US February jobs report: Too bad to be true?

Very weak payrolls number contradicts virtually all other evidence on the jobs market. Falling unemployment and rising wages should be the focus

A huge miss

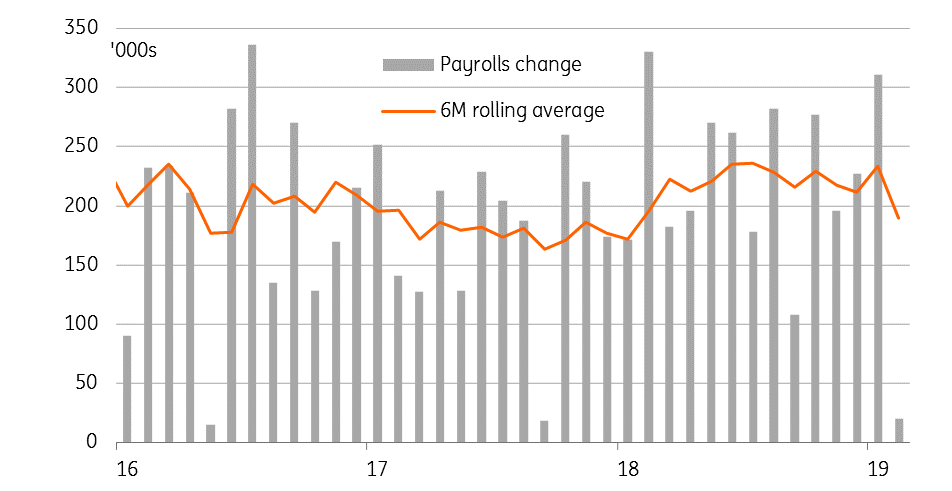

The February US jobs report has clearly disappointed, with total employment rising just 20,000 versus expectations of a 180,000 increase. January’s figure was revised up marginally to 311,000, but this is a troubling headline number and on the face of it offers support to the dovish shift in the Federal Reserve's policy stance while justifying market pricing that the Fed funds rate has peaked.

The details show there was a particular weakness in construction, which fell 31,000 with retail employment falling 6,000 and government workers falling 5,000. Elsewhere it was largely flat or single-digit gains in key components while business services rose 42,000.

| 20,000 |

February increase in US payrollsVersus 311,000 in January |

But we doubt it is telling the true story

While the US economy is clearly facing some headwinds, this report seems very odd since it completely contradicts other evidence such as the ISM employment indices, the ADP report and the NFIB jobs number.

The unemployment rate fell to 3.8% from 4% while wage growth picked up from 3.1%YoY to 3.4% - a ten year high!

Significantly, from a policymaking perspective, it also contradicts the Fed’s own sources. The recent Fed Beige Book noted that “employment increased in most Districts”, highlighting “notable worker shortages for positions relating to information technology, manufacturing, trucking, restaurants and construction”. We could argue that the weak payrolls number was because firms couldn’t recruit the labour they wanted – the National Federation of Independent Businesses did report yesterday that a net 37% of firms have vacancies they can’t fill – but this looks more like a data error.

US monthly change in non-farm payrolls

Focus on wages and unemployment

Moreover, there are clear positives in the report. The unemployment rate fell to 3.8% from 4% while wage growth picked up from 3.1%YoY to 3.4% - a ten year high! Here there are broad gains, with the Fed’s Beige book noting “wages continued to increase for both low and high skilled positions across the nation". Given the decent growth backdrop and the tight labour market we look for further unemployment falls with wages continuing to rise on the back of competition for labour.

We still look for one more Federal Reserve hike

Taking this all together we aren’t too concerned about the soft payrolls figure and think there will either be revisions or a sharp bounce-back in March. After all, Corporate America looks in decent shape and if the US and China can indeed resolve their trade issues that would be a clear positive for the global growth outlook.

At the same time wage growth is picking up and non-wage benefits are rising too, which should support broader spending while adding to inflation pressures. Consequently, we still think there is a strong case for another interest rate rise this summer, which is clearly at odds with a market pricing the next move as being a cut.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article