US GDP set to re-accelerate after 3Q Delta hit

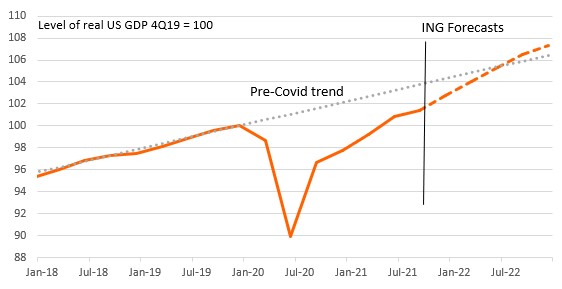

3Q GDP growth was a little weaker than expected, but not as bad as it could have been given the scale of the disruption to the economy from supply chain strains and the impact of the Delta wave. 4Q is already looking much stronger with the overall size of the economy set to overtake its pre-Covid trend early next year

| 2% |

US annualised 3Q GDP growth |

GDP held back by weak trade and investment

US GDP growth for the third quarter came in at 2%, which was a little below the 2.6% consensus, but not as bad as the 0.2% annualised figure indicated by the Atlanta Fed GDP Now model. This leaves the level of US GDP 1.4% higher than before the pandemic with the economy having rebounded 12.2% from the 2Q 2020 lows.

In terms of the contributions, personal consumer spending was quite a bit stronger than expected at 1.6% (consensus 0.9%) thus indicating robust spending in September – we get that data tomorrow – especially on services. This is still a substantial slowing from the stimulus-check boosted 12% rate recorded in 2Q with the hit from the sentiment-sapping Delta wave also contributing to the slowdown.

Inventories made a very big upside contribution of a full 2 percentage points. Ahead of time this was the wild card as valuation adjustments can heavily impact the number and the fact that it is measured as a change in the rate of change further complicates coming up with a forecast you have any confidence in. Investment was softer than predicted, falling 0.8%. Government rose 0.8% while net exports subtracted 1.1% due to exports falling 2.5% and imports rising 6.1%.

Given the scale of disruption wrought by supply chain issues, labour market shortages and the hit to sentiment from the Delta Covid variant in retrospect this isn’t a bad outcome.

US GDP contributions

A 4Q rebound awaits

We are confident that the fourth quarter will be much better. High frequency consumer activity numbers such as flights, restaurant dining and hotel stays have turned higher through mid-September into October as the Delta wave subsided. Inflation is a bit of a concern due to its impact on spending power, but incomes are rising and household balance sheets are in great shape with household wealth having increased $26tn since the end of 2019. This should allow households to weather this temporary storm of higher energy costs.

We also expect labour supply to make a gradually return and that will release some of the pressures on businesses while also boosting jobs growth and household incomes. Housing is also staging a recovery given the increase in mortgage applications over the summer, which should support construction while strong capital goods orders point to decent business investment. Meanwhile, net trade may be positive, but not for the best of reasons, given the disruption in Chinese output due to Covid constraints and the long queues of ships trying to get into US ports. At this early stage we think the US growth story will get back on track with the economy set to expand by around 6% in 4Q.

Looking further ahead we expect the US economy to overtake its pre Covid trend path early next year, but then again when the government has thrown $5tn at the economy and the Federal Reserve has expanded its balance sheet by $4tn you would hope that would generate something meaningful.

Level of US GDP with ING forecasts relative to pre-Covid trend

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article