UK: What next for the economy?

Nobody knows for sure where Brexit will take us over coming days, but PM May has written to the EU requesting an extension until 30 June 2019. All this uncertainty will continue to put pressure on investment, partly because firms may have to restart their contingency planning. The chances of a 2019 UK rate increase are fading, but don’t rule one out completely

With just a week to go until the current 12 April Brexit deadline, it’s fair to say that nobody knows for sure what will happen between now and then. After three failed attempts to persuade lawmakers to back her Brexit deal, UK prime minister Theresa May has conceded that she will need to reach across party boundaries to try and break the deadlock.

Things are changing quickly but, in principle, this makes a softer Brexit path more likely. Either the government will agree a solution with the opposition Labour Party directly or failing that, the PM will ask Parliament directly through another round of ‘indicative votes’. Either way, we suspect either a permanent customs union or the so-called ‘Common Market 2.0’ proposal (customs union plus single market) are most likely to prevail. For more on what these options mean in practice, see our infographic guide.

One way or another, a further extension to the Article 50 negotiating period looks likely – and in fact, the Prime Minister has already suggested she will ask for one. The EU will have to approve this – and there have been some splits among leaders about whether one should be granted, particularly if a request isn’t coupled with a decent justification.

Another extension looks likely, although some within the EU appear reluctant to let things drag on for much longer

At this stage though, our base case remains that the EU will allow a long extension to the Article 50 period, perhaps lasting as long as 9-12 months. This would be on the basis that the UK participates in European Parliamentary elections, but may well contain a mechanism to allow it to be cut shorter if British MPs can rally behind a deal sooner.

We’ll have to wait and see exactly what the EU decide, but what would a long delay mean for the economy?

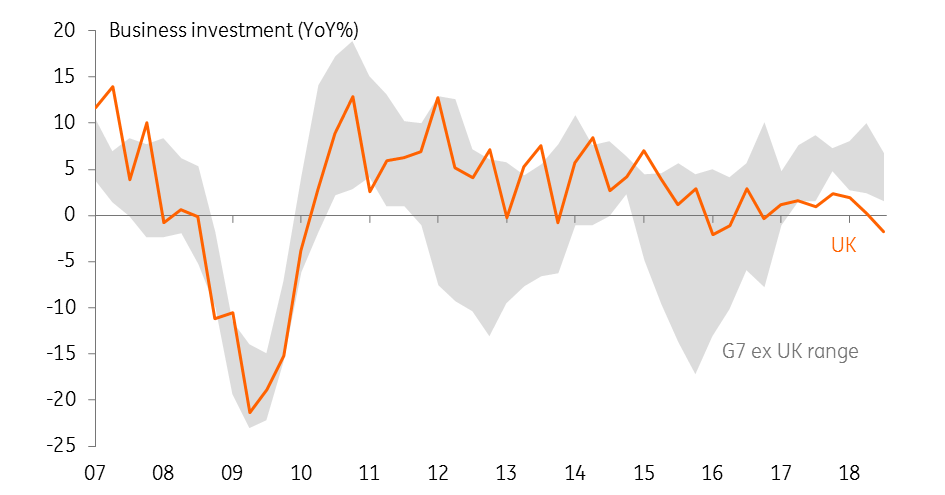

Investment has been really poor in the UK

Well, firstly it’s worth remembering that growth has already been very poor over recent months. In particular, investment has been very disappointing and on a year-on-year basis, was the worst among G7 economies in 2018. More recently, that can be easily attributed to businesses making preparations for a ‘no deal’ Brexit.

Judging by various surveys, it seems that for many firms, this contingency process may have only begun in earnest over the past few weeks. A Bank of England survey from January indicated that, back then, around half of companies felt they weren’t ready for ‘no deal’. Likewise, the government estimated in February that out of the 240,000 British firms believed to have only ever traded within the EU, only 40,000 had applied for a European Union registration and identification number (EORI)– the most basic requirement to fill in customs documentation.

This contingency activity has undoubtedly picked up over recent weeks, and the latest economic numbers show that this is taking its toll on growth. The service sector – which accounts for around 80% of UK output – slipped into contraction in March, according to the latest PMI.

If there is a long extension to the Brexit negotiating period then, in theory, the temporary removal of the ‘no deal’ threat would give businesses a bit of a reprieve. That could unlock a bit of pent-up capital spending and hiring, although overall we suspect investment will remain under pressure.

Not all firms had ‘no deal’ plans back in January

Having come this close to the cliff-edge once, we suspect firms will use the extra time carefully to prepare for a possible repeat scenario. For many companies, this will be very costly. Goods producers/suppliers will be forced to renegotiate and extend contracts on additional warehousing space to allow for future stockpiling requirements.

Those firms that deal with perishable goods may need to start the whole stock building process from scratch. Similarly, many firms may decide that it is simply too costly to hold or to finance elevated inventory levels for such a long time and instead may look to unwind the current stockpile and rebuild it nearer the new cliff-edge date.

Those are a few specific examples, but the upshot is that growth as a whole is likely to remain under pressure if Brexit is delayed for a significant period of time. In our opinion, this could easily write off any Bank of England tightening later this year.

A long extension would reduce the chances of a 2019 rate rise

However, if a deal can be approved relatively soon, and the transition period begins, things could look slightly different. Investment will remain clouded by an ongoing lack of clarity surrounding the details of the future relationship, but the reduced uncertainty could see some consumer spending come back online. Wage growth is accelerating pretty rapidly on the back of various skill shortages, while inflation remains benign.

A moderate recovery in growth if there is a deal could revive thoughts of Bank of England tightening later in the year, and certainly, policymakers have kept the door ajar to a rate hike if Brexit goes smoothly. We still very loosely have a rate rise pencilled in for November on the basis that policymakers appear to want to move policy to a more neutral stance. That said, with global central banks turning more dovish, it’s equally possible that the Bank of England could decide to remain on pause for much longer yet.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 April 2019

April Economic Update: Cheer up! The gloom is mostly set to fade This bundle contains 8 Articles