The path to net zero for the meat and dairy industries is far from clear cut

A rising number of major European and American meat and dairy companies have set targets to reduce emissions and become net zero by 2050. As strategies evolve, it has become clear the industry is looking to use a broad range of measures. For major European companies, we estimate they will require €5-10bn to achieve their 2030 reduction targets

Companies look to reduce their scope 1 and 2 emissions by 35-40% in 2030

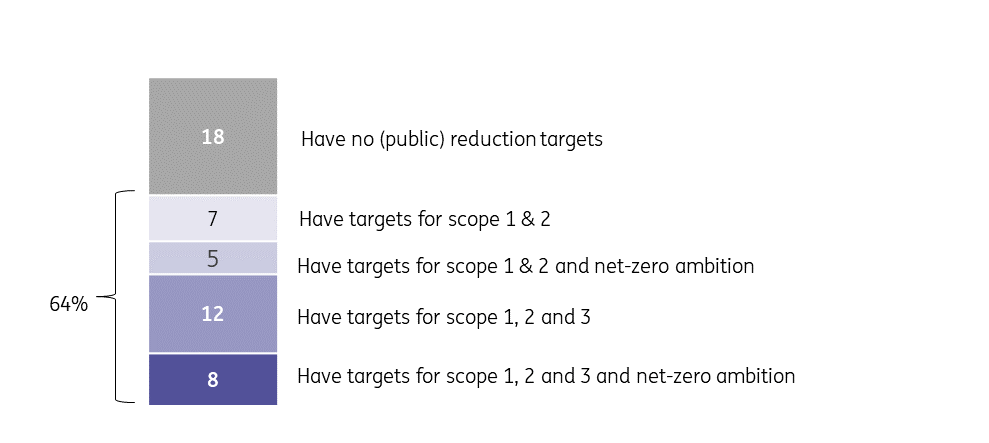

The list of meat and dairy companies that have recently announced or updated their carbon emission reduction targets is growing. To get an overview of where the industry stands, we’ve analysed the public targets of the 50 largest dairy and meat companies in Europe and North America. Almost 65% of those companies have published specific targets and one-quarter explicitly aim to be net zero in 2050. Some, but not all, of these targets have been verified by independent bodies like the Science Based Target Initiative (SBTi) and there are clear differences in the quality and the level of detail of commitments. Around 35% of the analysed companies don’t have any public targets. Although it’s not mandatory for them to disclose such targets, we expect they will follow suit over the coming years. Otherwise, it is likely to become a competitive disadvantage because customers such as retailers and fast-moving consumer goods companies increasingly expect their suppliers to have targets in place.

There seems to be a certain level of consensus in the industry on which reduction levels are feasible. Industry peers such as dairy companies FrieslandCampina and Arla and meat companies like Danish Crown, Tönnies and Vion or Tyson, JBS and Cargill have all set fairly similar targets. On average, dairy companies aim to reduce scope 1 and 2 emissions from company facilities, vehicles and purchased energy by 40% in 2030, while the average for meat companies is a 35% reduction. Most companies have set targets against a base year between 2015 and 2020.

Almost two-thirds of all major meat and dairy companies has set emission reduction targets

Number of meat and dairy companies*, 2022

Different levels of ambition for reduction of scope 1 and 2 emissions

Range of meat and dairy company emission reduction targets for 2030*

Fewer than half of companies have set a target for scope 3 emissions, which are more important

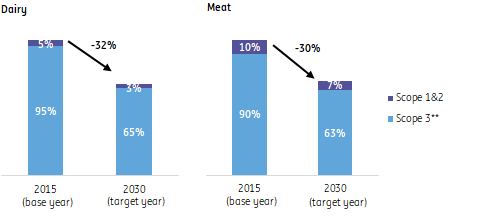

Twenty out of the fifty companies have a target for their scope 3 emissions. These emissions happen before and after products leave the factory and arise mainly at farms, during the production of ingredients and packaging material or because of transportation by third parties. Such indirect emissions are especially relevant because they represent approximately 90% (in meat) to 95% (in dairy) of all emissions in the value chain. In a relative sense, companies’ scope 3 targets are usually a bit lower compared to scope 1 and 2 targets. But it’s good to keep in mind that due to their significance, lower relative targets for scope 3 can still lead to a larger absolute reduction.

Scope 3 targets come in two forms as they can be absolute or intensity based. The latter is linked to total emissions per tonne of product, aimed at bringing down emission intensity. Such intensity targets attract criticism from non-governmental organisations (NGOs) because they don’t guarantee a reduction of total emissions when companies have strong production growth. That’s also why the SBTi recommends companies to have both absolute and intensity targets in place.

Meat and dairy companies with targets in place are looking to reduce total emissions by 30% in 2030

Expected development and weight of scope 1, 2 and 3 in total emissions from meat and dairy companies*

Companies must overcome several obstacles on their path to net zero

The targets are becoming clearer, but how companies will get there is often far from clear, although some major players do have quite detailed plans. We believe there are at least three major hurdles that stand between plans and reality:

- Economic: Measures to reduce carbon emissions usually require investments or lead to additional costs for companies and suppliers creating a need to be aligned on the goals. Some measures have a financial benefit, but more often higher costs will have to be passed on to consumers. If there is no willingness among consumers to pay and no legal obligation for companies to take a measure, then this reduces the incentive for companies to invest.

- Technological: Accurate measurement and tracking of emissions within the company, at farms and in other parts of the supply chain is becoming more common but is still not universal. Furthermore, some of the planned reductions in scope 3 emissions rely on technologies that still need to be developed or that haven’t been applied at scale yet.

- Cultural: The commitments made by large corporates depend on the willingness of many farmers and other suppliers to invest and require a different way of working. Some of them will like it, but others won’t. Due to this dependency, scope 3 targets come with more reservations and a higher level of uncertainty.

Most emissions in the life cycle of meat and dairy products arise at the beginning of the value chain

Schematic breakdown of emissions in the meat and dairy value chain

The easy part: reducing emissions of own activities

Lowering the emissions of meat and dairy processing is mainly about improvements in energy efficiency, electrification of production processes, and the switch to renewable energy sources. It will take multiple investment cycles to get closer to zero direct emissions, but the path that leads there is quite straightforward. Many companies have already invested in assets such as solar panels and biodigesters at production sites to boost the share of renewable energy in their energy use. High energy prices in Europe might give an additional stimulus while discussions within the sector are also fostered by the growing tendency to link the performance of sustainability-related indicators to the level of interest rates. On top of increasing their onsite energy production, companies such as Arla in Denmark and Danone in the US have also been entering power purchase agreements with solar and wind energy providers, while FrieslandCampina has signed agreements to buy green electricity directly from dairy farmers.

The hard part: reducing emissions in the value chain

The majority of the emissions stem from the raw materials and packaging that companies purchase. This is the harder part, firstly because it requires close cooperation with suppliers and customers, and secondly because it depends on a very diverse range of measures that all have some potential. At the farm level, it centres around reducing the carbon footprint of the animal (for example through breeding, improved health and the use of additives to reduce methane emissions), feed (move towards deforestation-free and more co- and by-products), manure (treatment and processing), and on-farm energy use. Downstream in the value chain, measures such as improved plastic packaging and low (or zero) emission transportation hold the largest potential.

One aspect that gets less attention in company strategies is that companies can also steer their product portfolio to consist of products with lower emissions. Meat and dairy companies can refashion existing products to lower emission intensity and keep the climate footprint in mind when developing new products. Adding plant-based alternatives to the product range and increasing the use of plant-based ingredients are explicitly mentioned by Nestlé, for example.

Offsetting hard to abate emissions, a solution for the hardest part?

Even though there are many opportunities to reduce the carbon footprint, some emissions are inevitable when producing meat or dairy. This also explains why companies have taken an interest in offsetting emissions either within or outside their own supply chain. The measure with the largest potential within the supply chain is to increase carbon storage in the soil. This is often mentioned as part of a broader push towards ‘regenerative farming’. Nestlé, and other similar companies, expect that improving carbon storage in grasslands can contribute a 15% share of its 2030 reduction targets for dairy and meat ingredients. Reforestation can also be an option for companies that operate extensive farming systems. But the scale to apply this on pastureland is likely to be limited and it will create a large administrative burden for companies to properly account for these planted trees. In both cases, a proper strategy needs to have details on how carbon is captured and stays locked in the longer term, especially because trees die and soil can get disturbed. Due to these complications, it’s still much easier and cheaper for companies to buy carbon avoidance or removal credits on the market as an instant solution. But this market has its flaws with the credibility and transparency of offset credits posing a major challenge.

From cheap to expensive: emission reduction measures vary in cost

The costs of emission reduction measures can vary significantly depending on the local circumstances, but in general it’s possible to make a distinction between relatively cheap and more expensive measures. Among the cheaper options are energy-saving measures. Other options like the switch to zero emission logistics, renewable energy production, and many on-farm measures tend to be more expensive. However, costs are dynamic and solutions such as feed additives that inhibit methane emissions from cattle are expected to become cheaper as production scales. Besides that, some measures serve more purposes than just reducing emissions. Preventing deforestation is also beneficial for biodiversity, and manure processing can reduce emissions and provide a source of renewable energy.

Meat and dairy companies can initiate a range of measures to reduce carbon emissions

Indication of the costs to reduce one tonne of CO2 emissions (or equivalent)

It could take €5-10bn to accomplish 2030 reduction targets for the 30 largest European meat and dairy companies

But it is possible to get a sense of the costs involved when we combine data on current emissions, reduction targets and reduction costs. We’ve done so for a group of 30 major European meat and dairy companies within our initial selection. Depending on the cost of reducing one tonne of carbon our estimate is that €5-10bn is needed this decade to achieve the scope 1, 2 and 3 emission reduction targets of these companies in 2030. This would mean a reduction of 50 million tonnes of CO2 equivalents.

Because we work with several assumptions this exercise is mainly intended to get a sense of the order of magnitude rather than trying to be exact. To arrive at this estimate we took the following steps and used the underlying assumptions:

- We started with the reported emissions for a group of dairy companies based in Europe and used calculations made by IATP for the emissions of meat companies based in Europe.

- We combined those figures with the average emissions reduction targets of 32% (dairy) and 30% (meat) for the period 2015-30 to calculate the total expected emission reduction between 2020 and 2030.

- Then we multiplied the outcome with the estimated cost of reducing one tonne of carbon emissions (or equivalent). For the lower end of the range, we used €85 per tonne (which is similar to the average EU carbon price in 2022) and for the upper end we used €200.

- We assume that companies haven’t run out of low-cost technologies yet and tend to favour these first.

- We assume that companies within this group that don’t have a public target adopt the average industry target (30% reduction in 2030).

Subsidies and carbon markets can facilitate transition to low emission industry

Most of the costs of emission-reduction measures will be with the industry but it’s not the only source of funding. Subsidies can alleviate some of the cost, facilitate innovation and lead to broader adoption of technologies, which is, for example, illustrated by the government involvement in the development of agricultural biogas installations in Denmark. There is a clear incentive to provide support because governments have signed up for global carbon and methane reduction targets. As a result, both the EU’s Common Agricultural Policy and the Inflation Reduction Act in the US include significant funds for farmers to reduce emissions. Policymakers are also looking at the regulatory framework, for example through the EU’s work on a carbon farming initiative, and could consider including food manufacturers in emission trading systems in the future.

Markets can provide another part of the funding for on-farm measures once farmers are able to get their efforts verified and sell emission reduction certificates on voluntary or mandatory carbon markets. These developments are of great interest to meat and dairy companies because the outcome can trigger additional opportunities to reduce scope 3 emissions and set the sector on a net zero pathway towards 2050.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article