US consumer spending points to 3%+ GDP growth this quarter

Consumer spending is still the main US growth driver. While incomes are not keeping pace with the rising cost of living, today's data suggests households are prepared to run down some of their accumulated savings to maintain lifestyles. With trade and inventory data also improving from 1Q levels we are firmly expecting 3%+ GDP growth in 2Q

Spending momentum remains strong

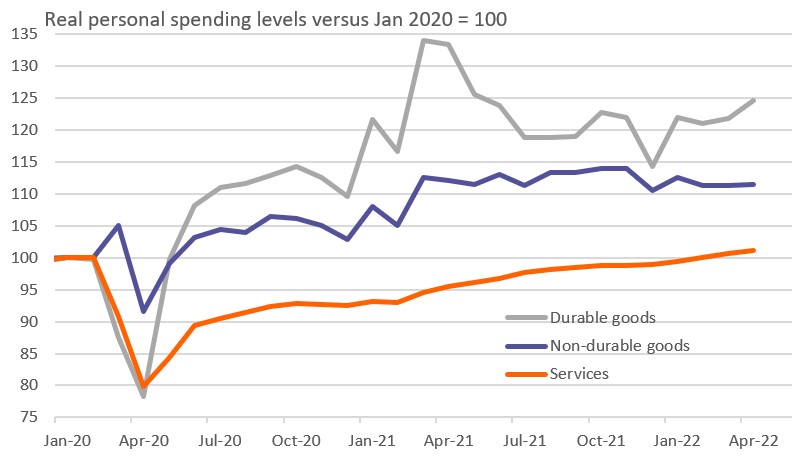

Today’s consumer spending numbers are very encouraging, rising 0.7% month-on-month in real terms in April after an upwardly revised 0.5% increase in March. The Omicron wave of the pandemic had been impacting the December-February numbers, but it is clear there is decent momentum in spending right now. Household incomes are rising 0.4% MoM thanks to a combination of higher wages and increasing employment, although admittedly they aren’t necessarily keeping pace with the rising cost of living. Nonetheless, for now, it seems that households are prepared to run down some of their savings accumulated through the pandemic to finance spending and maintain lifestyles.

US consumer spending versus pre-pandemic levels

We are hopeful that the strength of spending will continue. Google mobility data suggests an ongoing rebound in people movement around retail and recreation while restaurant dining numbers and air passenger numbers also point to a strong desire to get out and about and spend money. This leads us to expect a strong contribution from consumption within 2Q GDP growth.

Google mobility data suggest households are out and about spending

2Q GDP set to bounce by more than 3%

Yesterday’s revised GDP data showed the economy contracted at an annualised 1.5% rate in the first quarter. That was due to a huge hit from net trade and an inventory run down, which should be far less of a drag in 2Q – today’s trade and inventory numbers were very encouraging on that front with the goods deficit narrowing by $20bn in April. Consumer spending was actually already pretty good in 1Q. Capex improved and the outlook for capital investment remains good given robust manufacturing orders. Consequently, we are increasingly confident that we will see a 2Q GDP growth figure of more than 3%.

Inflation peaks out

There was also some encouraging news on inflation. The Fed’s favoured measure, the core personal consumer expenditure deflator slowed from 5.2% to 4.9%, the slowest rate since December. Nonetheless, inflation is going to be slow to fall back to target.

US core (ex food and energy) inflation readings look to have peaked

But it will be a long slow descent that requires more Fed rate hikes

We believe we need to see three conditions to get inflation to drop meaningfully quickly. Firstly, an improved geopolitical backdrop to get energy prices lower, which seems unlikely given Russia’s actions. Secondly, an improved supply chain environment, which also seems unlikely given China’s zero-Covid policy and the potential for strike action at US ports. Then thirdly, we would need to see a big increase in labour supply to mitigate surging labour costs, which again doesn’t seem on the cards just yet.

As such, inflation is likely to be sticky and in a decent growth environment, this fully backs the 50bp rate hikes in June and July favoured by the Fed with more rate hikes into restrictive 3%+ territory likely through the year and into early 2023.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more