US consumer confidence: On shaky ground?

Plunging equity markets unsurprisingly dragged confidence lower in December, but a strong jobs market, rising wages and lower fuel costs suggest there are plenty of positives for consumers at the start of 2019

Equity plunge takes its toll

Amid a dearth of data releases – partly year-end related and partly due to the government shutdown resulting in most official data being postponed – the December Conference Board measure of consumer sentiment gets even more attention than usual. Unfortunately it isn’t good news with the headline index falling more than expected to 128.1 from 136.4 in November.

That said, we think the consensus expectation of a 133.5 reading was looking rather optimistic (economists enjoying the Christmas parties too much?) given the near 20% peak to trough plunge in the S&P500 since October, which has wiped billions of dollars off investment and pension funds. It is also possible that there have been some concerns amidst the fractious politics in Washington and the government shutdown, while lingering trade concerns could also be in play.

But there's still some support

However the fact that sentiment only dropped back to the levels seen in the summer (when equities were still riding high) underlines the fact that there are still clear positives for consumers elsewhere in the economy.

Indeed, the jobs market remains very hot with demand for workers outstripping supply. This means wages are being bid up and employees are feeling the benefits. We also have to remember that gasoline prices have been plunging even faster than equities – down over 60 cents/gallon since October – and this means drivers have got more cash in their wallets. At the same time house prices continue to rise with mortgage applications picking up too, so households don’t seem too worried about the economic outlook.

2019 will be tougher...

Things will get tougher next year though and this explains why the expectations component of the report bore the brunt of the decline (99.1 versus 112.3 in November). We have talked at length about the intensifying headwinds facing the US economy in 2019 – namely the lagged effects of higher borrowing costs, the stronger dollar, the fading support from the fiscal stimulus and weaker external demand at a time of rising trade protectionism. These factors will increasingly weigh on sentiment in 2019, which is likely to lead to a slowdown in consumer spending growth next year.

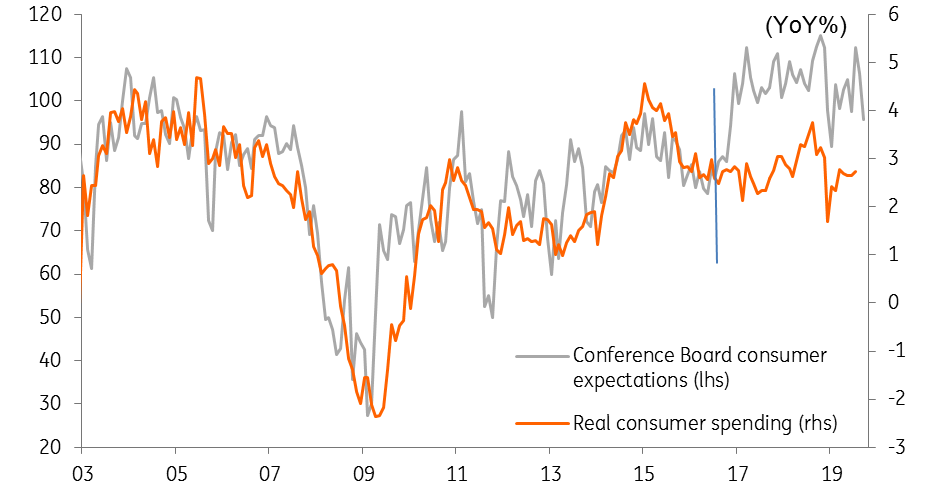

Consumer confidence hasn't been a great guide for spending since 2016

However, this slowdown is likely to be modest given the positive supports (wages, jobs, fuels costs, etc) already mentioned and if progress can be made on trade talks with China and equity markets stabilise then 2019 can still put in a decent performance for consumer spending. Moreover, it is important to remember that consumer confidence has been a poor guide for consumer spending since President Trump’s 2016 election victory, as the chart above shows. Indeed today’s fall in sentiment merely helps bring this index and spending more into line with one another.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article