UK: Outlook positive despite virus resurgence

The UK's final step of the reopening looks set to be postponed amid rapidly-rising Covid-19 cases. But barring a return to stricter rules, the economic damage may be pretty small, though much hinges on whether higher case numbers begin to dent safety perceptions among consumers

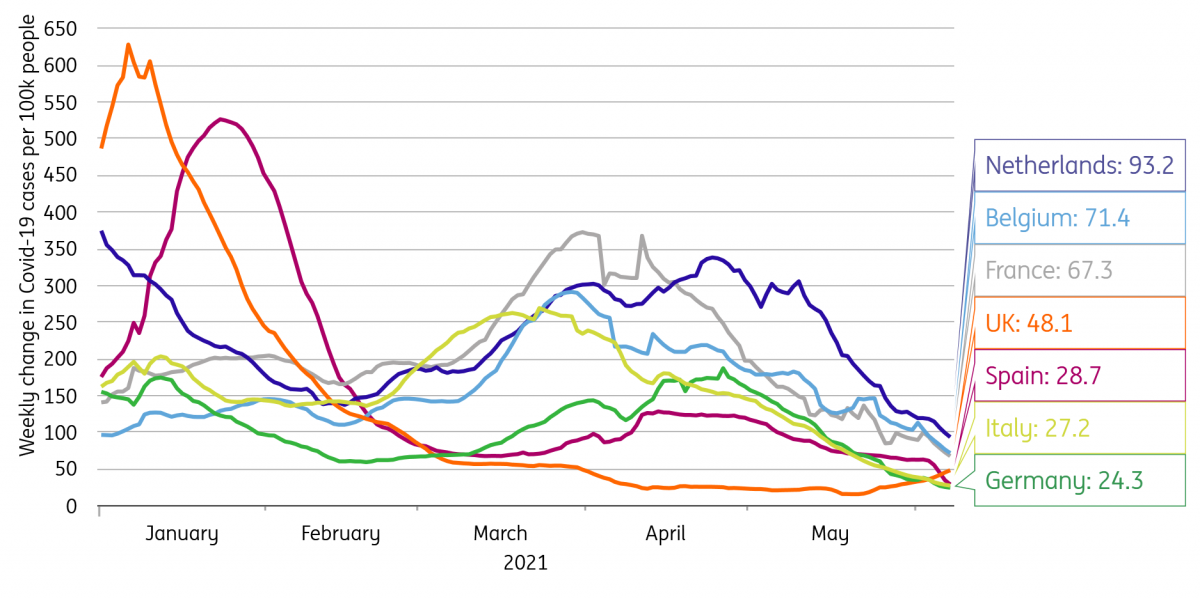

UK Covid-19 cases are on the rise once more

We’re a little under two weeks away from the date – 21 June – where the UK government had hoped to do away with the vast majority of remaining coronavirus restrictions. But amid rapidly rising case numbers, thanks to the now-dominant ‘delta’ variant (first detected in India), that’s now looking less likely.

The good news though is that the current batch of vaccines is so far proving successful in stopping disease. As of the last weekend, only 4% of UK cases so far recorded with the new variant were among twice-vaccinated people.

But with just under half of adults still awaiting their second dose, there is a period of vulnerability over the coming weeks. While the proportion of vulnerable adults that are not vaccinated is very small, scientists have warned that low percentages of a population of 68 million people can quickly still translate into large absolute numbers of people entering hospitals.

UK cases are low but unlike most of Europe, are rising

Ultimately the goal, as has been the case throughout the pandemic, is to avoid a situation whereby hospitals are full and can’t provide usual service levels. Whether or not that happens, in large part, depends on how much more transmissible this new strain is. The faster it spreads, the more quickly admissions rise and the more condensed the peak of the exit wave will be.

Early estimates of a 70% transmissibility advantage – potentially pretty bad news – have since been reduced to 40-50%. There have also been hints, though only anecdotal so far, that many hospital admissions are less serious than they were in previous peaks given the lower average age, resulting in quicker turnaround times. The vaccine programme is also being accelerated as far as deliveries allow, to bring forward second doses, while those in their 20s are now being (informally) offered their first dose.

The direct economic impact of a delay needn't be huge

In short, the end of most restrictions on 21 June is likely to be postponed, but perhaps only by a period of a few weeks until more people have been fully vaccinated. And that would mean that from an economic perspective, the impact probably won’t be huge.

Ongoing work-from-home guidance may slow the recovery in city centres, though rising transport usage suggests the return to office is already happening to some extent anyway. Capacity constraints on restaurants and events will slow the return to full profitability for some firms, though clearly, a return to closures would be a far bigger deal - and for the time being, that seems unlikely.

In other words, we think at most we’re talking a few tenths-of-a-percentage points off near-term GDP. However much will hinge on confidence, and whether the negative virus news tempers some of the confidence among consumers and businesses that has emerged over recent weeks. So long as vaccines continue to be shown effective, then we suspect most consumers will remain comfortable with going out-and-about. Incidentally, we think has been a key factor in driving social spending back above last summer’s levels, even before indoor dining reopened a couple of weeks back.

Could the Bank of England join the early-hikers?

Assuming the recovery isn’t derailed over the summer, then the next question is whether the Bank of England will join the likes of Norway and Canada with rate hikes before 2023. That prospect was raised by BoE dove Gertjan Vlieghe (who admittedly is leaving the committee shortly), who floated a possibility of a 2H22 hike.

For now, we’re pencilling in a move in 2023, which is more consistent with our Federal Reserve call – particularly given that UK inflation is likely to moderate beyond the first few months of next year. However a more rapid recovery – perhaps triggered by greater-than-expected unloading of household savings – could conceivably bring that forward.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 June 2021

ING Monthly Update: Looking for freedom This bundle contains 14 Articles