US data flow backs the case for 75bp

It has been a volatile week for interest rate expectations ahead of the July 27th FOMC meeting, but the final sets of data showing reasonable retail sales yet falling inflation expectations, lower import price inflation and the second consecutive fall in manufacturing suggests a 75bp hike is the most likely outcome

Inflation fears show signs of easing

There has been growing speculation over a possible 100bp hike from the Fed later this month following the 9.1% inflation print and the Bank of Canada opting for a surprise 100bp hike. However, we have had quite an array of US numbers this morning, which fit with the notion that a 75bp hike is the most likely outcome of the July 27th FOMC meeting.

The University of Michigan sentiment index is not always as closely followed as other indicators, but the surprise jump in its inflation expectations series last month was seen as the catalyst for the Federal Reserve to opt for a 75bp hike at the June FOMC meeting. Up until that point 50bp was the Fed’s forward guidance, but soon after the number was published journalists received a call to say momentum was shifting.

Today’s report shows both the year ahead and 5-10Y inflation expectations headed lower in July, the former to 5.2% from 5.3% and the latter to 2.8% from 3.1% (consensus 5.3% and 3% respectively). These are important developments as they suggest households are looking through the current period of inflation and have confidence that it will head lower with lower gasoline prices the likely instigator. If this holds then the risk of second-round inflation via higher wages will wane, meaning the Fed will have less work to do.

With regards to inflation, June import price inflation numbers were a lot softer than expected, coming in at 0.2%MoM/10.7%YoY versus 0.7%/11.4% expected. More evidence that dollar strength is acting as a brake on inflation by reducing some pipeline price pressures.

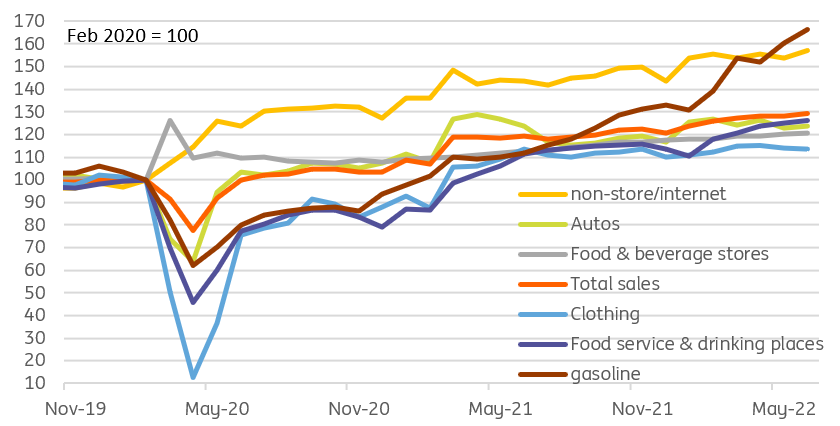

Retail sales by component

Still spending for now

Consumer confidence did improve marginally, but remains at incredibly weak levels as recession fears mount. Nonetheless, US retail sales still managed to rise 1% month-on-month in June at the headline level (consensus 0.9%) and there was a 0.2 percentage point upward revision to May's growth rate to -0.1% MoM from -0.3%. Gasoline was the key area of strength, rising 3.6% on higher prices, but there were also decent increases in furniture (1.4%) and non-store retail (2.2%) while eating and drinking out increased 1%.

The core "control" figure which excludes the volatile food, gasoline, autos and building materials rose 0.8% MoM versus the 0.3% consensus, but there were a net 0.3pp downward revisions to May's growth rate. So on balance the retail sales report is a little bit better than expected, especially given evidence from some of the credit card providers that suggested sales were not looking great.

It’s important to remember that this is a dollar value figure so higher prices are boosting the number. Adjusted for inflation “real” growth will be close to zero overall in June. However, it is important to remember that consumer spending is much broader than retail sales alone. Households are spending more on leisure and hospitality as spending reorientates back towards services and away from goods. This still has a long way to go with retail sales set to underperform broader spending trends over coming quarter – we look for it to drop back from the current 48% of total consumer spending and move towards pre-pandemic levels of 43% of total spending.

For now though households appear to be willing to run down some of the savings accumulated through the pandemic and we look for real consumer spending to rise 0.2% MoM in June leaving 3Q annualized consumer spending that will form part of the GDP report up 1.2% annualized. If correct this will be the weakest figure since the 33.4% plunge in 2Q 2020.

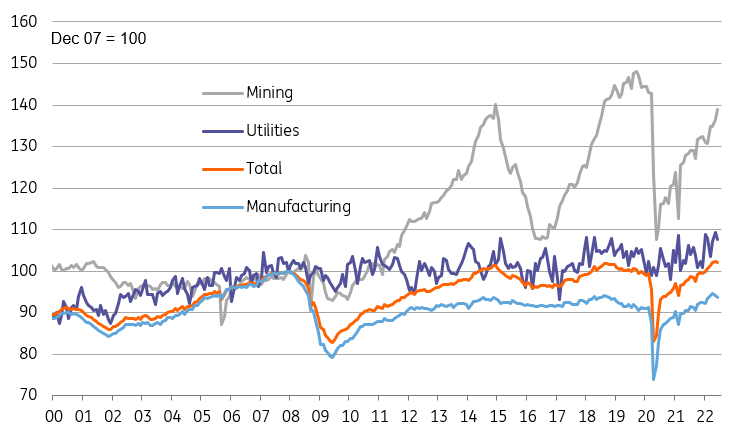

Manufacturing softness intensifies

Meanwhile industrial production was disappointing. Output fell 0.2% in June (consensus +0.1%) while May's figure was revised down a tenth to 0.1% MoM. Surprisingly it was manufacturing that was the weak point, falling 0.5% MoM for the second consecutive month (autos down 1.5%, machinery down 1.1%). Utilities fell 1.4%, which is weather driven while mining rose 1.7%.

Industrial production components

75bp on July 27th

Markets had been getting close to pricing in a full 100bp hike from the Federal Reserve on July 27, but comments from two of the most notable hawks yesterday (James Bullard and Chris Waller) had seen doubts emerge. While all options were on the table, they indicated they wanted to see strong numbers between now and July 27th to convince them that 75bp wasn’t the better option at this stage. Today’s numbers on balance don’t appear to be strong enough to make that case and if they can’t be convinced then it is unlikely that many others on the FOMC will be. Housing data is on the schedule for next week, but rising mortgage rates and falling mortgage applications suggest the numbers won’t be strong enough to alter the story. We still favour a 75bp move on July 27th with 50bp hikes in September and November and a final 25bp move in December.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article