Trade Outlook 2022: Clogged supply chains won’t hold trade back

Demand for consumer goods rose strongly last year despite the profound disruption to supply chains due to the pandemic. We expect global trade not only to nomalise in 2022 but to grow further despite still challenging circumstances

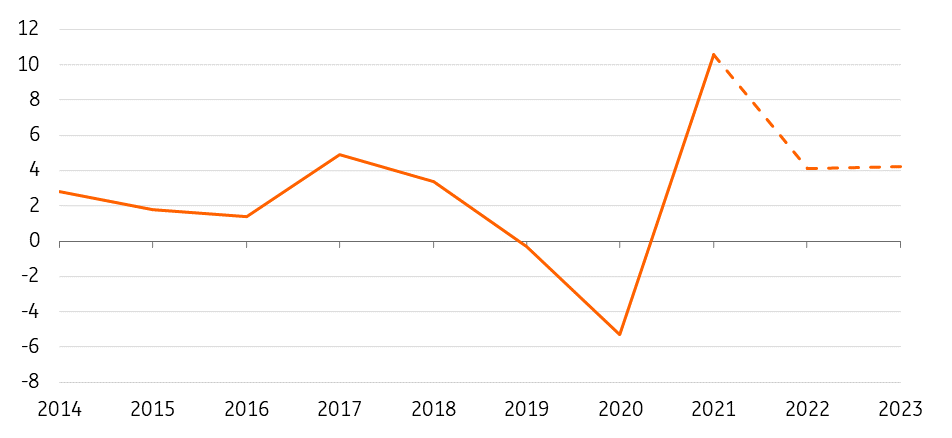

Despite the profound disruptive impact of the pandemic on supply chains, demand for consumer goods rose strongly last year. We expect merchandise world trade volumes to have increased by 10.6% in 2021 compared to the previous year, surpassing its pre-pandemic level by 4.3%. The growth rates of global merchandise trade should return to pre-pandemic levels this year, supported by industrial growth, global demand for goods remaining elevated, and only a limited shift of consumption back to services.

And that double-digit expected increase comes in spite of massive supply chain disruptions and soaring transport costs. It reflects strong demand for goods during the pandemic with China being one of the main drivers of the trade surge.

| 4.1% |

Expected growth in merchandise world tradeYear-on-Year, 2022 |

When we look at the details, world trade volume increased 2% month-on-month in November 2021, the second increase in a row. That's according to the World Trade Monitor for November from CPB. An increase in exports (+2.8%) and imports (+3.6%) mainly in advanced economies led to the rise in trade volumes, while China's exports decreased 4.1%. Imports showed modest growth of 1.2%. With some delay, this is also reflected in global container throughput which is regaining traction.

World trade in 2022: Return to pre-crisis growth rates

Global goods trade volume, %YoY

World trade normalises and continues to grow despite challenges

Going into 2022, we expect trade growth rates to return to their pre-pandemic levels in line with a continued but weakened global economic recovery. For this year, we pencil in a growth rate in merchandise world trade of 4.1% compared to 10.6% the year before, while we expect world GDP growth to come in at 4.4% from 6.1% in 2021. 2021 was an exceptional year driven by pandemic-related catch-up effects. Despite ongoing supply chain frictions and average containerised transport costs expected to remain high, we still expect to see a decent growth rate.

Overall, consumers' preference for goods remains elevated

We expect the global economy will gain traction and enter a new phase should the Omicron wave become significantly less of a threat by the European spring. The experience of almost two years of crisis shows that economies can adapt, suggesting any new regional lockdowns should have less of an impact. That said, a shift by consumers back into services will only be moderate in 2022 because of Covid caution. They might reduce some of their increased spending on the likes of electronics and furniture while resuming spending on services all the while seeing higher energy and food prices. Overall, however, the preference for goods remains elevated.

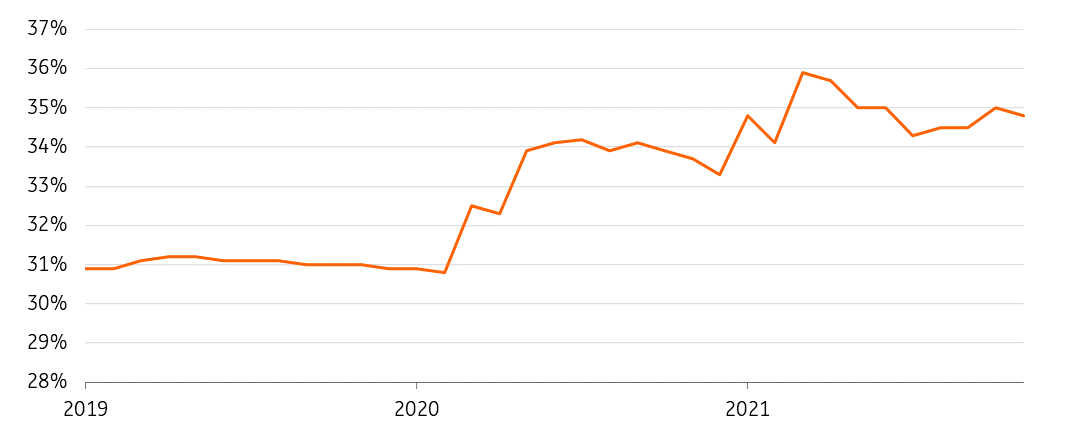

In the US, for example, the share of goods spending as a proportion of total personal consumption expenditure continues to hover around 35%, well above its 31% average in 2019. This indicates a continued goods' preference in the first quarter of 2022.

US personal consumption expenditure

Percentage share of goods likely to stay elevated

Ongoing labour shortages around the globe argue in favour of a rebound in wage growth and an improvement in workers’ bargaining power. This, in turn, means we should see an environment of continued elevated demand, fueling world trade volumes. However, there is a risk that real wages will remain negative despite those higher wages with worldwide inflation expected to surge to 4.6% this year.

Through 2022, however, we expect inflation to subside, which leaves room for real income growth to turn positive in the second half of the year. In the eurozone, data seems to confirm this with manufacturers mentioning easing sourcing constraints which in part helped to ease input price inflation to the lowest level since last April. Governmental fiscal support and infrastructure plans, partly related to the green transition, also point to a continued positive investment outlook despite a tightening of financing conditions from major central banks,

Asia to remain a driving force in 2022

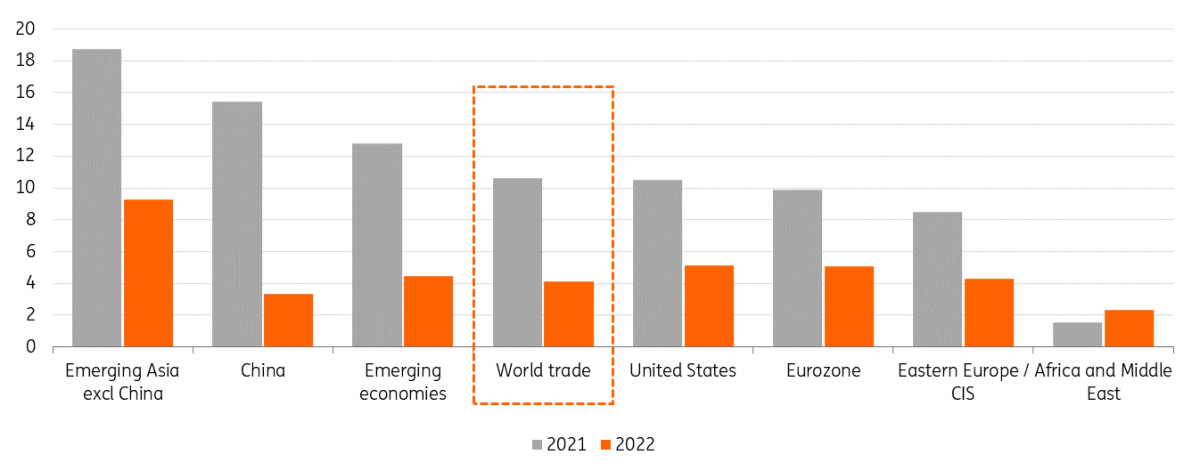

Trade growth remains uneven, however, when you look at different regions. The divergence across blocks and individual countries has been - and will be - driven by the progress and speed of vaccinations and the dependence on intermediate goods. Intra-Asia trade still has strong growth perspectives. Following an improvement in Asian industrial production over 2021 as well as significantly higher container throughput in Shanghai (+8%) and other major Chinese ports, the general macroeconomic outlook for Asia and especially China depends on Covid, chip shortages and the US relationship.

A slowing of economic activity in China remains a concern for northeastern Asian industrial economies. Cooling industrial demand for coal and iron ore from China has already led to bulk freight rates easing after a commodity-driven peak. Chinese trade flows may also be more volatile this year due to less real estate construction but more infrastructure investment may help to balance that out.

On a global level, we expect larger flows of oil and oil products alongside the global recovery of road and airline traffic and we think that China should remain a major driver of growth for metals exposed to the energy transition. We expect global automotive production to increase by up to 10% (we've written more about that here) and that will create extra trade volumes but the semiconductor shortage will be a limiting factor.

Lastly, the implementation of regional trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) within the Asia-Pacific area coming into force as of the beginning of the year or the African Continental Free Trade Area (AfCFTA) promoting intra-African trade, will likely affect regional trade flows.

Growth of trade in goods volume varies depending on the region

Percentage, Year-on-Year

Supply chain slump and elevated tariffs will drag through 2022

So it all looks positive but it doesn't mean we don't face any obstacles to our growth outlook. A combination of shipping capacity and container shortages, unforeseen incidents, whether those be terminal closures in China or another blockage of the Suez Canal, and we could also see labour shortfalls which helped lead to spiking container rates last year. And 2022 started off with new records here. Based on UNCTAD data, those costs pushed China to Europe port-to-port container costs up to some 15% of the average goods transported (up from 2-3%).

The effect of massive port congestion occupying 10-15% of the global fleet capacity feeds back to that disruption. We've perhaps seen the biggest impact of that in the US. Container ships waiting at Los Angeles-Long Beach (covering 40% of US containerised imports) hit record levels in January with shortages at port sites and a lack of truck drivers to push goods further down the line. In Europe, the effect is less pronounced but still, ports are packed too. In China, we have seen similar squeezes in the Ningbo, Tianjin and Zhenzhen ports because of the country's zero-Covid policy. After Chinese New Year we do expect things to improve. But when spot rates come down, term contract rates of large shippers are still being negotiated higher.

A record wave range of ultra-large container vessels will come online

We concluded earlier that container rates will remain under upward pressure and won’t return to pre-pandemic levels anytime soon. A record wave of newly ordered ultra-large container vessels will come online from 2023 and 2024 but the container shipping sector is much more consolidated with three large alliances. Container liners also have learned to manage capacity better. The container sector is also entering the energy transition with retailers aiming to reach zero-emission seabound trade by 2040 and companies are facing some sort of CO2 pricing. Maersk already started the shift by ordering 12 methanol-ready container vessels. But, in any case, fuel is expected to be more expensive, and that has an upward pressure on prices too, of course.

Risks ahead but trade fundamentals are still solid

The pandemic remains an uncertain factor affecting the outlook for 2022. Supply chain troubles and higher shipping costs also continue to pose risks to growth. At the same time, last year also showed this doesn’t necessarily hamper the world from continuing to trade.

The economics of trade still make sense. There are not many examples of re-shoring yet as this takes time; it requires a high level of automation, and it's easier said than done. But shippers do consider multi-sourcing options, buffer stocks and longer contracts and this is still highly supportive.

So, we're optimistic given the economic outlook, a hopefully receding pandemic, and clear evidence of richly filled order books, notably in the automotive sector. We expect trade volume growth to hold up well this year, resulting in a more moderate but still sound growth rate for merchandise world trade.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 January 2022

Looking forward to looking back This bundle contains 7 Articles