China to speed up “Made in China 2025” plan

Possible collapse of trade talks is likely to increase uncertainty for Chinese production. But we've kept our GDP growth forecasts unchanged as we expect investment in “Made in China 2025” to offset any potential loss from net exports

We are sceptical about the outcome of trade talks between China and the US over the coming months.

According to media reports, the US demands are mostly related to China's national strategy, “Made in China 2025”. Given that China maintains these demands are unreasonable. Therefore, it is difficult to see Vice Premier Liu He's forthcoming trip to the US yielding any tangible results. The most likely outcome for the second round of trade negotiations will be a stalemate.

Stalemate complicates high-tech production supply chain

Exporters that could be affected by the respective US and China trade demands should think hard about their business or at least contingency plans. The increasing uncertainty arising from a stalemate situation will complicate business decisions on future investments.

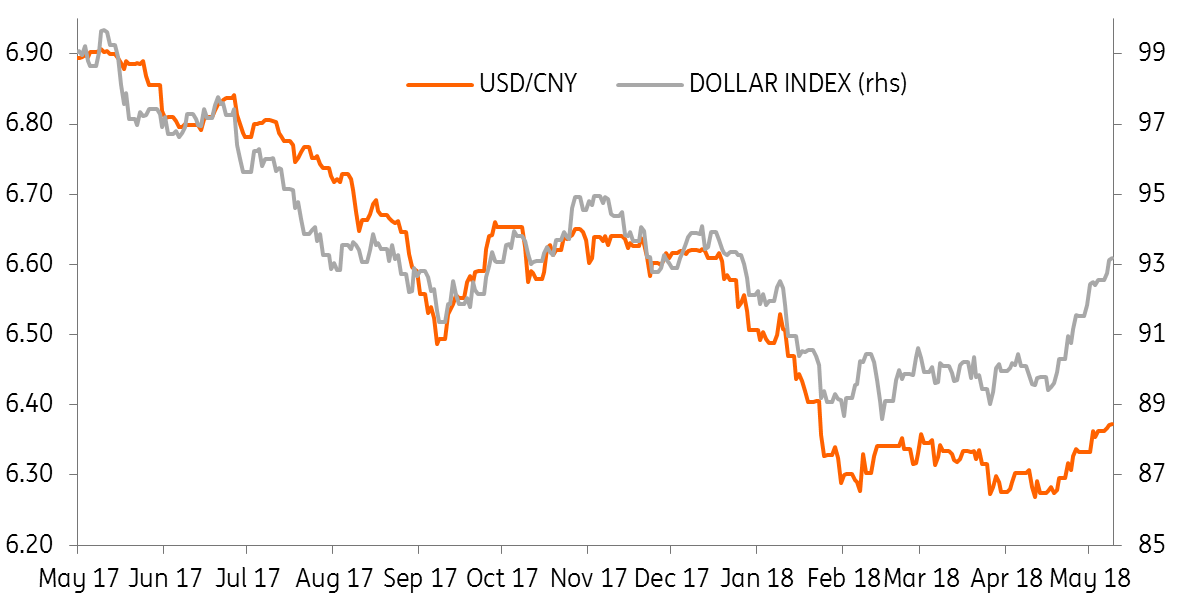

We believe that with the potential negative impact on the economy stemming from a more difficult trade backdrop, this would encourage the central bank to appreciate the yuan at a more moderate pace. This is one of the reasons that we have revised our forecast of USDCNY from 6.10 by the end of 2018 to 6.33.

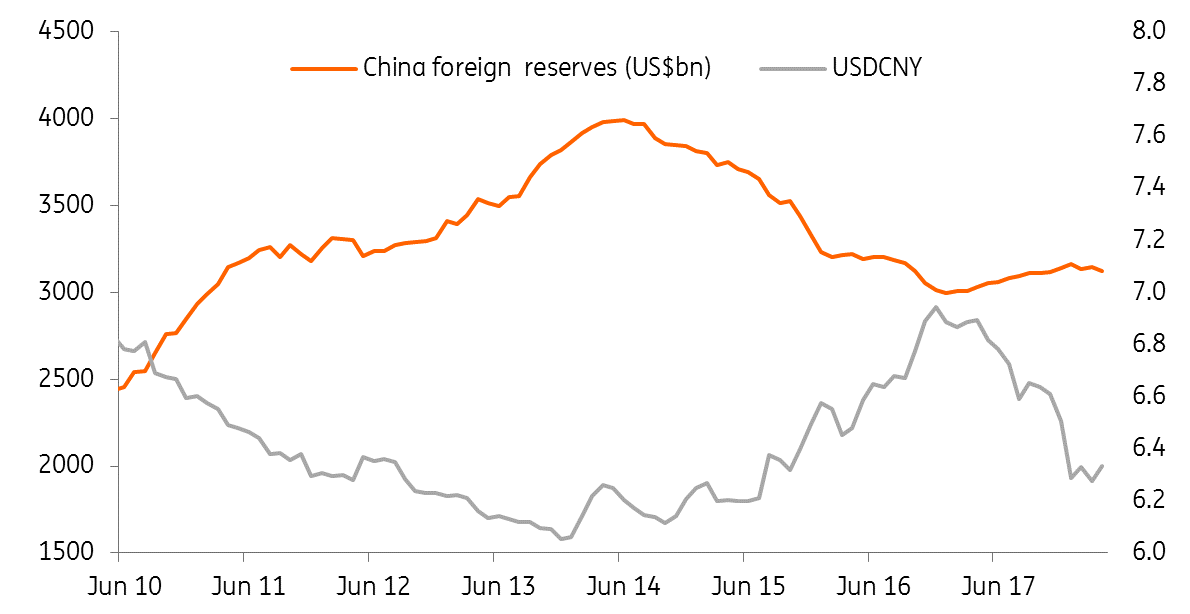

We still expect the yuan to appreciate in 2018 because depreciation would encourage capital outflows, leading to a rapid depletion of foreign exchange reserves similar to the situation between mid-2014 and late 2016. The central bank will try to avoid repeating history especially when the economy faces additional risks from trade tensions.

Central bank set to appreciate the yuan at a slower speed

Moreover, a few percentage points of yuan depreciation will do little to alleviate the trade pressures that China says the US is placing. Indeed, it would likely make negotiations even more fractious, as the US could claim, China was manipulating the currency to boost exports.

PBoC to prevent foreign reserves from falling again

We can see support for such reasoning in the recent path of USDCNY. Even when the dollar index strengthened more than 2.5% in April, the yuan only depreciated 1.2% against the USD. This should result in yuan appreciation against the dollar in 2018.

The yuan has not followed the dollar as closely as before

Why we've kept our China GDP growth forecast unchanged

The US sanctions on a Chinese telecommunication equipment producer has exposed the weakness of China in terms of its self-sustainability in the production of high-quality tech parts as well as the lack of its smartphone operating system. But the timing of all this is not too bad, given that China’s GDP is growing at a rate of 6.5%. The economy can afford to invest more in this sector to achieve self-sustained high-tech sectors as soon as possible.

We expect that fixed asset investments in high-tech manufacturing and infrastructure in 2018-2020 will grow to near 10% YoY and 20% YoY from the latest 3.8% YoY and 13% YoY, respectively. This is likely to boost GDP growth, which will offset the loss of net exports and related production and logistic services following from the US sanctions and potential tariffs.

This is why we have kept our China GDP growth forecast unchanged at 6.8% for 2018 and 6.7% for 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 May 2018

Good MornING Asia - 14 May 2018 This bundle contains 5 Articles