US construction 2022: Confidence is building with non-residential leading the way

We have become more upbeat on the prospects for 2022 due to an earlier-than-anticipated turn in the non-residential sector and a more resilient residential sector. This report provides an update on our key calls which now see US construction spending expanding by around 3% in 2022 and 6% in 2023

Residential outlook: more resilience than thought

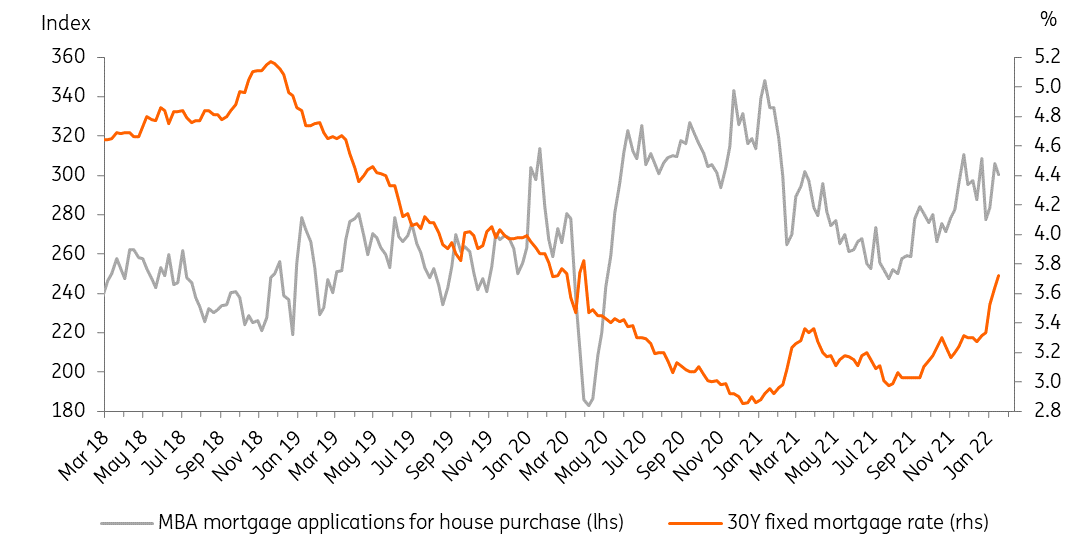

Back in September, when we wrote our initial US construction sector outlook, we had a cautious view of residential construction spending prospects. Mortgage applications for home purchases had slowed markedly despite mortgage rates remaining below 3% for a fixed 30Y mortgage. This decline in mortgage demand was attributed to deteriorating affordability in the face of considerable house price inflation. This was also reflected in consumer confidence surveys with a marked decline in home buying intentions.

Nationally, the S&P Case Shiller house price index is up 27% versus the pre-pandemic levels of February 2020. The median price for a new home in December 2021 was $377,700 versus $331,800 in February 2020 and while there has been a levelling out in prices for existing homes in recent months, the median is still $358,000 as of December 2021 versus $270,400 in February 2020.

Homebuilder sentiment improved through the fourth quarter, as did mortgage applications

We also suspected that there had been a tailing off in demand in some regional markets as workers returned to the big cities due to companies recalling staff back to offices. Rental prices had fallen sharply in the likes of New York, but swiftly returned to pre-pandemic levels as people returned through 2021.

We had expected this softening in mortgage demand and home buyer intentions to translate into a more cautious outlook from homebuilders, especially in light of surging costs for building materials and worker shortages that were boosting pay rates. Homebuilder sentiment, however, improved through the fourth quarter, as did mortgage applications.

This caught us by surprise given the median 30Y fixed-rate mortgage climbed from 3% in September to above 3.7% today in response to higher Treasury yields. It is possible that the Covid Delta wave suppressed activity in 3Q21 and as fears eased (cases peaked on 1 September) activity recovered in 4Q21.

Mortgage applications for home purchases versus mortgage rates

Demand to remain firm amidst a lack of supply

Unseasonally warm weather may also have helped keep demand elevated in late 2021, but a very cold January could see a softer start to activity in 2022, together with the Omicron wave of Covid. This has led to significant consumer caution and reduced people movements based on mobility data, including restaurant dining and air passenger travel. Nonetheless, data suggests that while it is a more transmissible variant, the hospitalisation and death numbers are not as bad relative to previous Covid waves. And with case numbers already falling sharply in parts of the US, this could mark a clear turning point in the pandemic and we're likely to see households re-engage with the economy more fully in 2Q22.

We expect rising labour supply to fill more of the vacancies

The fact that there are more than 10 million job vacancies in the US today, at a time when the unemployment rate is below 4% and wage pressures are mounting, is a clear positive for the residential sector. This should give households confidence about their financial position. We expect rising labour supply to fill more of the vacancies through the year and as such household incomes will continue to rise at a healthy clip. This should provide a solid foundation for demand. On the supply side, housing inventory for the sale of new builds has risen, but it is at record lows for existing homes.

Housing inventory for sale YoY

YoY change and inventory stock outstanding as measured as equivalent of months of sales

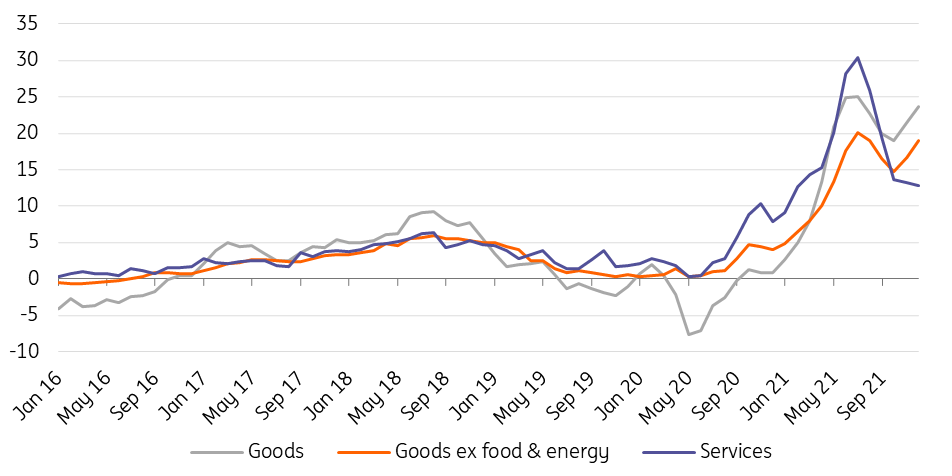

This combination of demand being underpinned by rising employment and incomes, amid limited supply of housing for sale, likely explains why homebuilders remain confident on the outlook even though labour and commodity costs remain elevated. Producer price input costs for construction continue to rise rapidly as the chart below shows, which is squeezing margins while the most recent data (from November) shows the proportion of construction workers quitting their jobs to move positions has hit a new high of 2.7% versus the 21-year average of 2.1%. With companies having to both raise pay rates to attract new workers and to retain the staff they currently have, average hourly earnings growth for construction workers came in at 5.5% in 4Q21, the fastest rate since the fourth quarter of 1982!

Construction sector input costs YoY% (from the producer price report)

But rising borrowing costs will soon bite

That said, the Federal Reserve is clearly outlining a timetable for tighter monetary policy that will have implications for the housing market. Four interest rate hikes are now priced for 2022 with the Federal Reserve continuing to suggest the funds target rate will trend towards 2.5% over the long term.

At the same time, the Federal Reserve’s Quantitative Easing programme is coming to an end and they are likely to start running down their $8.75tr balance sheet from 3Q onwards. Christopher Waller, a member of the Federal Reserve Board of Governors, suggested in December that he would like to see the balance sheet brought down to around 20% of gross domestic product (GDP) from the current 36%. Assuming average nominal GDP growth of 5% over the next five years, this would imply a balance sheet of roughly $5.9tr, which would mean the Fed offloading $2.8tr of assets that would need to be absorbed by the market.

A significant tightening of monetary policy backdrop combined with ongoing government borrowing, we believe, will push the Treasury yields above 2% and test 2.25% this year. This will push mortgage borrowing costs higher, possibly by 50-60bp, hurting home buying affordability.

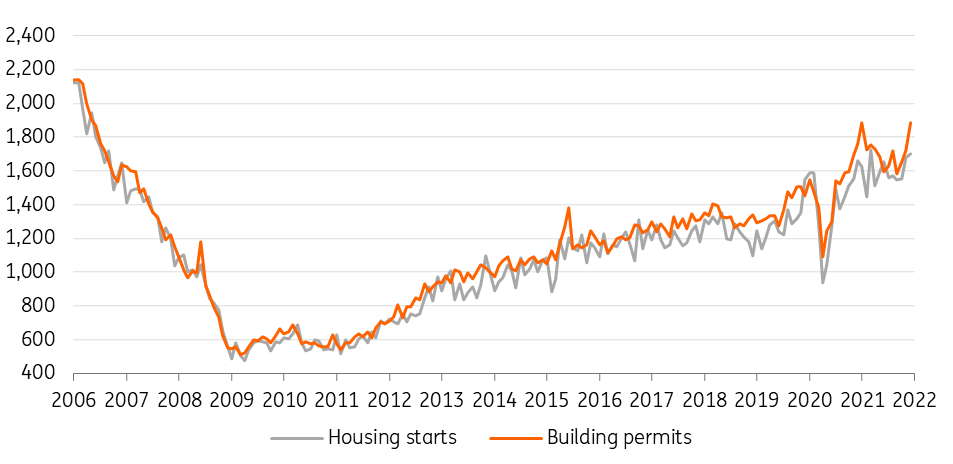

Housing starts and building permits at a peak

Housing construction set to slow, but not by as much as we had feared

We suspect that rising mortgage borrowing costs and high prices will see demand for housing slow, but with low inventory levels and decent household income fundamentals we see little reason for a collapse in activity.

Housing starts were 1702k in December 2021 and in our September report we saw that slowing to around the 1300-1400k range by the end of 2022 and staying there through 2023 versus the Bloomberg consensus of 1570k for 2022 and 1548k for 2023 at the time. We are now a little more optimistic and predict 1500k for end-2022 but still expect a slowdown to 1400k in 2023.

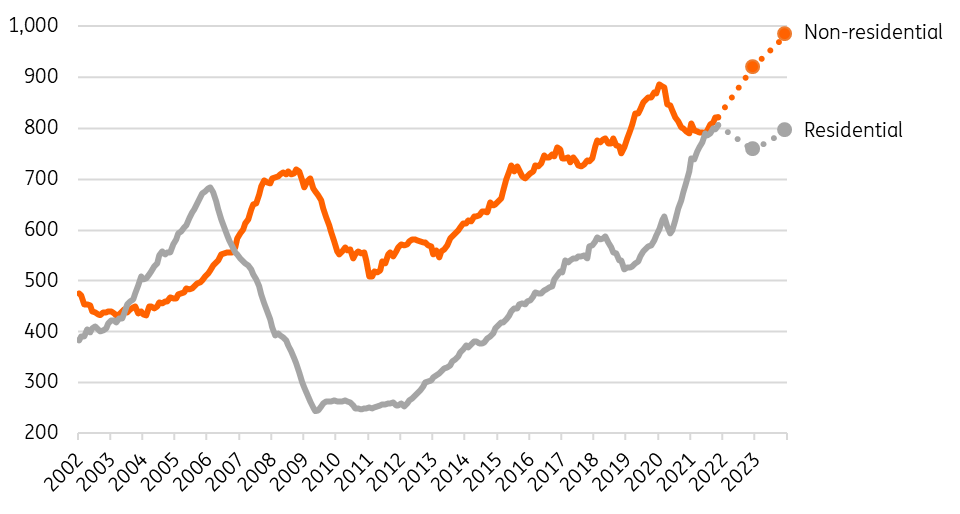

Non-residential: Already on the upward turn

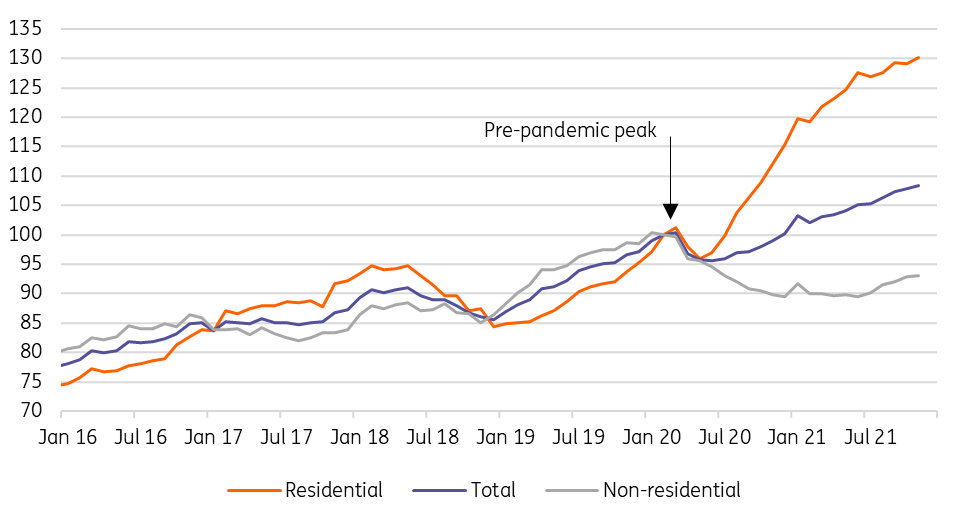

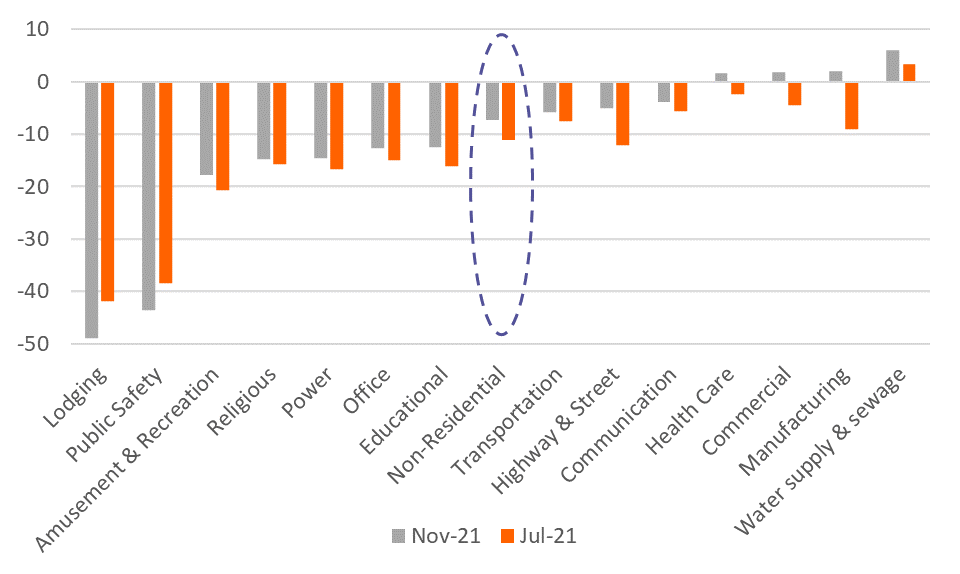

Back in September we noted that while residential construction spending was up 25% on its pre-pandemic highs, non-residential construction was down 11.1% from its January 2020 peak. Lodging (hotels), public safety and recreation were the hardest hit sub-sectors. Only water supply and sewage spending had increased since the start of the pandemic.

Levels of construction spending Jan 2020 = 100

We were hopeful that 2022 will be a much better year given that we had already seen tentative signs of stabilisation in non-residential construction activity in the third quarter. As more people returned to the office, cities were getting busier again, with bars, restaurants and hotels also seeing increased demand. Tourism and leisure activity started returning, which we thought would give another substantial uplift to demand within the US economy.

The non-residential construction numbers have improved more quickly than we had thought likely

Our assumption had been that there was going to be a major backlog of repair work with deferred projects being reinstated. The prospect of major government infrastructure investment was going to give the outlook for construction spending an additional significant boost in the coming years.

Since September, the non-residential construction numbers have improved more quickly than we had thought likely. Data revisions show that as of November 2021 non-residential construction has risen 9% since bottoming in February 2021. Looking at the components, lodging and public safety have seen spending fall further, but construction relating to the manufacturing sector has swung sharply into positive territory and is now back above its pre-Covid peak. The commercial sector has also moved into positive territory, while other components have made more modest improvements.

Performance versus pre-pandemic peak of non-residential components July 2021 vs November 2021

Offices to lag, but reason for optimism elsewhere

While footfall in office areas has increased, it won’t return to pre-Covid levels quickly and we remain cautious on office construction. Flexible/hybrid working is likely to mean demand for office space remains subdued with many firms seeking to sub-let under utilised floors. Emergency backup office sites are no longer required given working from home is available. The office sector accounts for 10% of US non-residential construction spending.

Given less people movement in office areas versus pre-pandemic levels, food outlets, bars, restaurants and business hotels are likely to see structurally lower demand. This could hamper the recovery in major cities. Indeed, business travel in general is unlikely to make a full recovery with video conferencing a much cheaper option, compounding the issue for major commercial centres.

That said, there was plenty to be optimistic about elsewhere. Given the effective mothballing of numerous entertainment venues, hotels, bars and restaurants during the pandemic, there is clearly scope for significant refurbishment work, which will benefit the construction sector. The return of foreign tourists should allow stronger hotel/lodging construction as well – note that pre-pandemic the US would regularly draw in 75-80 million foreign visitors each year, double the number of trips that Americans would make abroad. This is versus the 2.2 million foreign visitors the US has accommodated in total since March 2020!

With online shopping set to hold onto much of the gains made as a proportion of total spending, demand for logistics centres and warehousing also looks set to continue growing. And there is likely to be more demand for recreational venues outside of the major cities given households will likely spend less time commuting to work and more time in their local areas versus pre-pandemic levels. We would also imagine a strong pipeline of work required for educational buildings now that students have returned.

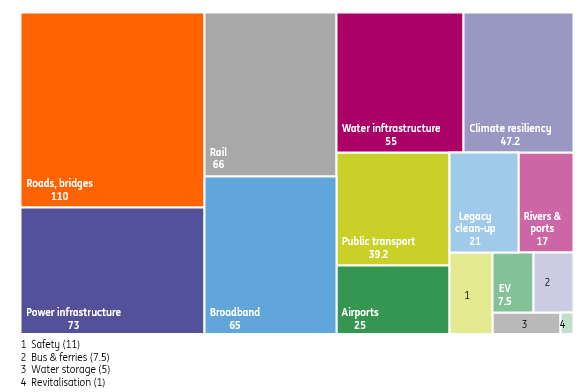

Biden's billions to start flowing later in 2022

Then we have to acknowledge the anticipated support from the Infrastructure Investment and Jobs Act, which was finally signed into law on 15 November 2021. It totals around $1.2tr of spending for the next five years. We wrote about this in detail here. It contains substantial funding for projects that range from public transport to the power system, and from climate resiliency to emerging technologies that can accelerate the country’s energy transition. This will also require additional workers, with President Joe Biden stating that the intention of this plan is also to “create good-paying, union jobs”.

However, the second part of President Biden’s investment aspirations – Build Back Better – has stalled. Republicans are opposed and some Democrats have concerns about parts of the bill and potential fears of it stoking inflation in an economy that is already experiencing the fastest increases in the cost of living for 40 years.

Composition of the Infrastructure Investment and Jobs Act (USD bn)

Parts of Build Back Better can still happen

President Biden has suggested that some of the social investment, such as extended childcare and investment in community colleges, are likely to be cut. By dropping these elements it makes it more likely that we will see some of the components of the bill that focus more on physical investment actually pass into law in the coming months. This includes $550bn that was designated for clean energy and climate change mitigation investment.

Admittedly more than half of this money is tax credits to incentivise behavioural change, but if it does pass its purpose is indeed to stimulate demand and investment in these new industries. There are also regulatory changes included as part of the broad policy shift that pivots towards sustainability-related themes. This too can help incentivise investment by the private sector.

Putting this all together, we see the non-residential construction sector performing very strongly over the coming years, which will more than offset the modest softening trend in the residential sector.

2022: Consolidation and rebalancing, but with overall positive growth

The second half of 2020 and first half of 2021 was a fantastic period for residential construction as massive monetary and fiscal stimulus supported household incomes and boosted wealth through rising asset prices. There was a slowing in the second half of 2021, but not by as much as we had expected and in any case was made up for by a stronger than anticipated growth in the non-residential sector as the economy broadly re-opened.

2021 Year-to-Date (Dec 2020-Nov 2021) total construction increased 8.1% to $1626bn annualised with residential spending rising 12.8% to $806bn annualised as of November 2021 with non-residential construction spending rising 3.8% to $820bn annualised.

This sets us up nicely for 2022, although the Omicron Covid variant has resulted in near-term consumer caution and this could translate into some delays regarding both residential and non-residential construction. Problems over worker shortages and high building supply costs are also a headwind. Nonetheless, we remain hopeful that with Covid case numbers falling in parts of the US we will see economic activity rebound and this can be very supportive.

We are particularly optimistic on the non-residential sector which is likely to see delayed projects reinstated, refurbishment plans increase while a generally strong economy can give a further lift together with massive government infrastructure investment support over coming years.

Back in September we saw the risk of residential construction spending falling 14% in 2022 after surging more than 50% since December 2018. We are now a little more optimistic and predict an 8% fall through 2022 with residential construction spending totalling an annualised $790bn. We then see nominal residential spending expanding broadly in line with nominal GDP for 2023 of 5% growth.

Construction spending with ING forecasts (US$bn)

However, this will be more than offset by the recovery in non-residential spending next year. For 2022, we were predicting growth of 15% in September, but given the earlier turn in spending in 2H21 and the risk that government infrastructure investment starts coming through a little later due to delays in passing legislation, we now think growth of 12% is more likely. Nonetheless, the dollar level is higher than what we had previously forecast and stands at $920bn for end-2022. We then forecast 7% nominal growth in 2023 as non-residential returns to and slightly exceeds its pre-Covid trend growth path.

In terms of overall construction spending, this implies dollar spending growth of 3% for 2022 and 6% for 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article