Update: US mid-term elections – what you need to know

President Joe Biden is not on the ballot at the 8 November mid-term elections, but the outcome will determine how much he can achieve in the second half of his presidential term and how the government can respond to growing recession risks. It will also be an important barometer for the Republican Party and whether Donald Trump will run against Biden in 2024

What's happening?

- All 435 members in the House of Representatives are up for election (currently 220 Democrats, 212 Republicans, three vacant). This is a two-year term.

- The Senate is comprised of 100 members. Each Senator has a six-year term with approximately a third up for election every two years; 34 Class 3 Senate seats + one seat due to vacancy is up for election on 8 November. Of these 35 Senate seats 21 are currently held by Republicans and 14 are Democrats.

- The Senate membership is currently 50 Republicans, 48 Democrats, and two independents who vote with the Democrats. Vice President Kamala Harris (Democrat) gets the deciding vote in a tied ballot. Republicans need to win one seat (net) from the Democrats to control the Senate.

- Should the Democrats lose control of either the House or the Senate (or both) then President Biden’s ability to pass legislation will be severely curtailed. He would likely be limited to using executive powers – a heavily restricted form of lawmaking without tax-changing powers. It will therefore be important in defining what support can be offered to the economy in a likely recession – will the onus be on fiscal policy or monetary policy?

- The presidency is not up for election until 2024, but the outcome of the mid-terms could determine whether Biden stands again and whether former president Trump will seek the Republican nomination to run.

- The mid-term elections will also have implications for Biden’s climate agenda. Partial or full Republican control of Congress will add difficulties to the execution of clean energy tax incentives and funding under the Inflation Reduction Act, as well as other climate measures the administration intends to establish before the next presidential election. In all the scenarios of the election outcome, we can expect more measures coming from federal government agencies to regulate emissions.

- 36 states and three territories also hold gubernatorial elections – a vote to elect a governor to a four-year term, except for New Hampshire and Vermont where the governor serves a two-year term. Of the 36 states up for election, 20 currently have a Republican governor and 16 have a Democrat. Guam (Dem), US Virgin Islands (Dem) and the Northern Mariana Islands (Rep) are the territories holding elections.

- Numerous state elections for the attorney general, secretary of state, treasurer and state legislative elections are also occurring. This could have major implications in a contested election in 2024. There are also various local referendums, including abortion legislation referendums in six states.

What are the key issues?

- President Biden’s approval rating, while low by historical standards, has increased following recent legislative “wins” surrounding green policies, infrastructure and technology. The Democrat Party’s stance following the Supreme Court’s vote to eliminate the constitutional right to obtain an abortion has also helped lift approval ratings.

- Nonetheless, the most important issue according to pollsters is the state of the economy with the rising cost of living, higher interest rates and falling asset prices all causing concern for the electorate.

Percentage of Americans mentioning economic issues as the nation's most important problem

- The perception of poor performance in government is the second-most cited negative factor. In the immediate aftermath of the Supreme Court’s vote on abortion, this issue did become the top concern for 8% of respondents, having been at 1% the previous month. It has since slipped back to 4%.

Other issues respondents cite as the top concern for the election

The state of play

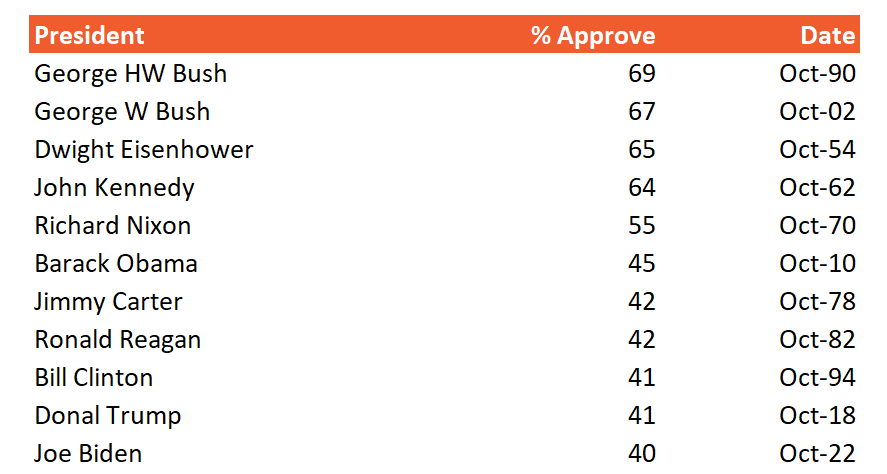

- Mid-term elections are typically seen as a referendum on the effectiveness of a president and their party during the first two years of their term. The omens are not good with President Biden’s approval at this stage in his presidency below all other modern presidents, including the rating of Donald Trump ahead of the 2018 mid-terms at which he took heavy losses. High levels of partisanship, the high (and rising) cost of living, a weakening economy and falling asset prices are all hurting President Biden and the Democrats.

Presidential approval ratings two weeks before mid-term elections

- The election of House members tends to reflect generic Republican-Democrat polling. FiveThirtyEight collates opinion polls which suggest that Republicans are on around 46% and Democrats are at 45% with 9% of the population undecided.

- Turnout is therefore key for the Democrats if they are to retain a winning margin in the House. People who want political change tend to vote in greater numbers than those who are content with the status quo.

- Mid-term election turnout tends to be far lower than for presidential election years. Typically, presidential election years see a turnout of 50-60% with 2020 seeing a 67% turnout. Mid-term elections typically see a turnout of around 40% although 2018 saw a 53% turnout. Hence, the consensus amongst political forecasters is that the Republicans will win a narrow victory thanks to their more motivated base.

- The Senate and Gubernatorial elections are different to the House elections in that senators and governors tend to be better known and individual personalities play a greater role in the decision-making process for the electorate. One way of looking at it is that California only has one governor and two senators, but 52 house seats. Consequently, the Senate races are less driven by national issues that impact generic Democrat-Republican voting patterns in the House.

- Most polls show the majority of Senate seats up for election are solid Democrat or solid Republican. There are perhaps only five Senate seats out of the 35 up for contention where there is genuine uncertainty on the outcome. The Cook Political Report lists one Democrat seat in Arizona, one in Georgia and one in Nevada as a “toss-up” while one Republican Senate seat in Pennsylvania and one in Wisconsin are listed similarly. Hence the Senate is a closer call than the House.

What history tells us

- Only three out of the last 22 mid-term elections (going back to Franklin D Roosevelt’s presidency in 1934) have seen the incumbent president’s party make gains in the House of Representatives (nine seats for Roosevelt in 1934, five seats for Clinton in 1998 and eight seats for George W Bush in 2002).

- The six-seat gain that the Republicans need to win control of the House has been achieved on 17 occasions since 1934 and in each of the last four mid-terms. The median loss of House seats for an incumbent’s party since 1934 has been 28.

- In the Senate, the incumbent president’s party has gained seats on six occasions and lost seats 15 times with one no-change outcome since 1934. The median change in the past 21 occasions has been a loss of five seats. The Republicans need to pick up just one seat to control the Senate.

What history tells us

- While the backdrop supports the view that the Republicans have a strong chance to win control of the Senate, individual Republican candidates have run into difficulties. For example, Herschel Walker in Georgia has lost ground following an abortion scandal, while there are independent voter concerns regarding inexperience and extremism in other candidates.

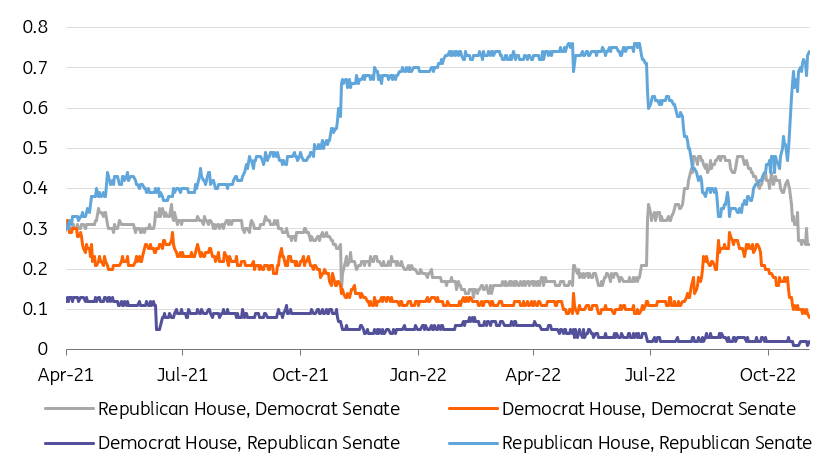

- Momentum does seem to be behind the Republicans gaining control of both the House and the Senate with betting markets pricing in a much stronger chance of this happening in recent days (see chart below).

- We probably won't get a final set of results next week. In Georgia, the rules require the winner to get 50% + 1 vote but with Democrat incumbent Raphael Warnock and Republican Herschel Walker both polling around 46%, and a third Libertarian candidate Chase Oliver polling 5%, there may need to be a run-off between the top two on 6 December.

Implied probabilities of outcomes based on PredictIt betting odds – spreads mean numbers do not sum to 1

The scenarios and what might happen in the next two years

- Republicans win the House and Democrats retain the Senate: Biden constrained. 40% probability

- President Biden struggled to pass legislation when he had a Democrat majority in both the House and the Senate. Without a majority in Congress, it is nigh on impossible. Intense partisanship with just two years to go until the next presidential elections means major legislation is unlikely to pass unless there is a national emergency.

- President Biden’s legislative actions are therefore likely limited to the use of executive orders and actions to circumvent Congress, where allowed. This is a much more limited form of government. Executive orders can only be implemented in areas where the president has constitutional powers, such as trade negotiations. The president cannot use an executive order to change taxes because that power is held by Congress.

- Executive orders can be an effective way of implementing policy since legislation is often written in broad, general language. Legislation is often set out to achieve certain targets or aims without explicitly saying how this should be done. An executive order can allow the president to specify in more detail the route to achieve those aims. These orders only apply to Federal agencies.

- Consequently, Biden’s focus may shift towards international relations and trade policy where the president is less constrained by Congress.

- Given that the fear of recession is rising, the president is going to have less scope to offer fiscal support given the requirement of having Republican legislators on board. This suggests that once inflation is under control the onus is going to be on the Federal Reserve to offer stimulus to the economy. This is our base case for aggressive interest rate cuts from the second half of 2023 onwards.

- A Senate controlled by the Democrats would still be able to approve the president’s choices for key positions, such as judges.

- With control of the House, Republicans gain congressional investigative powers, with some on the right already proposing looking into the president’s son, Hunter Biden’s, business dealings. They can also stall or disband other inquiries, including the committee investigation into the 6 January insurrection. Trump’s enlarged power base in the House could also lead to investigations into the FBI search at Mar-a-Lago.

- From a sustainability perspective, the landmark Inflation Reduction Act is unlikely to be repealed if the Republicans control either the House or the Senate because President Biden has the authority to veto the repeal, or any other passed legislation intended to replace the original law.

- However, under a divided Congress, it could be tough to execute the planned clean energy spending under the Inflation Reduction Act. Republicans could make it harder for the tax credits and funding to be distributed through stricter procedure inspection. Under this scenario, Biden will also likely embark on more climate initiatives from the executive branch, such as issuing executive orders or directing agencies to roll out more aggressive carbon regulations, although the latter faces challenges from the Supreme Court.

The market impact (Republicans win House and Democrats retain Senate)

FX: A split Congress and President Biden left to focus on international issues such as trade could end up proving mildly positive for the dollar. The Biden Administration’s stance on Chinese trade has not been as accommodative as many had expected back in 2020 and the recent tightening of restrictions in the semiconductor sector could lay the groundwork for a more hawkish trade path into 2024.

Rates: Equity markets tend to prefer political malaise, as there is usually less political meddling to fret about. Any material outperformance in the equity space can act to amplify the upside move in market rates in the month or so after the mid-term outcomes. But the more medium-term prognosis points to a bigger fall in market rates. With congress stuck and unable to provide much fiscal support, it is the rates environment that has more room to react, bolstered by bigger cuts from the Federal Reserve versus other scenarios.

2. Republicans win the House and Senate: A springboard for Trump in 2024? 50% probability

- A bad performance for the Democrats will prompt questions as to whether Biden is the best person to lead the party into the next election. Senior Democrats could start jockeying for position with potential party infighting, further undermining the president’s ability to deliver policy. However, the lack of a credible alternative still favours Biden standing again and defeating any Democrat challenger.

- The president’s ability to pass any legislation is curtailed and limited to executive orders as outlined above.

- A Republican Senate would be able to block Biden’s picks for key positions in the judiciary and elsewhere.

- The fact that candidates backed by Trump, and importantly that backed him, have won seats in both the House and Senate strengthens his position as the likely Republican nominee to challenge Biden in 2024.

- The Republicans, buoyed by a convincing victory, are likely to open investigations into Joe Biden's son Hunter and there could even be impeachment charges.

- Republicans making sweeping gains in the House and the Senate would likely be mirrored by major gains for Republicans in state positions that have influence over election processes and the certification of results. This could make the 2024 election even more contentious.

- As in the previous scenario, there will be little prospect of any meaningful fiscal support to counter the recession, putting the onus on the Federal Reserve to loosen monetary policy aggressively in the second half of 2023 onwards.

- On sustainability, like the scenario of a split Congress, while the Inflation Reduction Act is here to stay, the implementation process would be a lot harder. Moreover, a fully Republican-controlled Congress would encourage the party to propose energy legislation that could advance their policy platform. For instance, there will likely be proposals to increase oil and gas activities to cement US energy dominance and seize profits from exports.

- There might also be attempts to streamline the federal energy project permitting process, which can substantially shorten the permitting time for not only renewable projects but also oil and gas projects. Some clean energy areas that will likely see Republican support include carbon capture and storage (CCS, as it can be applied to hard-to-abate sectors such as oil and gas), clean manufacturing, and key domestic energy supply chain strengthening.

- Congress would also likely support blue hydrogen produced from natural gas using CCS technologies over the short to medium term, as opposed to a more radical transition toward green hydrogen produced from renewables. Biden will likely be more aggressive (than in scenario 1) in using his executive power to counter resistance from Congress on the climate issue.

22

The market impact (Republicans win the House and Senate)

FX: Republican control of both branches of Congress could initially weigh on the dollar via a hamstrung administration unable to deliver fiscal support in a downturn. Closer to 2024, however, the dollar could be making a comeback were Republicans to hold gains in the polls – given the experience with Donald Trump’s Tax Cuts and Jobs Act of 2017.

Rates: For markets, this extreme version of political separation between the executive and congressional powers is one that will likely see politics lurch to petty squabbling, removing the risk for big macro-impactful outcomes. As a pre-emptive swing in the direction of a potential Trump administration, a pro-growth tint should result in higher bond yields than would otherwise be the case. Expect an amplification of the risk in yields to the upside, and then a more dramatic fall in market rates to the downside as we progress through 2023.

3. Democrats retain House and Senate: Biden gets a second chance. 10% probability

- This would be a major surprise given the current state of polling, but it would reinvigorate the Democratic party and Biden’s presidency.

- Legislation in support of abortion, same-sex marriage and voting rights would be high on the agenda.

- With recessionary fears intensifying, this outcome would be the one most likely to generate a fiscal response, presumably on spending support for impacted households, e.g. the reintroduction of a federal unemployment benefit. Looser fiscal policy may mean there is less pressure on the Fed to cut interest rates, especially if inflation proves to be stickier than we project.

- The Republican party’s failure to pick up enough seats would likely weaken the chances of Trump being selected as the Republican candidate to challenge Biden in 2024. The party may look to put momentum behind alternatives such as Ron DeSantis, former vice-president Mike Pence and former UN Ambassador Nikki Haley.

- Climate and clean energy legislation could be expanded, building on the Inflation Reduction Act (if they gain a Senate seat and remove the need to get backing from Kyrsten Sinema or Joe Manchin). For instance, Congress might propose bills to change excessive emissions from the power sector – a provision that was originally part of the Democrats’ legislative efforts but was removed by Manchin.

- Congress could even go a step further to pass a new law and give authorisation to the Environmental Protection Agency (EPA) to put caps on power plant emissions. The EPA’s authority to do so was previously rescinded by a recent Supreme Court decision.

- Finally, the Biden administration could be expected to set up more regulation measures to curb emissions. These include tougher rules to reduce methane emissions, as well as new vehicle emissions and efficiency standards.

The market impact (Democrats retain House and Senate)

FX: A surprise retention by the Democrats of both the House and the Senate could be seen as a dollar positive for 2023. The administration would have more power to meet a recession with a fiscal response. This would potentially make more difficult the Fed’s objective of bringing inflation back to 2%.

Rates: Markets would perceive this as being the lower growth and heightened political meddling outcome, which would tend to present a downside risk for equity markets relative to the baseline. For bonds, one question is how inflation might be impacted, with risks that the elevation of climate-focused measures could result in higher inflation, at least in the short term. This could dominate the perception of a lower growth outlook, resulting in higher bond yields than otherwise would be the case (although they would still fall in 2023 once the cycle has turned). That said, there is also a route for bigger spending from a Democratic-controlled administration, bolstering growth and the supply of bonds. That could in turn ultimately skew the risk towards higher market rates on a more medium-term outlook.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article