Easing US inflation fears boost hopes for a Fed rescue

US recession fears linger on as softening activity spreads throughout the economy. There are also tentative signs that the labour market is cooling with increasing layoff announcements and slowing wage growth. Inflation pressures are subsiding and offer hope that the Fed will ride to the rescue with stimulus later this year

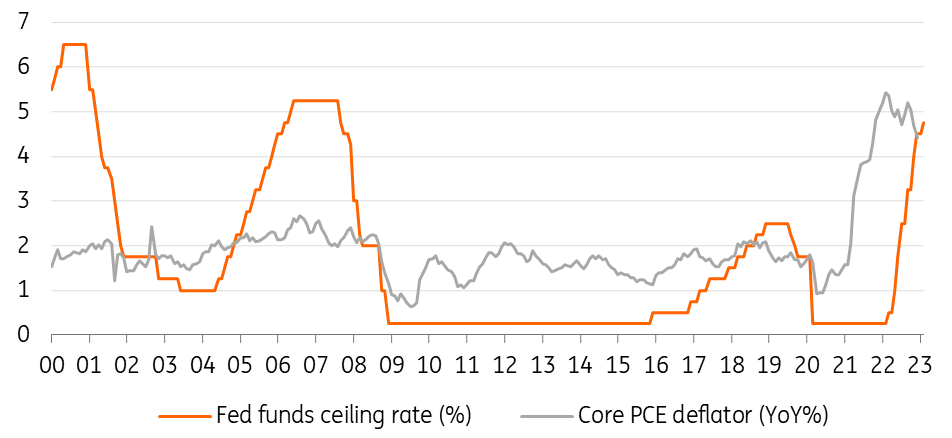

Real interest rates turn positive as Fed hikes continue

Inflation caught the Federal Reserve off guard last year and it had to catch up aggressively, implementing the most substantive series of interest rate increases in more than 40 years. Despite that, it has taken a further 25bp hike this week to finally get positive real interest rates; both the ceiling and the lower band of the Fed funds target rate range are above core inflation for the first time since 2019.

US policy rates finally exceed inflation

This doesn’t mark the end of policy tightening. Inflation remains well above the 2% target and unemployment is at very low levels leaving the Fed wary that any relaxation of policy could allow inflation to reignite, especially with China reopening and the European story looking more positive. Moreover, many officials are concerned that financial markets are getting ahead of themselves in pricing interest rate cuts later this year. Lower Treasury yields, a softer dollar and narrowing credit spreads could boost growth and undermine the central bank’s attempts to control inflation.

We don't share those concerns to the same extent. Instead, we expect a final 25bp interest rate increase in March. With inflation set to continue slowing and the outlook for both growth and the labour market deteriorating, we think that will be the peak and rate cuts will indeed be the story of the second half of the year.

Weakness is spreading

The economy is certainly feeling the impact of the Federal Reserve’s interest rate hikes and the knock-on effects for borrowing costs throughout the economy. The housing market has cooled rapidly in response to the surge in mortgage rates, with the number of transactions slowing sharply and residential investment contracting at an annualised 26.7% rate in the fourth quarter of 2022. In fact, we’ve had seven consecutive month-on-month falls in residential construction, three consecutive drops in industrial production plus 1%+ MoM falls in retail sales in both November and December.

We need to see a turn quickly to prevent GDP from turning negative in the first half of this year, but with the ISM manufacturing and non-manufacturing surveys pointing to a flat to weaker trend, this is going to be difficult. Auto sales are looking OK, but we are concerned that the strong boost to growth from net trade and inventory building experienced in the fourth quarter of last year will not be repeated.

We see a strong chance, therefore, that first quarter GDP growth will be negative. Moreover, the Conference Board’s measure of CEO confidence is now at the lowest level since the global financial crisis, which suggests that corporate America will turn increasingly defensive, implying a greater focus on cost control rather than a desire to expand businesses.

Inflation pressures are cooling, allowing Fed rate cuts from the third quarter

This isn’t encouraging from a labour market perspective. Job loss announcements are becoming more prevalent, and there have been five consecutive monthly falls in the temporary help component; historically, that's a strong leading indicator ahead of broader shifts in employment. If America’s boardrooms are as gloomy as surveys suggest, this does indeed indicate the threat of rising unemployment.

Fewer companies are looking to raise prices

Wage pressures also appear to be cooling, with the latest Employment Cost index posting the slowest increase in a year; both wages and salaries, along with benefits are seeing this trend. Corporate pricing power also appears to be softening, as you can see in the chart above. With fewer firms planning to raise prices, falling inflation looks to be a strong bet even before we consider slowing housing rents and falling car prices which together account for more than 40% of the basket of goods and services used to calculate the inflation rate.

A weak economy, a cooling jobs market and rapidly slowing inflation will, in our view, allow the Fed to cut rates from late in the third quarter. Remember that over the past 50 years, the average time elapsed between the last rate hike in a cycle and the first rate cuts has only been six months. We expect the fed funds ceiling to be cut to 4% by year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 February 2023

ING’s February Monthly: This could well be a ‘fool’s spring’ This bundle contains 12 Articles