US: Fed underwhelms with another cut

The Federal Reserve has delivered another 25bp rate cut, but has provided a confused message of upwardly revising its GDP forecast despite being concerned about growth while ignoring the recent pick-up in inflation completely. Moreover, there is no consensus on additional rate cuts being needed

The Fed delivers, but the FOMC is split

The Federal Reserve has cut interest rates 25bp as widely expected to a range of 1.75-2%, but it certainly wasn’t unanimous with both Esther George and Eric Rosengren, like in July, opposing the 25bp rate cut. On the other side James Bullard argued for a more aggressive response of a 50bp cut.

The accompanying press release was little changed from the one published in July with an upgraded assessment on household demand (“rising at a strong pace”) offset by a more negative opinion on trade and investment (both have “weakened”). One remarkable aspect is the fact there was no acknowledgment of the recent sharp pick-up in core CPI or average hourly earnings – both of which are running at their fastest 3m annualised rates since before the financial crisis. Instead, the statement persists with the line “market based measures of inflation compensation remain low” while in the press conference Fed Chair Jerome Powell suggested inflation pressures "clearly" remain muted.

Fed funds target and 10Y Treasury yield

No consensus behind extra easing

We also got new forecasts and there was little change here either. In fact, we get a slight uptick in GDP growth for 2019 and 2021 (both by 0.1 percentage points) while inflation forecasts were left unchanged with both headline and core PCE at 2% in 2021. As we suspected, their median prediction shows they don’t expect to cut rates again this year or next with the policy rate moving 25bp higher in 2021 before settling back at 2.5% over the longer term. In terms of the specific dots, just 7 officials expect one more 25bp rate cut this year with 8 officials expecting the policy rate to be in a 1.5-1.75% range in 2020.

This may be a little disappointing for those expecting a more dovish Fed outlook, but it won’t matter much for markets, who continue to price another 75bp of Fed funds rate cuts from today’s level. After all, the June median Fed forecast was for no rate changes in 2019 yet the Fed have delivered two 25bp cuts within three months of publishing that prediction.

But further easing will come...

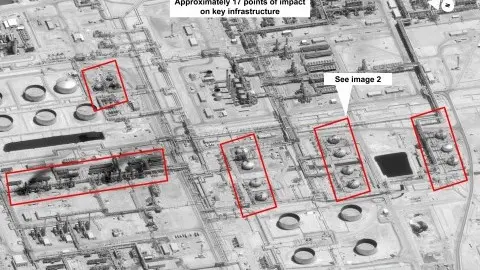

We believe more Federal Reserve interest rate cuts are coming. This week’s Chinese data only underlines our fears about global growth story while the latest round of ECB policy easing is unlikely to be the catalyst for a phoenix from the flames like recovery in Eurozone activity. Add in the rising geopolitical tension relating to Saudi Arabia and Iran, plus Brexit worries and a strong dollar (which is hurting US international competitiveness) and it is clear the US economy will continue to face major headwinds.

Trade tensions will also remain an issue. We doubt October’s US-China trade talks will yield much. At best we may see discussions continue over coming months which means this threat to growth persists, even if it doesn’t necessarily intensify.

For now, the consumer sector is performing well, but with payrolls growth showing signs of slowing and net trade and investment spending becoming drags on growth we worry about how long this can be sustained. To us, this justifies further “insurance” policy cuts. We expect another 25bp cut in December with another likely in 1Q20.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 September 2019

In case you missed it: A big week for oil This bundle contains 10 Articles