The US economy is slowing, but the Fed needn’t worry

US GDP growth looks set to have slowed sharply in the second quarter of this year to 1.8% from 3.1% in1Q19. However, this reflects trade and inventory idiosyncrasies. It is not a broader deceleration that would warrant an aggressive Federal Reserve response

GDP figures out on Friday

Friday's US growth numbers are set to show a big dip for the last quarter, but there's not much here to alarm either the president or the Federal Reserve. The US economy has grown strongly over the past couple of years, outperforming key trading partners as a vibrant domestic economy, supported by tax cuts, more than offset the headwinds from weaker external demand. The economy currently has unemployment close to 50-year lows with workers experiencing pay rises while equity and home prices continue to push higher. However, there are signs of that growth is starting to slow, which is principally coming from the confidence-sapping fallout from ongoing trade tensions.

Tariffs and trade

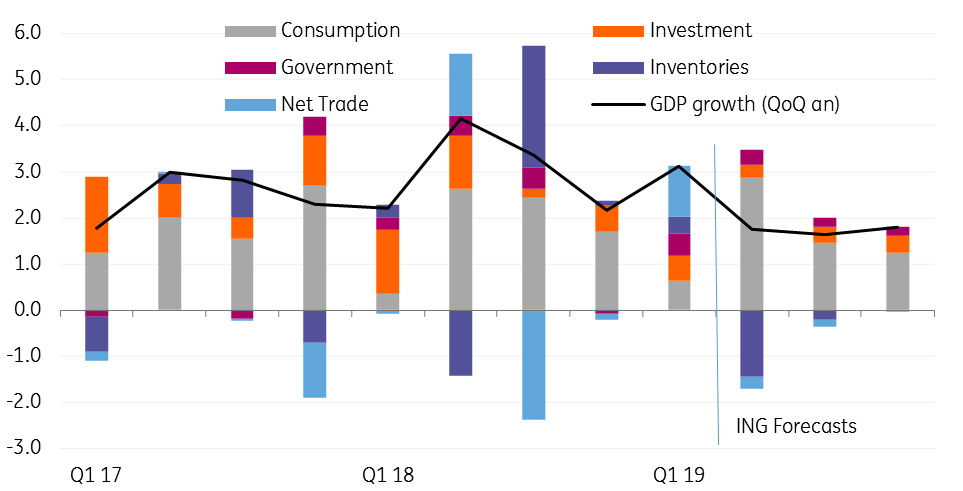

Those on-off US–China trade concerns have contributed to significant swings in GDP growth rates over recent quarters and look set to be a major story again in this Friday’s report. Back in the second half of last year, we saw a surge in imports and a big build-up of inventories as firms looked to stock up on Chinese consumer goods and components ahead of anticipated tariffs. Those tariff hikes were postponed by President Trump in December, but due to the length of time it takes to order and ship products from Asia there wasn’t a great deal that American businesses could do about it in the short-term.

Imports consequently fell back sharply in Q1 2019 but exports held up well, so net trade contributed 0.94 percentage points of the 3.1% total growth. However, imports are set to rebound in the second quarter, so this should be a major drag on 2Q growth. Inventories continued to be built in 1Q (contributing 0.55 percentage points) after big increases in 2H18 so we also expect to see a reversal here with firms running down stocks. This certainly appears to have been a key factor that has led to softer manufacturing output in recent months. In fact, we think the inventory and trade combination could knock as much as 1.7 percentage points off 2Q headline GDP growth.

Contributions to QoQ% annualised growth

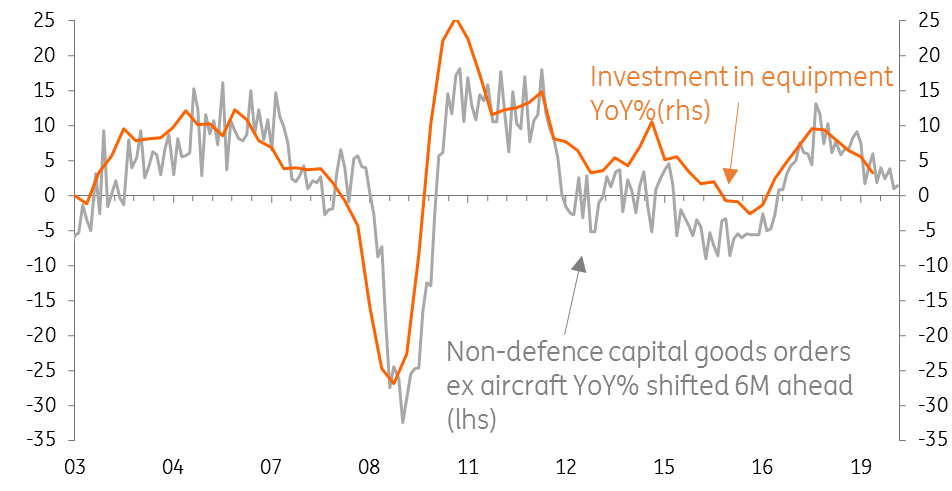

Investment growth is slowing

Business investment may also be a little disappointing relative to recent trends. Core durable goods orders point to weaker growth here, largely due to the global uncertainty and trade tensions making firms more cautious about putting money to work. Federal Reserve officials have commented on the weakness, including Fed Chair Jerome Powell, who said last month that "growth in business investment seems to have slowed notably". He also attributed this to "concerns about trade tensions and slower growth in the global economy".

Durable goods orders suggest investment has softened

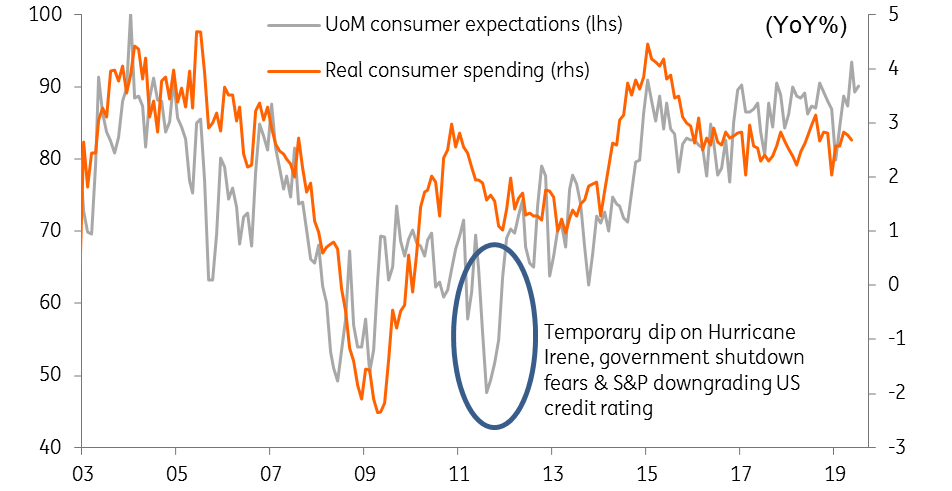

But the consumer continues to roar

Household consumption will be a massive boost though as the strong jobs market, rising pay and benefits, falling gasoline prices and rising asset prices create the perfect environment for spending. Confidence is understandably high and with cash in their pockets, households are prepared to buy, as we have seen in recent retail sales number, auto sales and mortgage applications for house purchases. In fact, we think consumer spending likely grew in excess of 4% in 2Q19.

Consumer sentiment and spending

Fed to take things slow

Recent data has been encouraging, with the consumer sector clearly in a good place and even manufacturing showing renewed signs of life. 2Q GDP will undoubtedly be weaker than in 1Q but, given the volatility in trade and inventories, we think it's better to look at the two quarters together. This gives an average growth rate of 2.5%, which is clearly very respectable. This is slower than the 3% growth seen in much of 2018 and there is the threat that trade uncertainty will continue to act as a brake on activity. To combat this risk, we expect the Federal Reserve to pull the trigger on a precautionary 25bp rate cut on July 31st with a further 25bp move likely in September. While inflation is benign, to us the economic backdrop doesn't appear bad enough to justify more aggressive action.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 July 2019

What’s happening in Australia and around the world? This bundle contains 7 Articles