Opportunities and threats for EU firms in the US-China trade war

The hot topic at Thursday’s Asia Europe (ASEM) meeting will no doubt be the China-America trade conflict. There are opportunities here for European firms, but potential harm too

Why we are where we are

In the first week of September, the US announced another round of increased tariffs targeting a group of import products from China worth some $200bn. Shortly after, China announced its retaliation, raising tariffs on 60 billion dollars-worth of US products. Currently, the trade flows covered by both countries' tariffs add up to approximately 2% of world trade. An escalation of trade tensions between the EU and the US is on hold after President Trump and the EU's Jean Claude Juncker started trade negotiations in July, but this does not mean the EU remains unaffected by the conflict between the US and China.

Gaps in American markets

So what about the opportunities here for European firms active on the American and Chinese markets that are affected by the trade war? Obviously, the raising of import tariffs by the US makes Chinese products more expensive for US importers. Where substitution is possible, US importers may switch to European products. European companies that already export to the US seem best suited to benefit quickly from this improvement in their competitiveness, and the products that European exporters specialise in are prime candidates to fill the gap in American markets.

We found the EU has a relative specialisation in more than half of the product categories currently taxed in the trade dispute between China and the US. Of course, the degree to which these European industries will gain from the tariffs depends on the substitutability of these products and how they can compete with domestic American producers and Chinese suppliers, which are more expensive.

Most promising American markets for the EU

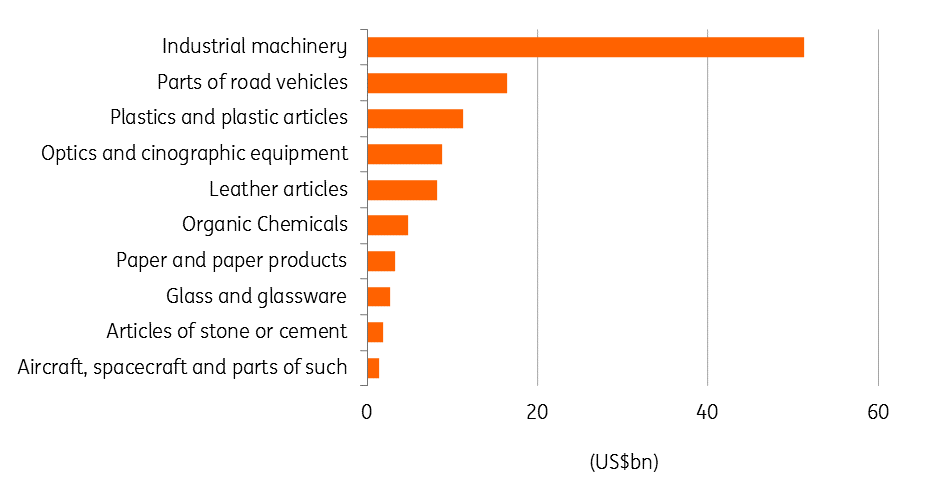

Good performing* EU-product groups on US markets for which the US has raised import tariffs from China. The figure shows the value of US imports from China for these markets.

Who can gain the most?

As we see above, mostly European machine makers could gain from the US tariffs on China. This is the largest category of exports by China to the US in which Europe is also relatively specialised. The EU is also relatively specialised in the export of beverages and tobacco to the US, which are both included in the US tariff measures. However, because China doesn't export too much of those to the US, the tariffs do not offer that much of an advantage for those European drink and tobacco firms.

If the tariffs cause the US to substitute 10% of the industrial machinery that it imports from China with imports from the EU, European machine makers would gain US$5 bn in extra orders from the US. However, the recent 7.5% depreciation of the Chinese currency RMB since May (according to the average USD/RMB exchange rate for September relative to the average rate for May) could compensate for the US tariff increases and thereby diminish the gains in competitiveness for European firms.

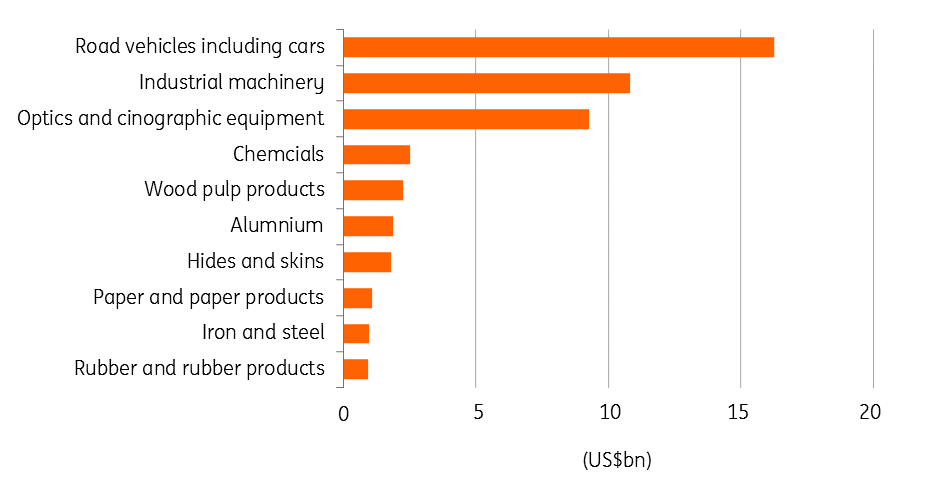

Similarly, the elevated Chinese import tariffs on US products offer chances for EU companies. In particular, the automobile industry (including car parts), machine makers and manufactures of optics are well suited to gain from the improvement in competitiveness due to the Chinese retaliatory tariffs, as we can see below. They are already relatively specialised in these product groups as far as exports to China are concerned.

*Balassa indices (ING calculations) show specialisation of European firms relative to the rest of the world. Products groups selected in the chart all have a Balassa index larger than one meaning that for those product groups European firms are on average more specialised in exporting to China than firms in the rest of the World.

Most promising Chinese markets for the EU

Good performing* EU-product groups on Chinese markets for which China has raised import tariffs from the US. The figure shows the value of Chinese imports from the US for these markets.

Not all good

Although it may seem promising that European firms potentially benefit from additional export orders as the China-American trade dispute escalates, it is not all good. The bilateral trade dispute potentially also harms European firms. A lot of products shipped between the US and China contain foreign parts. If the US demands fewer Chinese goods as a result from the tariffs, it indirectly demands fewer European intermediate goods which are processed in these Chinese products.

Using the world input-output database (WIOD), we calculated that the size of European inputs in bilateral China-American trade equals US$10bn. Although this amount is relatively small, the exposure can inflict pain on individual businesses.

Downward price pressure is another European pain point

Another potential source of harm for European businesses is downward price pressure due to oversupply from China and the US. When the US imports fewer products from China, these products will be shipped to other markets instead. The European Union is an important market for the Chinese. Increased supply will lead to lower prices and therefore lower profit margins for European firms. However, these effects would be temporary as the additional supply by China may (partly) be compensated for by extra demand for EU products from the US (and the other way around). Temporary lower profits may cause firms to postpone investments and forgo employing new workers.

A still unknown balancing act

A tit for tat tariff war creates some opportunities for European firms, but this isn't something to shout about. The bilateral trade flows between the US and China contain EU intermediate products and dumping of Chinese and American goods on the European markets hurts profit margins of those firms which produce primarily for European markets.

On top of that, lower US and Chinese investments, due to lower profit margins and rising uncertainty, potentially affect the demand for European capital goods in the US and China. The net effect of the bilateral trade conflict between China and the US is uncertain. Moreover, it is important to realise that the net effect will differ per industry and per EU- country. Countries whose exports to the US are dominated by capital goods such as Germany and the Netherlands will be hurt relatively more if American investment declines due to the trade war. Countries that are more specialised in goods that are dominant in the Chinese US bilateral trade flows may gain some extra orders from China and the US. However, those countries are potentially also hit most by negative price pressure from excess supply by China and the US. Overall, the net macro effect could just as well be negative as positive.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 October 2018

In case you missed it: A sense of urgency, perhaps This bundle contains 8 Articles