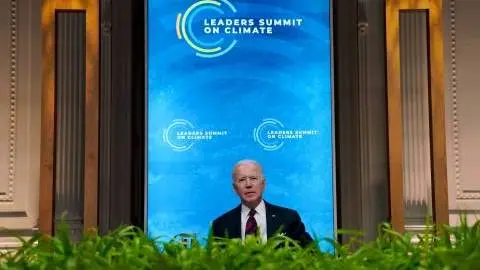

Biden promises big on climate change and the global impact could be huge

America aims to halve its carbon emissions below 2005 levels by the end of the decade. That's the surprise and ambitious announcement on day one of President Biden's global leaders' summit on the environment. If America is really now leading the charge and if the president succeeds, this could have far-reaching consequences not just in the States

Leaders' summit on climate change

Forty global leaders are taking part in Joe Biden's climate summit. And the US President's announcement this Thursday on new emissions targets is clearly designed to show that America is not just back in the environmental game but it wants to lead and encourage countries such as China and India to go down the same route. China's President, Xi Jinping is also attending and it's clear that relationships, at least in this area, are warmer.

But making ambitious announcements and achieving real change are two different things. And there's plenty of scepticism on whether these targets can be achieved. But by putting climate change at the heart of America's coronavirus recovery strategy is a major sign of renewed intent. And it builds on the enormous spending which had already begun under President Trump.

Phase 1 nearly complete – America is back on its feet

Throughout the pandemic, the government’s support for the economy has been remarkable. Under President Trump, we saw the $2.2tn Coronavirus Aid, Relief and Economic Security (CARES) Act signed into law within days of the initial lockdowns. This included stimulus payments, uprated unemployment benefits, the Paycheck Protection Program and other support for American businesses.

This was followed by an additional $900bn of relief in the form of December’s Consolidated Appropriations Act, 2021. Then in March, President Biden’s American Rescue Plan was approved, which provided a further $1.9tn of financial support for the economy with more stimulus payments and other direct payments for households, business and local government.

In total that is $5tn of fiscal stimulus, equivalent to nearly 25% of GDP, to mitigate the effects of the pandemic on America’s economy and its people. In combination with a highly successful vaccination programme, falling hospitalisation numbers and a gradual reopening process, it looks as though all of America’s lost output will have been fully recovered by the end of June with the majority of lost jobs regained by year-end.

Phase 2 – Building Back Better… and greener

With the US making such good progress, President Biden can push ahead with his key longer-term election manifesto pledges. His most prominent election slogan was “Build Back Better” - a plan to “mobilise” America in four key areas:

- Manufacturing and innovation to ensure that the future is made in America, and in all of America

- Build a modern infrastructure and an equitable, clean energy future

- Build a 21st-century caregiving and education workforce which will ease the burden of care for working parents, especially women

- Advance racial equity in America

This promise of a more equitable, sustainable and greener America was fleshed out in further detail within his manifesto. It included clear and ambitious climate goals such as decarbonising electricity production, culminating in 100% clean energy and net-zero carbon emissions by 2050 with an intermediate target of zero emissions from the power sector by 2035. There was the doubling of the amount of energy produced from offshore wind turbines by 2030 – wind currently accounts for 8.4% of total US utility-scale electricity generation. There were also pledges to create new efficiency standards for appliances and buildings plus a promise to upgrade electricity grid capacity to facilitate more electric vehicles as the US moves away from fossil fuels.

2019 consumption of energy by fuel (Exajoules)

It wasn’t just an inward-looking manifesto. There was an obvious desire for ambitious global targets for emissions that we have heard more about today. The decision to appoint former Secretary of State John Kerry as his special envoy for Climate Change is another signal of his intent to make progress.

Despite positive reactions from world leaders at the Climate Summit there is the risk that global action falls short. President Biden has therefore suggested linking current and future trade deals to climate and environmental commitments, stating at his inauguration “a cry for survival comes from the planet itself, a cry that can’t be any more desperate or any more clear”. Being cut off from American consumers could be a big incentive for change for producers in the rest of the world.

Money talks – but is it enough?

Having already re-committed the US to the Paris Climate Accord, the President is now steering his American Jobs Plan through Congress. This is a smaller package than was initially mooted – a little over $2tn versus talk of a $3tn+ package and is seemingly spread over more areas than initially proposed while also being drip-fed into the economy over the next eight years.

Put in the context of the $5tn spent over the past 12 months it may feel a little underwhelming especially given the climate targets he has set. This perhaps hints at less of a revolution and more an acceptance of gradual change while also necessitating a lot of return on each dollar spent.

This is likely to be just the start of a new way of engaging with sustainability and green issues

The money is split roughly one third for quality of life, which is a broad category focusing on rebuilding the electric grid, high-speed broadband access and improving clean drinking water infrastructure. Just under a third goes towards improving transport infrastructure together with incentives of moving away from combustion engine vehicles. A fifth then goes on “solidifying the care economy” through expanding access to affordable care for elderly and disabled people. It concludes with a final fifth of the money going towards research and development projects tied to new technology and several long-term sustainability projects.

This still amounts to spending worth 10% of GDP and marks what is likely to be just the start of a new way of engaging with sustainability and green issues.

The $2.2tn American Jobs Plan

Investment – but not as we know it?

Not all of the $2.2tn is going on what might be termed “traditional” physical infrastructure spending projects, which has drawn the ire of Republicans and many in the business community. Instead, it looks to be more focused on people and the planet rather than driving economic growth.

For example, if we look at the $621bn allocated to transport infrastructure, $174bn is put towards electric vehicles and a network of 500,000 charging points. Much of the money will be allocated towards “point of sales rebates and tax incentives to buy American made electric vehicles”.

Likewise, the $400bn for solidifying the care economy is effectively current spending. It is “expanding access to quality, affordable care” by ”creating new jobs and offering caregiving workers a long-overdue raise, stronger benefits and opportunity to organize or join a union and collectively bargain”.

As such, it is fair to say the definition of “investment” is broad. While there certainly is physical investment in the proposals, there is also a lot of what we could term “investment in opportunity”. The expanded social care that can allow people to return to work rather than stay at home caring for family members can be characterised in this way. As can the money for training, worker development and worker protection.

This has the potential to boost labour participation and improve the quality of the workforce, which should raise the productive potential of the US economy over the longer term – hence why it comes under the umbrella of investment.

The details: Transport infrastructure:

This is where the bulk of what might historically be termed “traditional” infrastructure can be found. It includes plans to modernise 20,000 miles of highway, roads and streets along with repairing bridges, improving airports and railways stations and modernising and expanding transit and rail networks.

There is also money for public transport metro systems and money for connecting neighbourhoods that are relatively isolated or underserved to try and improve life opportunities.

Some 28% of the money goes on incentivising the use of electric vehicles, as already mentioned. While there will be subsidies to make EVs more affordable – in 2019 the average cost for a new electric vehicle was $55,600 versus $36,600 for a traditional combustion engine vehicle – a substantial proportion of the money will be used to create the required vehicle charging network. The Administration is looking to establish a “grant and incentive program for state and local governments and the private sector to build a national network of 500,000 EV chargers by 2030”.

Building World Class Transport Infrastructure

Quality of life:

This section of the infrastructure plan is again largely what we might term ”traditional” infrastructure although it also involves some subsidies for end consumers and lots of tax incentives to stimulate the private sector to participate.

The largest part is money to “build, preserve and retrofit” millions of homes, commercial buildings, schools and Federal buildings to make them fit for modern use and more energy-efficient. For the private sector, this will primarily be done through target grants, tax incentives and “project-based rental assistance” while removing various planning barriers that have historically made it more expensive and time-consuming to get approval for building and renovation work.

There is $111bn set aside to improve water quality which includes within it a pledge to replace 100% of the nation’s lead pipes and service lines. There is an additional $100bn to expand high-speed broadband to 100% of the nation. This will see money prioritised for organisations focused on expanding access to entire communities, but will also try and encourage price transparency to bolster competition as “Americans pay too much for the internet”. In the very near term, there may also need to be some money to subsidise high-cost provision, but there is an acknowledgement that this is not a long-term solution.

Another $100bn is set aside to improve the electricity grid; to make it more resilient given the huge economic cost of power cuts and to link up to new greener sources of electricity production. This plan also includes a drive to source all energy for Federal buildings from clean power 100% of the time.

Clean water, renewed electric grid, high speed broadband

The care economy

This component has caused the most debate about what “investment” really is. Much of it appears to be what most economists would term current spending. The plan states that the President is calling on Congress to “put $400bn toward expanding access to quality, affordable home or community-based care for ageing relatives and people with disabilities”.

This will expand the care sector, create new jobs in the sector and give those people who have left the workforce to stay at home to care for family or friends the opportunity to return to work.

Research and Development

The final section sees a large number of projects brought under the umbrella of investment in research, development and manufacturing.

It includes money to fund research surrounding critical technologies and climate solutions while also providing money to promote greater equality of opportunity in the sector. There is also funding for a new national science foundation to help promote and upgrade America’s research infrastructure while there are also grants for other projects to promote research and development.

Research, development & manufacturing

How is it being paid for?

Unlike the stimulus seen over the past 12 months, the Biden Administration claims the package will be fully paid for through higher taxes and the additional revenue generated by the long-term economic boosting effects of the measures.

Corporate America is expected to make the largest contribution. The Administration has placed heavy emphasis on the corporate share of Federal tax revenue payments having fallen from more than 30% in the early 1950s to just 7% today while for individuals it has gone from 50% to 85% over the same time frame.

Measures include:

- Corporation tax goes to 28% from 21%

- Discourage offshoring by strengthening the Global Minimum Tax for US multinational corporations

- Encourage other countries to join minimum tax strategy

- Prevent US corporates from claiming tax havens as their residence

- Deny corporations expense deductions for offshoring jobs and credit expenses for onshoring

- Eliminate other loopholes

- Eliminate tax preferences for fossil fuels and make sure companies pay for environmental cleanup

- Bolster tax enforcement

Additional tax-raising proposals are coming with the American Jobs Plan documentation stating that the President “will be putting forward additional ideas [….] for reforming our tax code so that it rewards work and not wealth, and make sure the highest-income individuals pay their fair share”. This will likely result in President Trump’s tax cuts for high earners being reversed and potentially changes to the way capital gains charges are calculated.

Will it pass?

It is fair to say that this plan has its detractors. Many Republicans argue that there is not enough investment and there is too much spending on social issues. There is also push-back from corporate America which argues that this overly burdens them and could result in lower private investment and job creation if they end up paying higher taxes.

Democrats argue this will not be the case and cite Bill Clinton’s tax rises which were followed by a period of strong growth, robust corporate profitability and healthy investment growth. They argue that a stronger and “fairer” economy can benefit more people, including corporate America.

On balance, we would suggest that it may not be particularly stimulative in the near term given the heavy tax offset, but if it can raise worker participation that can be beneficial over the longer term. Meanwhile, proponents would argue that the cost of not mitigating climate change will likely be significantly higher than the cost of intervention.

Either way, it is clear that this is not going to get bi-partisan support and given the thin Democrat majorities within the House and the Senate, there may need to be compromises that see some initiative modified. This means that there is the potential for the package ending up being somewhat smaller even if the Administration chooses to go down the budget reconciliations process to get it approved.

A question of efficacy

There are valid questions about the effectiveness of some of the policies. For example on the adoption of electric vehicles, the Biden administration is only offering incentives – the carrot - and has stopped well short of combining it with the big stick of higher gasoline taxes that could have accelerated adoption/incentivised fewer car journeys.

The Energy Information Administration reports that the average tax and fees levied by US states at the beginning of 2021 was 30 cents per gallon (¢/gal). This is in addition to the federal tax of 18.4¢/gal, which has remained unchanged since 1993. Taxes in Europe are substantially higher and replicating them in the US could raise substantial revenue in addition to spurring more rapid change towards EVs.

However, such policies are unpopular with the electorate[i] due to what it means for household finances, and this is a difficult balancing act for the President. The national average for US gasoline prices is currently $2.87/gallon while in the UK and France it is $6.53/gallon and in the Netherlands, which is Europe’s most expensive, it is currently $7.78/gallon.

We are also a little surprised at how little specific investment has been announced regarding decarbonising America’s electricity production given the ambitious targets already announced. This ties into our point that the plan sees lots of different areas receiving relatively small amounts whereas focusing on larger investment in specific projects may have yielded more tangible results. Time will tell.

[i] A review of polling by Mineta Transportation Institute in 2016 found a majority in favour of higher gasoline prices in just 24% of polls conducted, with support in favour of higher fuel taxes reaching 40% or more in just 42% of polling. They found that when polling was conducted there were significant variances in the proposed tax increase of anywhere from 1c/gallon to $2/gallon.

More still to come

That said, this is just the start of the US shift towards a more sustainability-orientated economy. We are yet to hear about regulatory changes that can complement the investment proposed. Michael S. Regan has recently been confirmed as the new head of the Environmental Protection Agency and he is likely to announce plans surrounding guaranteed protection/conservation of key land and water resources and programmes for reforestations and the support for developing renewable energy programmes on federal land.

This is just the start of the US shift towards a more sustainability-orientated economy

Already, the President has halted further development of the Keystone Pipeline through executive order and has directed agencies to review and reverse numerous policy actions on the environment implemented by President Trump. New permits for oil and gas drilling on federal lands and water have already been stopped, for example.

This shift in political attitude towards sustainability-related issues could also see more support for the sustainable bond market, which is currently lagging well behind that of Europe. A positive underpinning factor is the bottom-up sustainability approach that corporate America has already begun to take, embracing environmental and social sustainability issues through their funding programmes. In a recent ING survey of corporate leaders and institutional investors, 58% of US corporates said the Covid-19 pandemic had accelerated their sustainability transformation plans and heightened their ESG targets.

Taking the global lead

The US is also looking to take a global lead on these issues. Within Joe Biden’s manifesto, there was a desire to engage with international leaders to create new, more ambitious global targets for emissions that are enforceable. This has already started with the US rejoining the Paris Climate Accord in February 2021 and convening a global climate summit in April 2021. We are certainly going to hear proposals surrounding a global moratorium on offshore Arctic oil drilling, but support from other nations will likely be lacking.

He has already demanded a ban on countries subsidising fossil fuel usage with penalties for those countries that try to “outsource” pollution. China and its Belt and Road initiative could be in the target sights here, but so too Japan, which has been funding coal-fired electricity generation capacity in developing nations including Vietnam, Bangladesh and Indonesia. Funding that has been benefiting Japanese companies.

Linking current and future trade deals to climate and environmental commitments was also included within his manifesto. This would include plans for minimum environmental standards regarding production and power generation. Penalties for failing to comply would include carbon-adjustment fees or quotas on carbon-intensive goods. This could be a huge motivator for other countries to embrace more sustainable practices given that US goods imports totalled $2.33tn in 2020.

Another programme that could accelerate global initiatives is the manifesto proposal of “green debt relief” for developing countries that make and meet climate commitments. Given the scale of debts built up globally during the pandemic, this could be a major inducement to speed up the adoption of more environmentally friendly energy usage around the world.

Bold Steps, but momentum needs to be maintained

The new Administration’s attitude towards sustainability, social policy and climate change, and the willingness to work with other world leaders on these issues marks a huge change from what we saw under President Trump. The financial commitments are large and regulatory changes may accelerate developments. They will need to given the ambitious goals the president has set.

Taking a global lead on these issues has a wide impact beyond US borders

Indeed, the intention to take a global lead on these issues and the willingness to apply standards to trade will ensure the shift in position has a wide impact beyond US borders.

The way the investment plan itself is structured with the eight-year time frame and the heavy tax-raising associated with it mean the direct economic stimulus may be somewhat muted in the near term, but the potential for a larger, more productive workforce will benefit longer-term growth.

Moreover, the benefits of attempting to address climate change’s long-term impact on the economy could be even greater. It is fair to say this plan is much more orientated towards people and the environment than boosting GDP growth over the next couple of years.

This is the first step in the process and momentum needs to be maintained, which also requires the electorate to remain on board. With mid-term elections coming up in less than two years that will be the first major test of America’s newfound desire for a more sustainable future.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 April 2021

What a wonderful world This bundle contains 6 Articles