US Construction Outlook: 2022 the year of consolidation and rebalancing

Residential construction will fall, but private non-residential construction is set to rebound as economic reopening drives the need for remodelling and rebuilding. Government infrastructure investment will add an extra layer of spending that can mitigate the headwinds from housing and leave overall spending down 0.5% in 2022 after 2021's 7% gain

$550bn over five years for transport, power, broadband and water

We have already outlined that we think residential construction spending will fall as the cooling housing boom translates into less home building. We also think that private non-residential construction will partially offset that as more and more people return to the cities, and delayed projects are restarted, with a strong economy adding to the incentives to put money to work.

An additional key swing factor will be the government's new infrastructure spending plan that will see an extra $550bn being spent on everything from road improvements to broadband upgrades, to power network improvements and the replacement of water pipes.

Where Biden's Billions are going (USD bn)

Transport

A fifth of the $550bn will be focused on repairing and building new roads and bridges. While this is well short of the $786 billion backlog of investment needs, as estimated by the American Society of Civil Engineers, it is still a substantial amount of money. We also must acknowledge not all of the money will be going on construction, with new buses, ferries and electric vehicle technology all set to receive a portion. The full breakdown is as follows:

- $110bn on road, bridges and major projects - repair and rebuilding of bridges with a “focus on climate mitigation, resilience, equity, and safety for all users, including cyclists and pedestrians”. $40bn focused on bridges with $16bn for major projects “that are too large or complex for traditional funding programs but will deliver significant economic benefits to communities”.

- $66bn for rail repair and Amtrak service expansion – eliminate maintenance backlog, modernising fleets and expanding services

- $39.2bn for public transit – modernise transit fleet of 24,000 buses and expand services.

- $25bn for airports, $17bn for ports - address repair and maintenance backlogs, reduce congestion and emissions near ports and airports, and drive electrification and other low-carbon technologies.

- $11bn for transportation safety including money to reduce crashes and fatalities and money for replacement of cast iron and bare steel gas pipelines under roads.

- $7.5bn for electric vehicle infrastructure – create a network of EV chargers to encourage adoption of EV vehicles to address climate issues.

- $7.5bn for zero and low-emission buses and ferries.

- $1bn for revitalisation of communities - the programme will fund planning, design, demolition, and reconstruction of street grids, parks, or other infrastructure.

Energy and sustainability

- $73bn for clean energy / power infrastructure - including building thousands of miles of new, resilient transmission lines to facilitate the expansion of renewable energy. Creation of a new Grid Deployment Authority, investing in research and development for advanced transmission and electricity distribution technologies, and promotes smart grid technologies that deliver flexibility and resilience.

- $65bn to boost broadband availability for rural and low income households - ensure every American has access to reliable high-speed internet.

- $55bn for water infrastructure - including elimination of lead pipes to ensure drinking water is safe.

- $47.2bn for climate resiliency – making infrastructure more resilient to the impacts of climate change and cyber-attacks. This includes funds to protect against droughts, floods and wildfires, in addition to a major investment in weatherisation.

- $5bn for Western water storage.

- $21bn for environmental remediation - addressing legacy pollution. The bill includes funds to clean up Superfund and brownfield sites, reclaim abandoned mine land and cap orphaned gas wells.

What it might mean

The additional $550bn is worth around 2.5% of GDP, but assuming it is spread out evenly over five years it is equivalent to around 0.5ppt of GDP per year. However, as a proportion of US construction spending it is equivalent to a 7% boost each year for the next five years, overwhelmingly focused on the non-residential sector. Remember this is on top of the extra $450bn of spending already approved, but we also need to acknowledge that not all is "pure" construction so the actual boost will be a little less.

With government impetus behind greener initiatives with a focus on sustainability, this could incentivise more private sector investment in these areas.

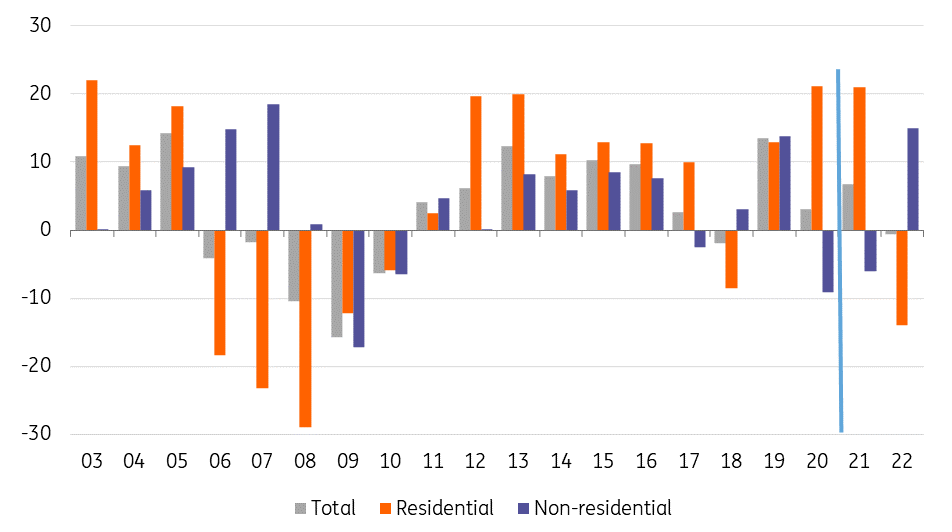

Nominal construction GDP (YoY% with ING forecasts)

2022: Consolidation and rebalancing

The second half of 2020 and first half of 2021 was a fantastic period for residential construction, but with clear evidence that the stimulus-fuelled wave of home buying is waning we expect a drift lower in output over the next 18 months. Higher borrowing costs and high prices mean affordability issues will slow demand, and with costs having risen substantially, we expect construction activity to gradually decline.

It is the opposite story for non-residential where shutdowns and uncertainty led to a steep decline in new business. The next 18 months should see a major reversal of fortunes as reopened leisure, entertainment, travel and hospitality sectors are updated and refurbished, with new businesses developing to take advantage of strong consumer demand.

The corporate sector has largely put things on hold since Covid hit and we see significant growth opportunities for the non-residential construction sector outside of offices and commercial space in major commercial areas. With a significant wave of government infrastructure funding hitting the economy, this should propel the US non-residential construction sector for the coming five years.

Putting this all together we expect total construction spending to increase by 7% in 2021, but suspect that the decline in residential spending of potentially 14% (after two consecutive annual rises in excess of 20%) will more than offset the recovery in non-residential spending next year. For 2022, we expect overall construction spending to fall by around 0.5%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 September 2021

2022 US Construction Outlook: Non-residential set to boom as housing cools This bundle contains 3 Articles