Tourist arrivals in Spain reach 90% of pre-pandemic levels

Spanish tourism is reaching pre-pandemic levels thanks to a strong rebound in domestic tourism, compensating for the drop in the number of foreign visitors. International tourism is still 10% below 2019 levels. However, economic headwinds pose a risk to the tourism recovery

Nine million customers visited Spain in July, near pre-Covid levels

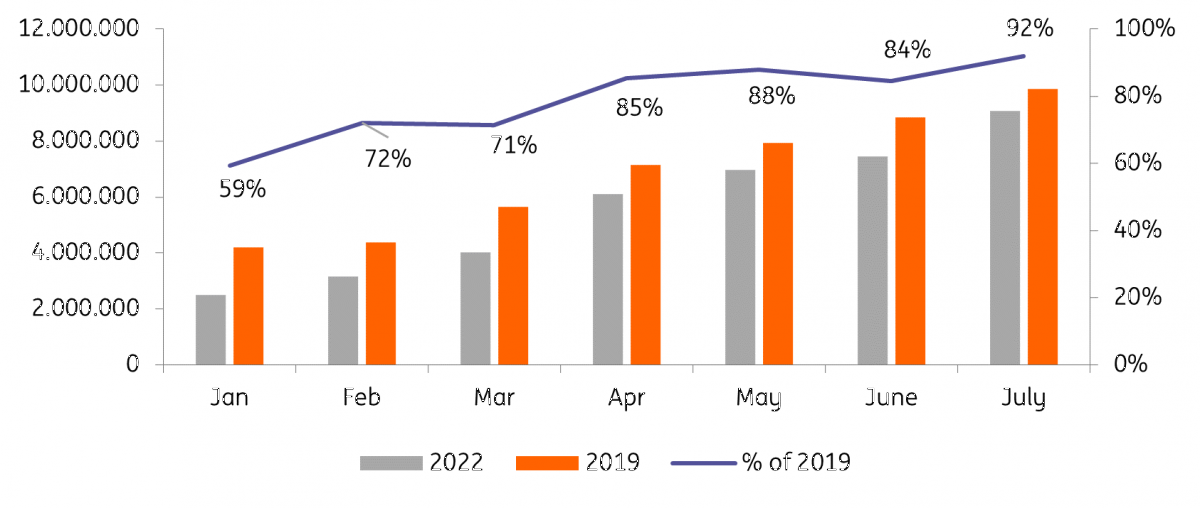

Despite the gloomy economic outlook and uncertain geopolitical situation, the Spanish tourism sector is recovering rapidly from the pandemic. In July, Spain welcomed 9.1 million international tourists, equivalent to 92% of its pre-pandemic level. In July, most Spanish visitors came from the United Kingdom, accounting for 21% of all international tourists visiting the country. France is the second-most important source country accounting for 16% of the total tourist inflows. Since the start of the year, the gap in international arrivals with its pre-Covid levels is narrowing rapidly. In January we were at 59% of the 2019 level while in July this had risen to 92%. Total tourism spending, corrected for inflation, also rose to 88% of its pre-pandemic levels in July. Although inbound tourism continues to close the gap with 2019, it will likely take another year to return to pre-pandemic levels.

Fig 1. International tourist arrivals in absolute levels and as a % of its pre-pandemic levels

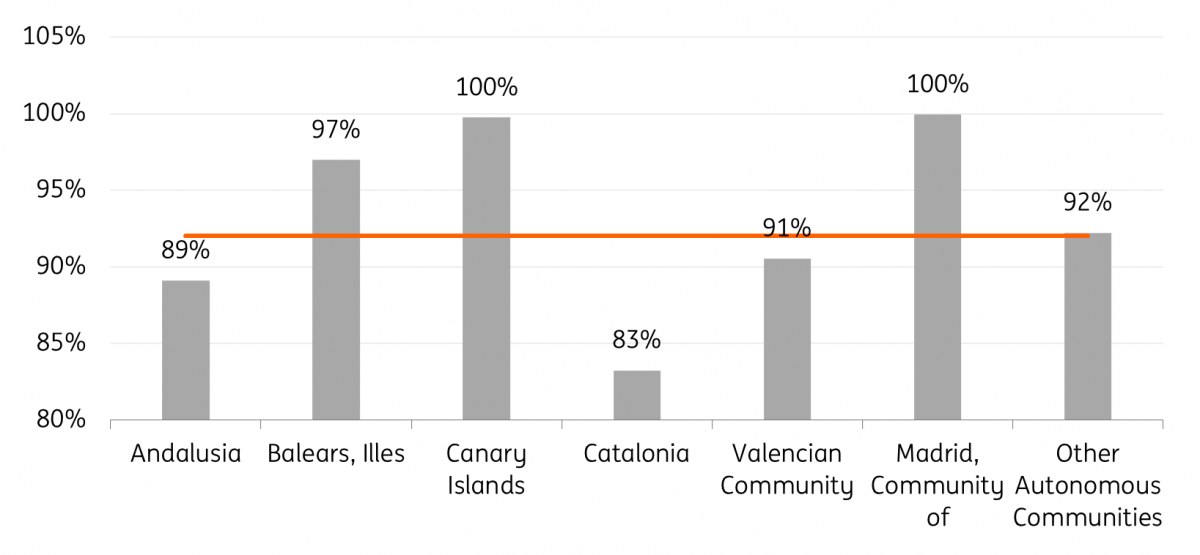

The Canary Islands and Madrid have reached pre-Covid levels

In July, Illes Balears (2.3 million arrivals) was the main destination chosen by international tourists accounting for one in four inbound tourists, followed by Catalonia (about 2 million) and the Valencian Community (1.1 million). The Canary Islands and Madrid welcomed the same number of international tourists as in July 2019. Illes Balears almost reached pre-pandemic numbers with a recovery of 97% compared to July 2019. On the other hand, the number of international tourists in Catalonia and Andalusia is still considerably lagging behind the levels of July 2019.

Fig 2. Number of tourists by region in July relative to pre-Covid levels

Domestic tourism compensates for lower number of international visitors

The number of hotel guests exceeded its pre-pandemic levels for the first time in July, mainly driven by a strong rebound in domestic tourism, which has recovered even faster than foreign tourism. The number of domestic hotel guests was already above pre-pandemic levels in April 2022, while the number of foreign hotel guests was still 3% behind in July. Thus, the strong recovery in domestic tourism offset the lower number of international visitors. However, economic headwinds will hinder domestic tourism over the coming months. In July, Spanish consumer confidence fell below the Covid-19 pandemic low illustrating that Spaniards are increasingly worried about high inflation. Although it improved slightly in August it still remains historically low. Consumer confidence in Spain is also significantly lower than the eurozone average. As half of the hotel stays are booked domestically, this will hinder domestic tourism.

Employment in tourism accounted for half of all new jobs in 2Q

The tourism sector accounts for 13.3% of the total number of registered workers in the country and is one of the sectors contributing most to job creation. According to data from Turespaña, the national tourism body of Spain, the employment rate in the tourism sector already reached its pre-pandemic level in April. Between April and June, tourism-related activities accounted for half of all new jobs created in the country, and employment was 0.8% higher than in the same period of 2019.

Spain’s hospitality sector was hit hard by the pandemic and the sector’s rapid recovery has led to a surge in demand for new employees. However, the sector – which typically employs one in eight workers – is struggling with staff shortages. As the sector further recovers over the summer months, a labour shortage may intensify which might hamper the recovery. The World Travel and Tourism Council estimates that the tourism sector could face a shortage of about 137,000 workers over the third quarter which corresponds with one in eight vacancies remaining unfilled.

Tourism’s contribution to Spain's economic growth is likely to fall

As tourism is a key economic sector in Spain, contributing 14% of total GDP in 2019 according to the World Travel and Tourism Council, a continued recovery is a substantial factor underpinning economic growth. The uncertainty related to the war in Ukraine, rising inflation, and high energy prices continue to pose a risk to tourism recovery. So far, the industry has shown a strong degree of passing on higher costs to consumers. The sharp increase in hotel prices (+16.4% year-on-year) did not deter tourists from booking overnight stays. However, the sharp decline in consumer confidence shows that consumers are increasingly concerned about high inflation and may begin to cut back on their tourism spending. This will also weigh on international tourist arrivals, as one in three incoming tourists are from the UK and Germany, two countries that have been hit very hard by the energy shock. Tourism’s contribution to Spain's economic growth is likely to fall over the coming months as the eurozone heads for recession. Even over 2023, the unfavourable economic environment will continue to weigh on the Spanish tourism sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article