Early China bond market concerns unjustified

Chinese sovereign bond yields have increased. But that is not alarming - for us, it is more a combined result of financial deleveraging and the usual year-end liquidity tightness.

Rising interest rates would become a norm under financial deleveraging

Financial deleveraging has pushed up interest rates in the interbank from short rates in the money market to long rates in the sovereign bond market. However, we need to have evidence that there has been quick sales of assets before we conclude that recession is coming. But we could not locate them. First of all, financial deleveraging has just begun from cleaning off the Negotiable Certificate of Deposits in the interbank market. Progressing to clean up the financial sector further, especially wealth management products traded in interbank market, would push up interest rates.

Don't worry, the central bank is always there to calm the market

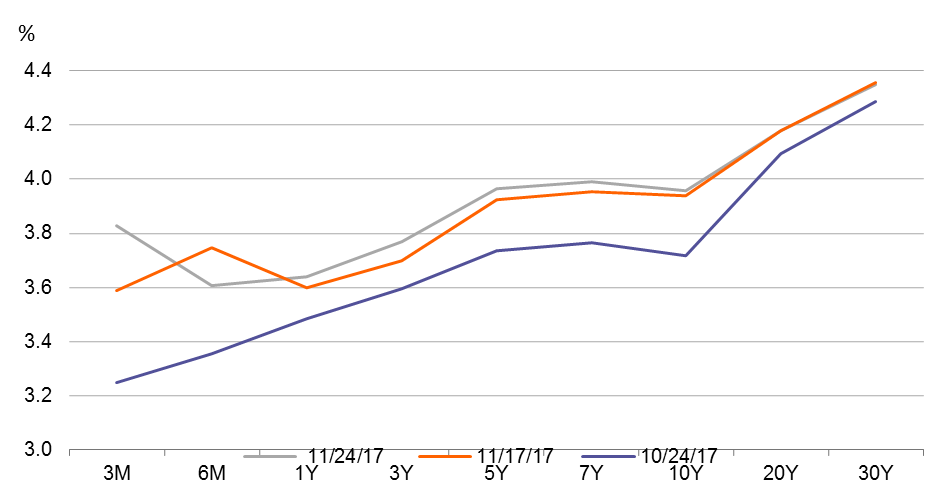

The pace of the rising sovereign yield has stagnated since 17 Nov 2017, an effort by the central bank.

No whistle blowing

The whole financial deleveraging exercise has just kicked off, not even in the middle of the progress. If there are financial institutions that need to prepare for more cash rather than investing in longer term bonds at this beginning stage then it may hint cash tightness in some financial institutions.

Some may argue that investors are forward-looking enough to leave the interbank market by selling government bonds. This could be true for financial institutions that fulfill liquidity ratios at the end of the month, and this phenomenon would be more intense when it comes closer to the end of the year.

Is this alarming? We don't think it is the right time for whistle blowing because the pace of sovereign curve shift has stagnated since last week. The central bank has injected liquidity whenever bond yield rises to the central bank's threshold. This means the central bank is in control of liquidity as well as the shape of the curve.

It could also due to positive factor from bonds to stocks

Market’s reallocation of asset from bond to stocks also adds shift-up of the sovereign curve. Then in fact, market participants are looking for higher profits from corporates, which should read as a positive sign of the economy.

After all financial deleveraging would only be mild and gradual. The central bank is very mindful that it should avoid systemic risk as stated in the 19th Congress.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).