US: FOMC preview – calm before the storm?

An aggressive fiscal and monetary response has helped financial assets recover most of their Covid-19 related losses and is now also delivering tangible economic results. However, a rising number of Covid-19 cases and reintroduced containment measures pose challenges with the Fed set to signal it is prepared to do more to keep the recovery on track

All about the “V”

No-one can say the Federal Reserve has under-delivered during the current crisis. Their measures include liquidity injections on a massive scale, bringing interest rates down to zero, buying more than US$2 trillion worth of Treasuries and Mortgage Backed Securities and implementing numerous credit easing programs in various markets. Stimulus on such scale has given asset markets the confidence to effectively price in a “V” shaped recovery with equities making back virtually all of their losses and corporate bond spreads narrowing in sharply too.

In combination with unprecedented fiscal action we are seeing evidence of a V-shaped recovery in economic activity, particularly relating to the household sector. Mortgage applications for home purchases and car sales have rebounded while retail sales have recovered to within half a percentage point of their value in February. Businesses are returning to work and output is on the rise broadly across the economy.

But doubts are creeping in

However, Covid-19 is far from beaten. While there is optimism about a vaccine that can allow a return to “normality”, the timing and its efficacy are still unknown. Meanwhile, a renewed spike in cases is forcing state Governors to backtrack on re-opening plans, which is shuttering businesses with workers losing their jobs.

At the same time the US$600/week benefit boost to 31.8 million claimants is scheduled to end this weekend with a best-case scenario that it is replaced with something far smaller – Republican lawmakers suggest they are looking at a figure of around US$200/week. This will be a massive income drop for a large section of the workforce at a time when unemployment appears to be on the rise again due to re-instigated Covid-19 containment measures. We would certainly not rule out negative payrolls and retail sales readings in July and/or August.

What the Fed will do…

With markets functioning well and longer-dated yields remaining at such low levels, the Fed has little need to alter its language or stance at this stage. Given this backdrop, particularly as we await the outcome of negotiations over another fiscal stimulus, the Fed will retain their cautious language on the recovery and will leave the Fed funds target rate unchanged at 0-0.25% with no change to their QE stance.

Fed funds target rate set to remain at 0-0.25% for a very long time.

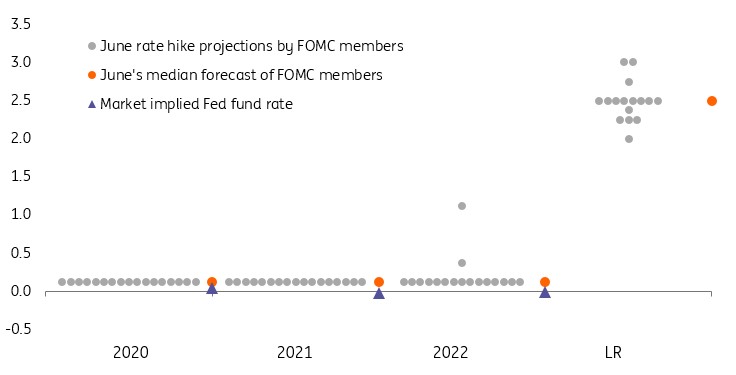

The accompanying statement will no doubt repeat the line that the Fed remains committed to keeping the Fed funds rate at the 0-0.25% level “until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals”. Given the Fed’s dot diagram from June, which showed just two FOMC members expecting the Fed to announce any increase in the policy rate before the end of 2022, there is little need to be any more explicit with their policy guidance at this stage.

The key take-away from the press conference is likely to be Fed Chair Jay Powell expressing a similar view to his comment at last month’s testimony to Congress that “until the public is confident that the disease is contained, a full recovery is unlikely”. Pretty obviously, interest rates are not going anywhere for a very long time.

Specifically on quantitative easing, it has been tapered to around US$4 billion per day (officially US$80bn per month) of Treasury purchases versus US$75bn per day at the peak. We suspect they will retain the language that they will continue purchases “at the current pace to sustain smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions”.

Federal Reserve dot plot indicates no rate hikes for at least two years

And what they won’t… yet…

One thing that they probably won’t do at this meeting is implement a change in strategy pertaining to the way they ensure price stability and maximum employment. This relates to the Fed’s long running review of its policy setting framework.

It is more likely to be September, or possibly even December (depending on how turbulent the economic and market backdrop is) when they announce a shift away from a policy of pre-emptively raising interest rates before inflation got to the 2% target. Instead, they are likely to move to one that targets 2% inflation over a period of time – thereby tolerating bouts of above 2% inflation to make up for long periods of sub-target inflation. This would clearly imply looser monetary policy for longer.

And what they might never…

Financial markets continue to price in the possibility of negative interest rates, but officials have been dismissive of this and within the press conference Jay Powell will suggest they are not an attractive option – we outline here the reasoning. Instead, this pricing behavior is more likely to be some traders hedging positions rather than a conviction the Fed will take this step.

One option that continues to be discussed as a potential future policy tool is yield curve control – using QE to target specific yields to prevent borrowing costs rising too far too quickly. However, with the US 10Y Treasury yielding just 60bp and the 30Y a mere 1.25% there is no pressing need to do anything. If yields start to rise on economic optimism and the perception that inflation is rising the Fed is unlikely to stand meaningfully in the way. However, if it is more a fear of a demand/supply mismatch, as Treasury issuance rises to fund a fiscal deficit we think could hit 20% of GDP this year, then they will be far more willing to prevent rising borrowing costs from threatening the recovery.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article