US GDP: 1Q good… 2Q GREAT!

US GDP grew 2.3% in 1Q despite tough comparisons and a legacy of seasonal adjustment headwinds. We think it will be above 3% in 2Q

| 2.3% |

US 1Q18 GDP growthvs 2.0% consensus forecast |

| Better than expected | |

Consumer soft, investment strong

US GDP came in at 2.3% for 1Q18, close to our 2.4% forecast and a bit ahead of the 2% consensus. The details show consumer spending was soft, rising 1.1% with bad weather playing a part, but we also have to remember there was a tough comparison with 4Q17 given the post hurricane rebound in spending we saw back then. Government spending also slowed to 1.2% for similar reasons.

Investment was good, rising 7.3% with structures a big positive while inventory building contributed 0.43 percentage points to growth and net trade added an extra 0.2%. Given the equity market volatility in the quarter and worries about protectionism this is a pretty good outcome all in.

So much for seasonal adjustment... but good news for 2Q18

Outlook for Q2 and beyond

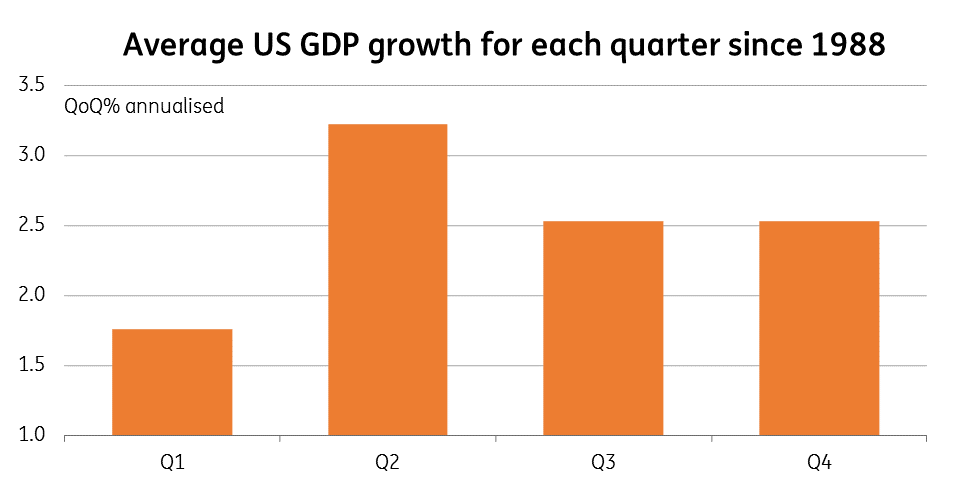

It is also important to remember (as the chart above shows) Q1 is typically the worst quarter for US growth, despite seasonal adjustment. Over the past 30 years, growth in the second quarter of any given year has on average been 1.4% faster than in the first. So here’s to 3.7% growth in 2Q!!

In all fairness, it is close to what we are currently forecasting, which is 3.4%…After all, retail sales rebounded in March, suggesting the domestic economy has regained some momentum while confidence is strong and the jobs market is robust, which is contributing to higher wages. Tax cuts will also be supporting spending while a rebound in asset prices following 1Q volatility is helpful.

Meanwhile, the dollar’s weakness means that exporters are in a competitive position which allows the US to really benefit from the upturn in global demand. With inflation pressures starting to become more evident and protectionism fears subsiding, this will help keep the Fed on course to hike interest rates three more times in 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 April 2018

In Case You Missed It: How much of this surprised you? This bundle contains 6 Articles