US debt ceiling drama piles on yet more unwanted pressure

The US debt ceiling drama is back with its usual political farce. Unfortunately, it matters. ‘Extraordinary measures’ are keeping the show on the road for now. But any delay to a budget deal runs the risk of debt downgrades, Fed taper delays and even the possibility of a government shutdown. Given Covid, it's the last thing anyone needs or wants right now

It comes around like clockwork

The debt ceiling is just one more thing that sets the US apart from most other countries. Ordinarily when a country outlines its spending plans and they are approved the government can simply borrow what it needs. In the US there is sometimes an extra hoop to go through whereby if the level of accumulated debt were to go over a set level – the debt ceiling – Congress needs to approve this by raising the debt ceiling level to a new higher figure.

Since its inception in 1917, the debt ceiling has been raised well over 100 times, mostly without incident. However, recent years have seen more fractious politics on Capitol Hill. One implication is the debt ceiling has increasingly been used as a tool to obstruct legislation and score political points while often disguised as an effort to instil fiscal discipline.

Such impasses have previously resulted in a debt downgrade, government shutdowns and major market volatility and we should be alive to the risks of this happening again this year.

Extraordinary measures only last so long

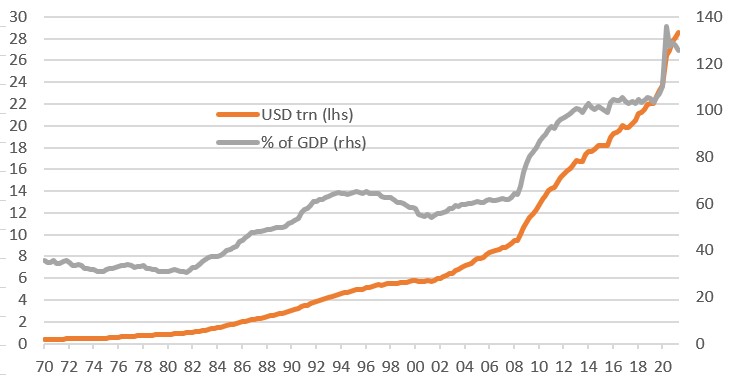

In a deal struck back in 2019 the debt ceiling was raised to $22tn before being suspended until July 31st 2021 during which time it was adjusted to the current level of debt – which is now $28.5tn. Given the expiration of this deadline and no new deal in sight, the US Treasury has the tricky task of preventing an increase in debt at a time when government expenditure is running well ahead of tax revenues.

Total US government debt

To pull this off they are using skilful accounting. The Treasury has published a list of 'extraordinary measures' that will 'prevent the United States from defaulting on its obligations as Congress deliberates on increasing the debt limit'.

The Treasury's "Extraordinary Measures"

- suspending sales of State and Local Government Series Treasury securities

- redeeming existing, and suspending new, investments of the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund

- suspending reinvestment of the Government Securities Investment Fund

- suspending reinvestment of the Exchange Stabilization Fund.

However, these measures can only prevent a breach of the debt ceiling for so long. Most estimates suggest it gives the government a few months of breathing space, perhaps to October or maybe November. If the ceiling hasn’t been raised (or suspended again) by that point we will either need to see draconian cuts to government spending – the government shutdown route – or the country defaults on its interest payments.

A deal needs to be done

Unfortunately, these deliberations are going nowhere fast. 60 Senate votes are needed to raise the debt limit, but the Senate is split 50-50 down the middle. Democrats could tough it out and hope that fears over a potential debt default and assumed resulting market turbulence could bring the two sides together for the good of the nation. This appears highly unlikely given the polarised nature of politics right now.

Talks are going nowhere fast

The Republicans also know that debt conjures up negative images in voters’ minds. Placing the blame for higher debt levels firmly on the shoulders of the Democrats is an opportune thing to do, especially with mid-term elections little more than a year away.

Consequently, the Democrats will most likely end up having to include a debt limit increase with their budget legislation (including the extra $3.5tn of social security spending). This is almost certainly going to have to go through the long-winded budget reconciliations process.

Here, a simple majority in the Senate is required rather than the usual 60 votes. This would allow the debt ceiling to be raised while the Republicans can then go into next year’s mid-term elections stating the higher spending, taxes and debt are entirely the fault of the Democrats.

There is a downgrade - and for good measure a Fed tapering - risk to consider

Fitch recently revised its rating outlook for the US from stable to negative, partly premised on the buildup of US debt through the pandemic. It’s still at AAA with Fitch, but it’s now a stone’s throw from a downgrade. If we go through September, and Congress has failed to act, there is a reasonable likelihood that Fitch could downgrade the US to AA+, meaning that America would become composite non-AAA (based off the big three).

Does this matter? Yes and no. When S&P downgraded the US in 2011, there was in fact a flight into the “safety” of Treasuries. So while the product was optically tarnished, it in fact saw an excess of demand. In all probability, the same would occur if Fitch were to do the same.

The risk is that yields could ratchet to the upside on a severe credit deterioration discount

But then again, that would depend on a whole host of key ancillary factors. It is not impossible that there could be a buyers' strike on Treasuries if they were (finally) deemed to be exceptionally rich by investors, and especially if the Fed were shaping up to taper at the same time. With real yields so deeply negative and nominal yields not offering much by way of positive yield, the risk is that yields could ratchet to the upside on a severe credit deterioration discount. This would be the opposite of the reaction to the S&P downgrade but could be rationalised by valuations versus fundamentals and the psychology of Federal Reserve tapering.

As an important counter to this, the Federal Reserve could, in extremis, simply finance redemptions by vacuuming up new issuance. This would not avert breaching the debt ceiling by the way as Fed holdings are included in the measure of overall government debt, rightly or wrongly. But it would appease any talk of systemic default.

Even if there were a technical default (e.g. one coupon payment missed), we're confident that it would be made good because, at the end of the day, the Fed is always there as a backstop if things ever get really severe.

Rates could collapse on this, but could then recalibrate higher

We understand completely the thought process that the most likely scenario is a flight-to-safety to Treasuries by way of protection. But there’s also a reasonable probability that moments like these could be an opportunity to recalibrate US yields to more sensible valuations, and that means much higher.

It could in fact be a bit of both. First lower, think sub-1% for the 10yr on the flight to safety and Fed backstop narrative. But then there's a risk higher, think towards 2% for the US 10yr on a combination of both credit and fundamental recalibration.

One thing is for sure though, potential extreme outcomes like these breed volatility. Brace for it if nothing has happened by the end of September!

Government shutdown can’t be ruled out

One slim possibility is that debt ceiling talks break down irreconcilably with Democrat progressives and moderates at war with each other. Time then runs out on striking a deal and extraordinary measures are exhausted. This means more drastic action is required to prevent a default on government debt obligations. Expenditure would need to be cut to such an extent that the Federal government stops paying workers with the government shutting down.

More drastic action is required to prevent a default on government debt obligations

This last happened in late 2018/early 2019 and resulted in 800,000 federal government workers not being paid for 35 days. Around 380,000 were furloughed – sent home without pay – with the other 420,000 deemed “essential”, thereby working, but not receiving paychecks. This places an obvious financial strain on those impacted with many struggling to meet rent and mortgage payments. Consumer spending will also be impacted; one study following the 2013 government shutdown found that a typical unpaid worker cut their spending by around 10%. The spending by furloughed workers dropped more, by some 15 to 20%, because they were not leaving the house as much.

It also means a lot of work isn’t being done. It would result in the closure of numerous museums and National Parks, which would hurt tourism and the companies that operate around them. In fact, everything from housing to transportation to the Treasury would be hit. Even 'essential' federal employees, such as police officers and firefighters would be working without pay. The risk is that they take jobs elsewhere just to pay the bills.

Shutdown: Economic pain, but political disaster

While very painful for those workers affected, the direct spending impact on the broader economy is going to be fairly small. 800,000 workers impacted represents just 0.5% of the total 146.8 million people on US non-farm payrolls. And if they cut their spending by 15%, as we saw with furloughed workers last time, we are talking about a hit to GDP of mere tenths of a percentage point. Moreover, once a deal is struck, Congress is obliged to give back-pay to those who worked through the shutdown, the same isn’t the case for those who were furloughed although they have always received it after previous shutdowns. This would likely see spending lifted in subsequent weeks.

The political ramifications are huge

The political ramifications would be far greater. The Democrats have it in their power to resolve the situation themselves well ahead of a debt downgrade or government shutdown. To let it get to such a situation would in all likelihood hurt their credibility and therefore harm their chances of retaining the House of Representatives and gaining full control of the Senate at next year’s midterm elections.

The result would likely leave President Biden hamstrung by Congress and unable to achieve his policy objectives set for the second half of his term.

FX Market Reaction: Flight to safety versus dollar-centric risk

The dollar was weaker across the board at the time of those previous shutdowns in 2013 and 2018. But don't read too much into that. Towards the end of 2018, the dollar had been bid on a host of other factors, such as the US-China trade tensions. Some of that dollar strength reversed during the shutdown. And December is typically a weak seasonal period for the greenback anyway.

Instead, the dollar’s reaction to a potential debt ceiling stand-off and shut-down this year needs to be put in the context of what is currently priced. Market positioning is slightly long the dollar on the view that the Fed is ready to taper. The largest speculative dollar longs are held against the Japanese yen and the Australian dollar, the latter position held for China slowdown fears.

A debt ceiling stand-off would clearly pose a risk to the benign pricing of equity markets and likely see the JPY outperform on the crosses and probably outright against the dollar too. There have been periods of USD/JPY selling off and US yields rising, namely a ‘sell America’ theme, but these have been few and far between.

More likely would be a downward reassessment of global growth prospects on a potentially gridlocked Congress from 2023 onwards. This would keep the commodity FX complex vulnerable. And softer pricing for Fed policy plus the unwinding of carry-trades funded out of the euro could keep EUR/USD supported in a 1.17-1.19 range.

People are getting nervous

So, people are rightly getting nervous, not least the US Treasury Secretary, Janet Yellen. She warned earlier this month that Congress should act ‘to protect the full faith and credit of the United States’. Failure to do so, she said, ‘would cause irreparable harm to the US economy and the livelihoods of all Americans’. After more than a year of dreadful harm caused by Covid, we couldn’t agree more.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article