favour, but there wasn’t enough support in the Senate leading to a partial government shutdown starting midnight.

US government shutdowns since 1976

A deal looks remote

With the House now controlled by the Democrats following the November mid-term elections, the prospect of a deal looks even more remote. President Trump is refusing to back down from his position that funding for the wall must be included for him to approve a budget, while Democrat House leader Nancy Pelosi has labelled the wall “immoral” and is refusing to comply. This means we are at a stalemate which risks prolonging the shutdown for weeks, if not months to come.

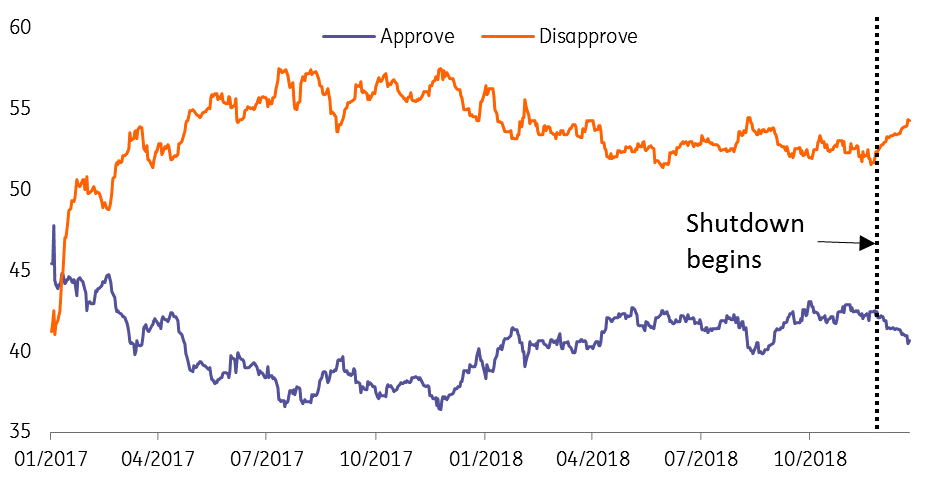

How it is resolved is uncertain, but with President Trump's approval rating on the slide, the onus seems to be more on him to come up with a solution. One way out of the impasse could be if President Trump follows through on recent threats to declare a national emergency on the southern border. This would allow him to use funding from the military budget to pay for wall construction. However, Democrats are likely to challenge such a move in the courts, and even some Republicans might baulk at such a move given the problematic precedent it would set. So such a move could easily end up further increasing tensions and prolonging the stalemate.

Trump feeling the heat? President approval rating

The direct impact on employees

The direct implication is that around 800,000 federal government workers are not being paid. Around 380,000 have been furloughed – sent home without pay – with the other 420,000 deemed “essential” so are working, but not receiving paychecks. This places clear and obvious financial strains on those impacted with many struggling to meet rent and mortgage payments. The result is people are running down savings or borrowing from friends and family to meet their financial obligations. They are also likely to be cutting their discretionary spending and as a result, localised areas with a high proportion of affected Federal workers are likely to see some slowing in the pace of economic activity.

The impact on the US economy will be modest but still noticeable

While very painful for those affected, the impact on the broader US economy is going to be modest, but still noticeable. The 800,000 workers represent just 0.5% of the total 150.3million people on the US non-farm payrolls. While they will cut back on their spending, the magnitude may not be huge. A study by Scott Baker from Northwestern University and Constantine Yannelis from New York University using anonymised data following the 2013 government shutdown found that a worker who was not being paid but still going to work cut spending by around 10%. However, the spending by furloughed workers dropped more – 15-20% simply because they were not leaving the house as much. To try to alleviate some of the hardship, furloughed workers are eligible to claim unemployment benefits and while there is little evidence of a major increase at present, we could see the numbers climb if the shutdown continues.

Once previous shutdowns ended the workers all received back-pay. Our base case is that the same applies this time around, so we assume spending should quickly recover. Government contractors are unlikely to be as fortunate with little chance of receiving compensation based on previous instances of shutdowns.

Broader implications

With 380,000 employees not turning up to their desks, it means that work isn’t being done. Examples include the closure of several museums and the effective shutting of several national parks, which is hurting tourism and the companies that operate around them. The Department of Commerce, the Department of Housing and Urban Development, the Department of Transportation and the Department of the Treasury are severely impacted, which means a delay in new business permits, processing of federal loans for things such as home purchases and visa applications. This will stifle business activity and weaken economic growth at the margin.

Closed government departments

Corporate deal-making could be hit

Government agencies have also been affected including the Securities and Exchange Commission and the Federal Trade Commission. This means that IPOs could be delayed with corporate deal-making broadly hit. The majority of NASA employees have also been furloughed.

The Inland Revenue Service is also being impeded so if the shutdown continues there are concerns that federal income tax refunds will be delayed given around 90% of the agency’s workers have been furloughed. This means the seasonal cash flow boost – the 2018 average was $2899 according to the IRS – may not come until later in the year, which will likely hurt spending and sentiment in the near term.

Policymakers will not have a complete picture of the economy

Economic data flow has also been impacted, with the publication of trade data, home sales, factory orders and shipments, budget data and Wednesday's retail sales report all delayed. With statisticians not collecting data, it means the figures for December 2018 and January 2019 may be viewed with scepticism when they are eventually published. This means that policymakers will not have as complete a picture on what the economy is doing as they would have liked.

The 420,000 federal employees working without pay include over 40,000 federal law enforcement officers, including those at the FBI and the Drugs Enforcement Agency. It also includes employees from the Department of Homeland Security, Coast Guard employees, Forest firefighters, Customs and Border protection and Transport Security Administration officials.

There have already been some anecdotal stories that airport security lines are lengthening as some of those workers affected fail to turn up to work. Indeed, with people struggling to make payments on bills and rent some are taking jobs elsewhere to provide some cash. The longer the shutdown lasts the greater the risk of walkout and disruption at airports and crime agencies as staff seek paid employment elsewhere. This too will have negative economic implications.

1Q GDP below 2%?

Taking this altogether 1Q19 GDP growth will be weaker than would otherwise have been the case. The Bureau of Economic Analysis estimates that the 2013 government shutdown reduced GDP growth by 0.3 percentage points because of the reduction in hours worked by federal employees while the Congressional Research Service concluded after reviewing a range of third-party estimates that the shutdown resulted in a reduction of GDP of “at least 0.1 percentage points for each week of the shutdown, with a cumulative effect of up to 0.6 percentage points in the fourth quarter of 2013”.

We suspect that the longer the current shutdown lasts the greater the impact on confidence and spending. Given the lack of clarity on the likely duration of the shutdown, we are tentatively forecasting 1Q GDP growth of 1.7% annualised.

More bad news to come?

Given the lack of bi-partisanship on this issue, there are concerns that getting an agreement on the US debt ceiling, which has been suspended until March 1st, will be just as fraught. If the US debt ceiling (the Congress set a maximum level of debt the federal government can carry at a given time) is reinstated as scheduled, but the House and Senate fail to vote in favour of increasing its level, the government would immediately have to implement special measures since that debt is already above that ceiling. Action could include the suspension of payments to employee retirement funds, which would allow money to be diverted to keep the broader government functioning.

With these funding options likely exhausted by the summer, the US government would not be able to borrow money to cover existing debt obligations, which could lead to a situation where the US would not be able to pay interest or redeem maturing government securities i.e. it effectively defaults on its debt. During the 2011 debt ceiling crisis, the rating agency S&P downgraded the US government’s credit rating to AA+ which contributed to a sharp sell-off in US equities – the S&P500 fell 17% during the crisis period. A repeat of this risks extending the period of weaker growth.

Looking further ahead, the stalemate around the government shutdown raises the prospect that even if some sort of compromise is found to reopen the government, the next two years in Washington will continue in the same vein. More political stand-offs around important budget deadlines look likely, and the chance of any major bi-partisan legislation – such as the much-discussed infrastructure package, which could give the US economy a boost -- looks to be receding quickly.

Federal Reserve: a delay… not a stop

With so many agencies closed the lack of published data means it is more difficult for the Fed to follow what is happening in the economy. That said, Fed Chair Jerome Powell, speaking at the Economic Club of Washington D.C last week acknowledged that “A longer shutdown is something we haven't had. If we have an extended shutdown, I do think that would show up in the data pretty clearly."

We had already scaled back our expectations for Federal Reserve rate hikes this year to two 25bp moves versus the four seen in 2018. This was on the basis that growth would slow due to lagged effects of higher interest rates, a stronger dollar, the fading support from last year’s fiscal stimulus and weaker external demand in the environment of rising trade protectionism. However, the strong jobs market and rising wages mean there is decent underpinning that justifies tighter monetary policy.

We suggest growth risks are moving to the downside

The additional headwind of the government shutdown coupled with fears that the lack of bi-partisanship in Washington will lead to more political stand-offs suggests growth risks are moving to the downside. Just in terms of 1Q GDP growth, we predict 1.7% annualised, which would be the weakest quarter of growth since 1Q 2016. This further reinforces our view that the Federal Reserve will not raise interest rates in the current quarter.

Pressure will only intensify on politicians to come up with a deal to bring an end to the economic hardship being faced by so many federal employees so we remain optimistic that a positive outcome will be achieved in coming weeks. The hope is that the lessons learned from this event may also incentivise politicians to work together in a more bi-partisan manner on future issues including the debt ceiling. Once normality resumes the federal workers will receive back pay while the backlog of work could lead to more recruitment in the sectors affected. This should see activity rebound given the firm underlying fundamentals in the US economy. With record employment and rising wage pressures, we continue to look for additional rate hikes from the Federal Reserve this summer.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article