UK pound and gilts to retain political risk premium despite British PM quitting

Markets have greeted the news of UK prime minister Liz Truss's resignation with minimal reaction. We suspect UK assets will find it difficult to fully shake off the political risk premium that has been built in over recent weeks. 10-year yields could struggle to stay below 4%, while the pound looks vulnerable in an environment of further dollar strength

Little market reaction to PM Truss's resignation

The news of UK prime minister Liz Truss’ resignation hasn’t been greeted with much of a reaction in either gilts (government bonds) or sterling. The absence of a sell-off suggests a widespread assumption that the process of finding a new leader – which is expected to take at most a week – won’t deliver any more political uncertainty, on top of what the UK is already suffering. By the same token, we also conclude that gilts assign a low probability to fresh elections.

From the perspective of gilts, all investors really want to see is a credible fiscal trajectory. Here too, sanguine market reaction suggests that the leadership contest will result in some degree of political backing of these fiscal measures. The government has, for now at least, confirmed the Medium-Term Fiscal Plan will still go ahead on 31 October.

The leadership contest isn't without risk for markets; election probabilities are slowly rising

As we see it, there are three risks to this view:

Firstly, investors may begin to question whether a fiscal plan can credibly be delivered a matter of days into a new prime minister’s tenure, with a set of measures that have been crafted without their input. There’s a chance that the plan gets pushed back a week or two – albeit at the expense of occurring after the Bank of England's meeting on 3 November.

Secondly, there’s the question of whether all the leadership candidates back Chancellor Jeremy Hunt’s plans. The incentive to do so is high, and no new leader will want to fall foul of the markets in the same way as the outgoing prime minister. But markets will be closely monitoring the potential leadership favourites – Rishi Sunak, Penny Mordaunt and Boris Johnson – for signs of potential disagreement on fiscal strategy (we wrote more on what the Chancellor's options look like earlier this week).

The risk of an election before January 2025 is clearly rising.

Thirdly, there’s a chance that the opposition Labour Party puts forward a motion of no confidence in the government in the coming days and weeks. As we understand it, the rules surrounding this – which changed earlier this year – mean an election could be triggered if the government were to lose a no-confidence vote by a simple majority. Again markets are probably right to price this as a low-probability event for now, given that as things stand the Conservative Party is considerably lagging in the polls. But the risk of an election before January 2025 – the latest the next vote can occur – is clearly rising.

Gilts to keep trading with a political risk premium

If investors are right about the fiscal trajectory and likely state of UK politics, then the focus in the gilt market going forward will mostly be on the BoE. If markets are right that the Bank rate will go above 5% in the coming months (from 2.25% now), then 10Y gilt yields will struggle to remain below 4%.

The Bank essentially faces a choice between hiking aggressively and baking in the ultra-high level of mortgage and corporate borrowing rates, amplifying the depth of a recession through the first half of next year – or undershooting market expectations, at risk of a weaker pound and more imported inflation.

We think the latter will be seen as the lesser of two evils, and indeed that was the message from BoE Deputy Governor Ben Broadbent who in a speech made it pretty clear that he thinks market pricing is overdone. We expect a 75 basis-point rate hike in November, but think Bank Rate is more likely to peak in the 3.5-4% range.

10Y gilts are still trading with a 50bp political risk premium, but it won’t go away in a hurry

However markets have questioned the BoE’s policy stance for a long time now, and it is unclear what would convince them in the near term.

Gilts are likely to continue to trade with a sizeable political risk premium for the foreseeable future. At just above 50bp, it is already less than half of what it was in the aftermath of the 'mini' budget, which did so much damage in late September. The old adage, that it takes years to build confidence but only one day to destroy it, applies here. At most, 10Y gilts can hope to tighten another 50bp against German Bunds and US Treasuries but the pace of gains is likely to be much slower from now on.

Sterling: Buy the rumour…

The most compelling question is whether sterling needs to completely unwind the losses imposed by Trussonomics. We had felt that the starting point for this influence on FX markets was in early August when it looked as though Liz Truss was becoming the Tory membership’s top choice for PM. At the time GBP/USD was trading near 1.20 and EUR/GBP near 0.84.

Arguing against Cable returning to 1.20 is the fact that US real interest rates have climbed substantially since then, where the real 10-year Treasury yield now sits at 1.70% versus 0.50% in early August. Equally, it is questionable whether the new UK leadership team can fully regain lost fiscal responsibility even though we presume they will attempt to present a balanced budget on October 31st.

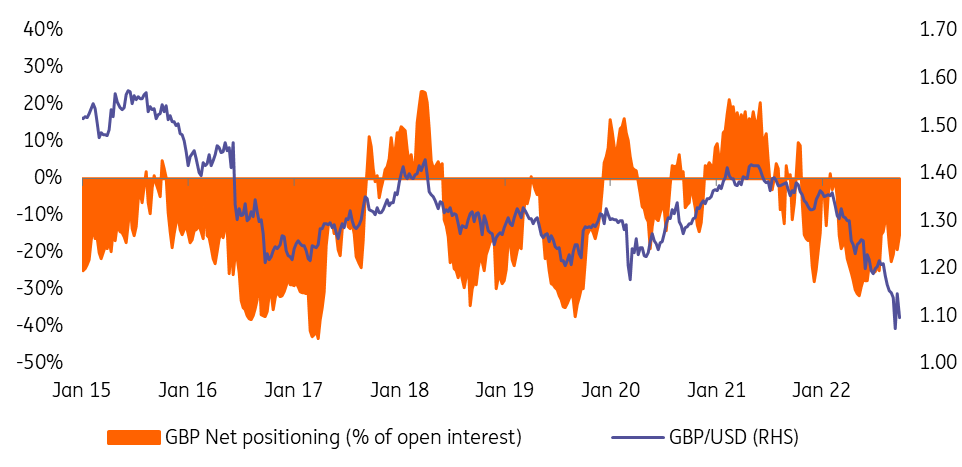

Position data suggests speculators are short sterling

Positioning data should always be treated with a pinch of salt, but the latest data from the futures market suggests speculators are short sterling – but not to an extreme degree. In all, we would say GBP/USD can bounce around in a 1.10-1.15 range into the October 31st event risk. However, into year-end, we favour broader dollar strength as US real rates push to 2.00%, meaning that GBP/USD could be back at 1.05. EUR/GBP may struggle to break much lower than 0.8600 and any policy misstep could easily push EUR/GBP back to 0.90.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article