Three calls for the Dutch economy in 2022

As uncertainties surrounding the coronavirus grow, here are our three calls for the Dutch economy in 2022

If you'd prefer to read our thoughts in Dutch, click here.

The Dutch economy is forecast to grow by 3.6% in 2022 as far as our base case is concerned, after an expansion of 4.4% in 2021. This makes a quarterly profile of stagnation followed by above-normal growth, as lagging expenditures are set to recover.

Dutch GDP growth will be held back by the flare-up of the virus, the social distancing measures introduced in November and supply chain frictions we're seeing in the fourth quarter which will continue into next year. Private expenditure is set to expand very slowly, while the downscaling of regular health care to make room for Covid patients brings the development of public consumption into negative territory.

Previous lockdowns and recent ING consumer transaction data show that restrictions on service consumption, at least to a large extent, are being substituted with more online goods consumption. When we look at the impact on mobility, not least from Google Mobility data, we see that various aspects of the economy are able to better adapt to the pandemic and the bulk of expenditure is maintained. And that guides our thinking about those flat development in our base case. That said, since Covid-related uncertainties are clearly elevated, a quarter with negative growth compared to the previous quarter cannot be fully ruled out.

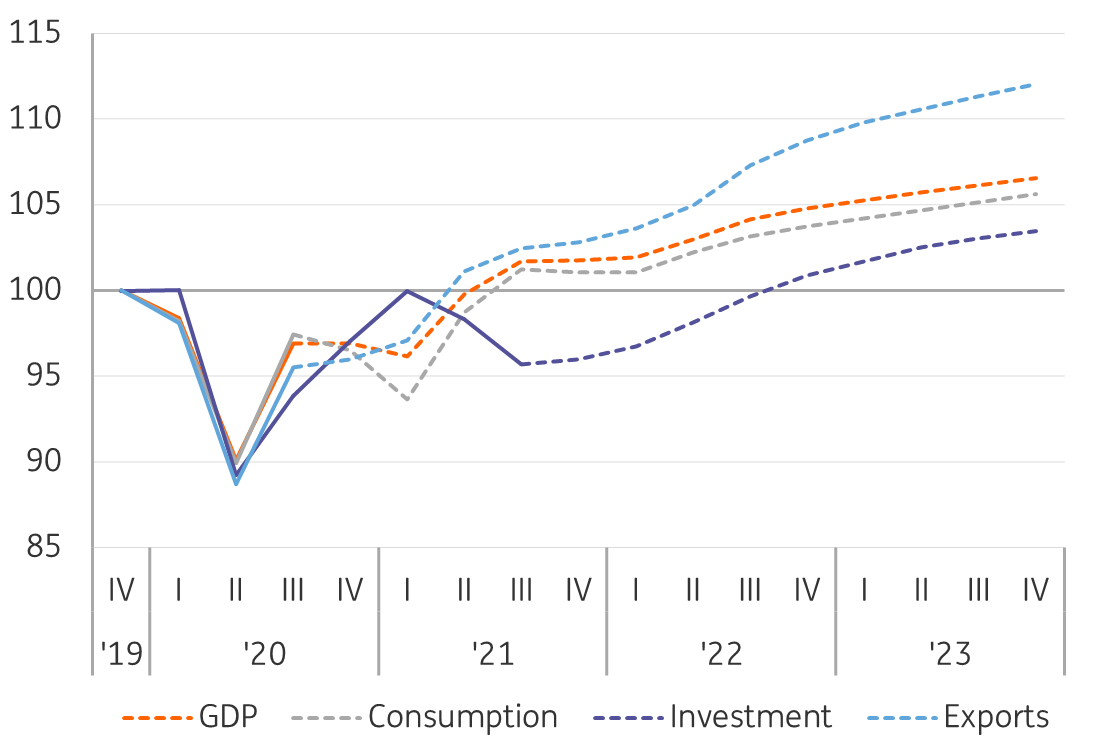

Short-term stagnating expenditure, accelerating in mid-2022

Expenditure* as an index where the fourth quarter of 2019 = 100

We'll regain traction in the second half of the year

In the second quarter, growth should regain traction if the assumptions in our base case hold - that Omicron forces some European governments to tighten restrictions which were already being planned rather than being a game-changer. Dutch GDP reached its pre-pandemic level in the third quarter of 2021, in contrast to the four largest eurozone economies. Nevertheless, there is still catch-up potential for the Netherlands; a recovery in service consumption and service exports are expected to contribute to overall GDP growth next year.

This potential should be unlocked mostly in the second half of 2022 and continue into the following year. GDP in the Netherlands is forecast to reach 4.1% above the 2019 level, the year before Covid started to reach the European continent.

The labout market will remain tight

The current caretaker government, which is ruling with a restricted mandate after elections in March this year, ended most Covid support measures at the end of September. It's worth noting we'll likely have more political manoeuvrings any day now with the announcement of a new coalition agreement made up of the same four political parties. With the tightening of social distancing measures in November 2021 came the reintroduction of public support for businesses, notably a wage subsidy and fixed cost schemes. This left little time for business dynamics to normalise.

We expected a mild increase in insolvencies after the temporary support measures are over. Such an increase might still happen, but only later in 2022. In our projections, this leads to job losses and therefore an increase in the unemployment rate. Since general demand overall seems very solid, this situation is expected to be short-lived and cause only a mild uptick in the number of unemployed. The recovery of the Dutch labour market is quite remarkable so far. With an unemployment rate at 2.9% in October, it is back at its pre-pandemic lows. This happened as new records in participation rates were broken.

The difficulty in hiring appropriate staff will be a drag on growth in the years to come

As business surveys show, a shortage of personnel is already the main factor limiting the production of non-financial businesses; this is expected to remain so in our forecast horizon. The difficulty in hiring appropriate staff will be a drag on growth in the years to come. As a result, wage growth should accelerate. In fact, we do already see higher pay rises in recently agreed collective wage agreements, which should average about 2.4% in 2022. With increasing labour costs and many vacancies unfilled, businesses should look at productivity improvements and to (some of the remaining recovery) potential in hours-worked-per-person to help mitigate these labour market strains.

A shortage of the right personnel is the main factor limiting production

Weighted share of businesses* that consider factor** as the main driver limiting production

Consumer price inflation higher than in 2021

November HICP consumer price inflation came in at a hefty 5.9% year-on-year on 7 December 2021. This was above expectations which made us update our recent inflation figures significantly. Like in most other eurozone economies, it is energy (mostly gas and electricity) and fuel driving the bulk of inflation movements over the past few months and this will continue next year. Since Dutch households tend to rely heavily on gas - The Netherlands used to be a net gas producer until 2017 – it's no surprise that this has had a particular impact in the Netherlands.

Energy prices are notoriously difficult to forecast. We assumed these will fall after the winter. Even though futures suggest that prices will decrease significantly then, these might remain higher than before the pandemic. This is in line with our view that most, but not all, causes of higher gas prices are temporary. To mitigate the impact of high prices for consumers, the Dutch government has already announced a temporary energy tax reduction for 2022, which will suppress the still positive and significant contribution of energy to the HICP inflation rate for that year.

Energy price developments are also the main reason overall inflation is forecast to fall over the course of 2022 and will drop below 2% by the end of the year. Besides energy and fuel, the rising cost of housing and food and the normalisation of clothing and aviation prices will contribute positively to 2022's numbers. The end of the temporary energy tax cut is the main reason why energy also has a substantial positive HICP-contribution even in 2023, even though energy prices net of taxes fall.

Inflation in 2022 higher than in 2021

Change in harmonised index of consumer prices year-on-year in % and contributions in %-points

All-in-all, the outlook for the Dutch economy is more uncertain than it was just a few months ago, especially in the very short run, but things are looking more favourable as we head towards the second half of 2022 and beyond.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article