Uncertainty over Russian gas flows means large risk premium will remain

The European gas market is in a comfortable place. Inventories are trending higher and are at similar levels to 2021. If this continues, storage should be secure starting next winter. That is a big if though, given the uncertainty over future Russian gas flows. This uncertainty means the market will continue to price in a significant risk premium

Gas storage back in the five-year range

Fears over whether Europe had enough gas to make it through the winter proved to be exaggerated. The region has basically finished heating season, and whilst inventories are still quite some distance below the five-year average, they are at relatively more comfortable levels. The gap between inventories and the five-year average has narrowed as we have moved through the year. In addition, storage levels are above where they were at this stage of the year in 2018 and on par with 2017 and 2021 levels. Storage is around 29% full, compared to sub-20% in 2018. There are several reasons behind inventories finishing the heating season at relatively comfortable levels. We explain these below.

European gas storage (TWh)

A milder winter has helped

There were plenty of fears going into the 2021/22 winter that inventories may not be enough, particularly if the region was to see a colder than usual winter. However, Europe saw a milder than usual winter, which helped to reduce heating demand. The International Energy Agency (IEA) estimates that European gas demand fell by around 4% year-on-year over the 2021/22 heating season due to milder weather and weaker industrial demand. Despite elevated gas prices, demand from the power sector is still estimated to have grown by around 1% year-on-year for the period.

The higher price environment is likely to continue weighing on European gas demand through the course of the year. The IEA estimates that European gas demand over 2022 will fall by around 6% year-on-year. This will be driven by lower industrial demand as well as lower demand from the power generation sector with gas-to-coal switching as well as the further roll out of renewables capacity.

Europe sees a milder winter

Stronger LNG inflows

In 2021, the EU imported around 80bcm of liquefied natural gas (LNG), which was down from around 84bcm in 2020. For much of 2021, EU gas prices traded at a discount to Asian spot LNG, which limited LNG inflows into Europe. This flipped as we moved through the year, due to concerns over EU storage levels. And this has continued into 2022, which has ensured record LNG imports into the EU more recently. The European market continues to trade at a premium to Asia and in fact, the TTF forward curve is at a premium to spot Asian LNG all the way through until 2023. This should ensure that spot cargoes continue to make their way to Europe. Under the EU’s REPowerEU plan, the aim is to increase LNG imports by 50bcm this year. To achieve this, the EU would basically need to maintain a similar pace of imports that we have seen so far this year. And for that to happen, European prices will need to remain at a premium to spot Asian prices. This is where it becomes less clear, given the uncertainty over Asia’s appetite for LNG in the coming months.

Whether the EU really needs this amount of additional LNG imports will depend on how Russian gas flows evolve for the remainder of the year.

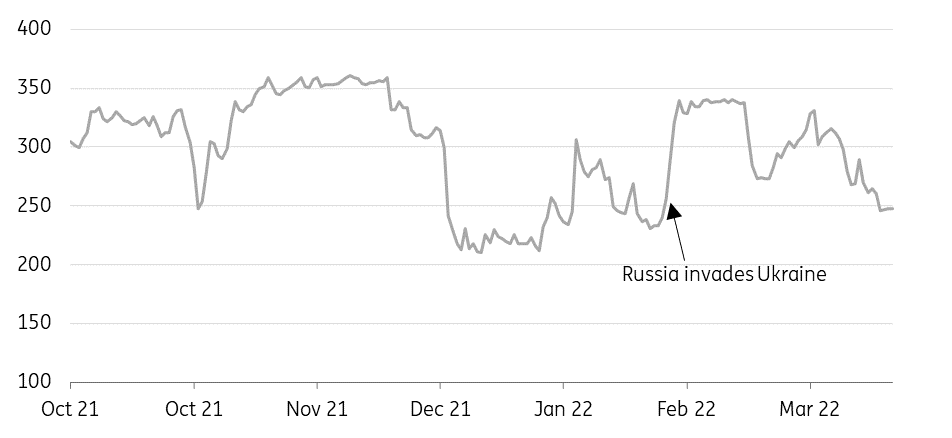

Russian gas flows since the war

The key driver behind the tightness coming into the 2021/22 winter season was reduced gas flows from Russia. Over the fourth quarter of 2021, Russian pipeline flows into the EU fell by 24% year-on-year. This trend continued into January 2022. However, since the war, Russian gas flows to Europe have picked up. Daily average flows in March were up 17% month-on-month, and 40% higher than levels seen in January. European buyers who have long-term contracts for Russian gas reportedly increased their nominations due to the large difference between spot prices and prices under their long-term contracts. Similarly, we can expect that flows would fall if spot prices were to decline relative to long term contracts, and we appear to be seeing this at the moment, with the sell-off that we have seen in European prices more recently.

Daily Russian pipeline gas flows to Europe (mcm/day)

Where next for storage levels?

If we are to see injections at the same pace as the five-year average between now and the end of October, European inventory levels should be above where we started the 2021/22 winter season and exceed the EU proposed target of being 80% full by 1 November. There is the potential that the EU overshoots this target, particularly if Russian pipeline flows remain largely unaffected and LNG imports remain at the pace we have seen since the start of the year. Although, clearly current price levels do not reflect this, given the uncertainty over how Russian gas flows will evolve over the injection season and into next winter. Given this uncertainty, we expect European prices to remain elevated through the year. It would be prudent to assume that we would see some decline in Russian gas flows. Even if Russia did not restrict flows, European buyers would likely be reluctant to extend long term contracts for Russian gas as they come to an end, given the European Commission’s push to become independent of Russian fossil fuels. According to the IEA, European buyers have import contracts equivalent to 15bcm per year which are set to expire by the end of 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article