Tide turns on the Swiss Franc

Investors will question the need to hold CHF as European political risks subside and the ECB prepares to taper.

New-found optimism in the euro

The euro (EUR) is the strongest G10 currency this year, up around 9% against the dollar. Its strength is largely down to three things:

i) Key electoral challenges in the Netherlands and France having been successfully negotiated,

ii) Surprisingly strong Eurozone growth - driven largely by domestic demand.

iii) The ECB having sounded the all-clear on deflation, questioning the future of QE.

The recovery in the EUR also questions whether investors really want to hold CHF as a safe haven, especially since inter-bank rates remain near the -0.75% level.

There are early signs that investors may be drifting towards the exit

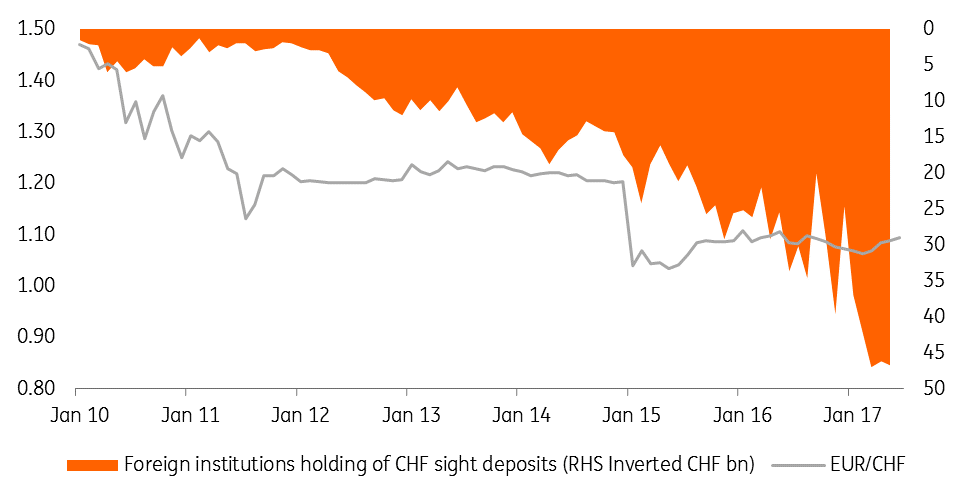

Indeed, there are early signs that investors may be drifting towards the exit, judging by the recent move in EUR/CHF above 1.10 and the fact that the relentless rise in holdings of CHF sight deposits seems to be slowing.

Foreigners to unwind CHF50bn? Probably!

EUR/CHF comes in from the cold

Many in the FX world say the Swiss National Bank has damaged the FX market by their intervention, firstly by installing the floor in EUR/CHF at 1.20 and then dramatically removing that floor in January 2015. Certainly, BIS turnover statistics support this view, where EUR/CHF turnover dropped by 50% between 2013 and 2016. Yet we now think EUR/CHF is back on the map.

We now think EUR/CHF is back on the map

We have a relatively simplistic argument here. The collapse in EUR/CHF from 2010 onwards was largely a function of Eurozone political risk (starting with Greece in 2010). And the abandonment of the 1.20 EUR/CHF floor was largely due to the prospect of ECB quantitative easing. Both those factors are now in reverse, and we would question whether foreigners really need to hold CHF50 billion as a safe haven investment when the factors that drove that original portfolio allocation have reversed.

SNB will welcome a hawkish ECB

The SNB game-plan seems pretty clear right now. It is still of the opinion that the CHF is significantly over-valued, has no intention of shifting the -0.75% policy rate anytime soon and will continue to intervene to limit CHF strength. What seems to be a 'free option' to buying EUR/CHF is, to some degree, supported by prices in the options market, where the cost of buying a EUR call/CHF put (i.e. the right to buy EUR/CHF) over a one month horizon now deemed more expensive than an equivalent EUR put/CHF call (the right to sell EUR/CHF). This is the first time we've seen this since January 2016.

| 46.8 |

Billions of CHF held by foreign institutions as sight deposits |

We are bullish EUR/CHF

We think EUR/CHF can rally a lot more. Low inflation and sluggish activity mean the SNB's monetary policy stance (i.e. lagging the ECB) looks tenable. And as the ECB tapering debate heats up this summer, we suspect the EUR/CHF rally can extend. Currently we have modest upside targets at 1.11/12 for EUR/CHF over the next six to twelve months. Yet these feel very conservative right now.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article