Early China bond market concerns unjustified

Chinese sovereign bond yields have increased. But that is not alarming - for us, it is more a combined result of financial deleveraging and the usual year-end liquidity tightness.

Rising interest rates would become a norm under financial deleveraging

Financial deleveraging has pushed up interest rates in the interbank from short rates in the money market to long rates in the sovereign bond market. However, we need to have evidence that there has been quick sales of assets before we conclude that recession is coming. But we could not locate them. First of all, financial deleveraging has just begun from cleaning off the Negotiable Certificate of Deposits in the interbank market. Progressing to clean up the financial sector further, especially wealth management products traded in interbank market, would push up interest rates.

Don't worry, the central bank is always there to calm the market

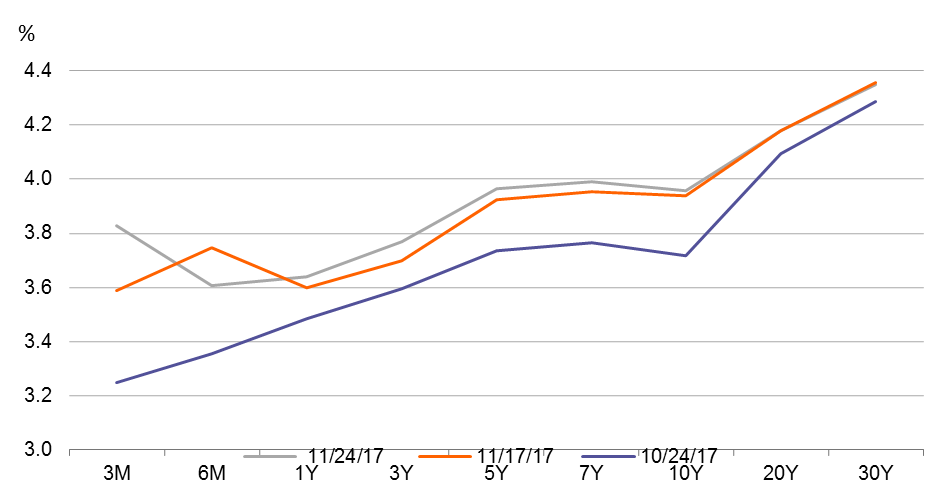

The pace of the rising sovereign yield has stagnated since 17 Nov 2017, an effort by the central bank.

No whistle blowing

The whole financial deleveraging exercise has just kicked off, not even in the middle of the progress. If there are financial institutions that need to prepare for more cash rather than investing in longer term bonds at this beginning stage then it may hint cash tightness in some financial institutions.

Some may argue that investors are forward-looking enough to leave the interbank market by selling government bonds. This could be true for financial institutions that fulfill liquidity ratios at the end of the month, and this phenomenon would be more intense when it comes closer to the end of the year.

Is this alarming? We don't think it is the right time for whistle blowing because the pace of sovereign curve shift has stagnated since last week. The central bank has injected liquidity whenever bond yield rises to the central bank's threshold. This means the central bank is in control of liquidity as well as the shape of the curve.

It could also due to positive factor from bonds to stocks

Market’s reallocation of asset from bond to stocks also adds shift-up of the sovereign curve. Then in fact, market participants are looking for higher profits from corporates, which should read as a positive sign of the economy.

After all financial deleveraging would only be mild and gradual. The central bank is very mindful that it should avoid systemic risk as stated in the 19th Congress.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article