A stop-start approach to policy normalisation and FX

The best example of the balancing act between monetary policy normalisation and lockdowns came last month when the Reserve Bank of New Zealand defied market expectations of tightening and left its policy rate unchanged. This occurred despite the RBNZ raising its own projections for the interest rate cycle.

Barely a week later, the RBNZ confirmed that it would have hiked on 18 August (perhaps by 50bp!) were it not for Prime Minister Jacinda Ardern announcing a new national lockdown on that same very day. NZD/USD fell 3% in mid-August and has since recouped all of those losses.

Beyond those cross-currents playing out in a single country, we have seen these themes drive regional FX trends this summer. Asian FX, in general, has fared the worst as low vaccination rates have exposed South East Asia and then most recently Korea to new waves of the virus.

With higher vaccination rates, European FX has actually performed better during this period and generated outright gains for the likes of the Czech koruna and the Hungarian forint as local central banks have pushed ahead with tightening cycles.

Local stories can play out if Fed tapering is benign

We prefer these local stories to dominate into year-end. Those G10 central banks confident enough to tighten rates - New Zealand, Norway, and into 2022 Canada and the UK - should see their currencies outperform. While those committed to deeply reflationary policies, such as the eurozone, Switzerland, and Japan, should see relative underperformance.

FX trends assume Fed policy remains a benign market influence

In the emerging markets space, this theme extends to Brazil, Russia, the Czech Republic, and Hungary outperforming and now the Chinese renminbi underperforming based on Iris Pang’s view.

FX trends based on this policy divergence assume that the external environment – Fed policy – remains a benign market influence. The Fed has developed a good track record here and we would assume that tapering is communicated and performed in an orderly manner such that it need not trigger a dramatic repricing in bonds and equities.

This was the experience during the last Fed tapering in 2014/15. Mismanagement by the Fed here would deliver a stronger dollar and a sell-off in the high-beta FX pairs.

Fed tapering needs to be orderly

EUR/USD: Waiting for the spark

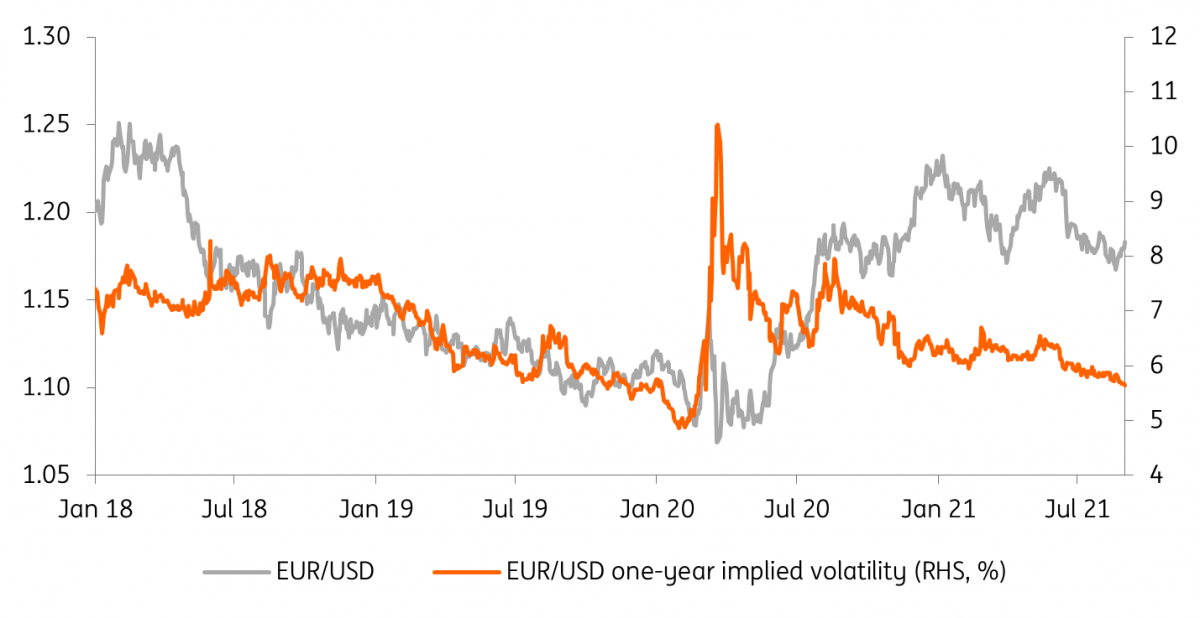

FX options markets can provide a good gauge of sentiment – or at least expected volatility. Currently, prices for one year EUR/USD options are continuing to decline and appear to be heading to their pre-pandemic levels of 5.00%. This points to continued calm in a currency pair dominated by abundant liquidity on both sides of the Atlantic.

1.17-1.20 may be the EUR/USD range into year-end, with the pair ending towards the top of the range given seasonal dollar weakness. We would expect a broader dollar rally to emerge through 1H2022 as the market grows increasingly confident of the first Fed tightening later in the year.

Beyond the usual event risks of central bank meetings, it is also worth noting that the European political calendar is getting noticed. The FX options market prices 30% more volatility than normal around the German election on 26 September. But the French presidential election next April is seen as a much bigger deal for FX markets. Volatility around the run-off vote on 24 April is priced at four times a normal day.

EUR/USD option prices continue to correct lower

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

ING Monthly: Back from the beach, into the breach This bundle contains 11 Articles