This week’s Bank of Canada rate decision is a coin toss

Consensus is leaning in favour of a cut on 4 June, but markets are pricing in only 6bp. We see this as a 50/50 call, but if the BoC holds this time, the signals may be dovish, and we’d expect the next cut in July. Markets are also underpricing the risk of a July move, and we see downside risks for CAD, which is also in quite stretched overvaluation territory

Markets are underpricing the probability of a cut

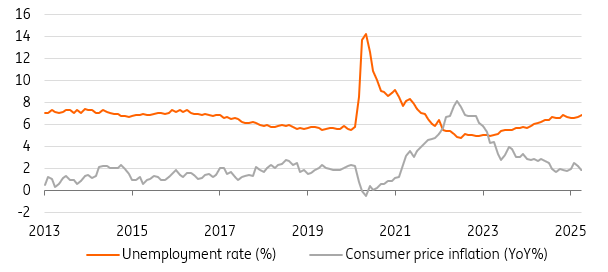

The Bank of Canada decision on 4 June is an incredibly close call. Unemployment is in danger of breaching 7% in the upcoming jobs report, but despite a low headline inflation print, core CPI has been moving higher again. First quarter GDP growth exceeded expectations at 2.2% annualised versus the 1.7% consensus, but this was primarily driven by front-loading ahead of tariffs – with inventories and net exports, mainly to the US, the main contributors after consumer spending stalled and business investment fell.

These conflicting signals mean we have a split, with the market favouring a no-change outcome while economists look for a 25bp cut – although several banks switched their call to no-change after that GDP print.

On the flip side, Trump’s Friday announcement to hike steel and aluminium tariffs from 25% to 50% throws a wrench in the works, escalating trade tensions with Canada, which is the largest exporter of those metals to the US. This move underlines that, despite a brief calming in tensions following Prime Minister Mark Carney’s White House visit, the trade war remains very much alive and unpredictable.

We think this week’s decision is a coin toss. Market pricing at the time of writing is 6bp, which appears too conservative in our view, especially in light of the higher US steel and aluminium tariffs announced on Friday. Our view is that if the bank doesn’t move this week, it will do so in July.

Unemployment and inflation in Canada

CAD looks expensive

Whilst lagging other G10 currencies due to its higher correlation with US growth sentiment and negative tariff news, the Canadian dollar has appreciated on the back of idiosyncratic USD weakness. At 1.37, USD/CAD is more than 3% undervalued relative to its short-term fair value, and we suspect some support should build now.

We have a moderate bullish bias on USD/CAD in the near term, also because we think market pricing for July (15bp) looks too hawkish. A return to 1.38-1.39 looks appropriate in our view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Bank of CanadaDownload

Download article