The return of US corporate pricing power

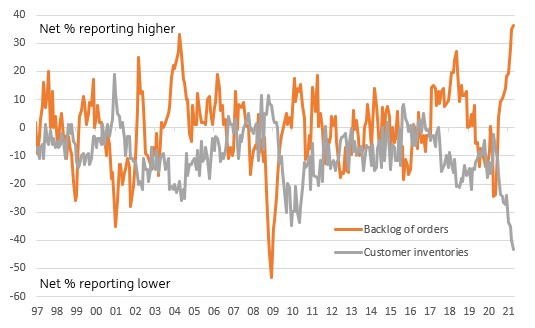

US manufacturers are being flooded with orders and are struggling to cope. Auto makers are particularly hard hit as they are accutely suffering from the global semi-conductor chip shortage. With order backlogs surging and customer inventories at record lows we are increasingly confident that corporate pricing power is back

Companies are putting money to work

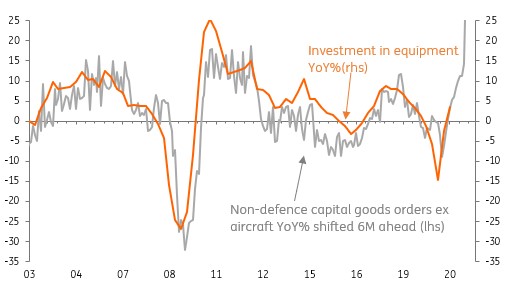

US durable goods orders may have dropped 1.3% month-on-month in April versus expectations of a 0.8% rise, but we aren’t especially worried by this given the weakness is concentrated in transport, which has very specific issues. Moreover, “core” non-defence capital goods orders excluding aircraft rose 2.3% MoM versus expectations of a 1% gain and there were also upward revisions. This is the most important component as it is a good barometer for investment spending and supports a bullish 2Q GDP number (see chart below).

Investment outlook on the up

Transport has particular difficulties

We knew that transportation was going to be a drag (-6.7% MoM) given the widely publicized difficulties in the auto sector. The global semi-conductor chip shortage has seemingly had a disproportionately large impact on the auto sector given highly efficient just-in-time inventory management – which works fine when you can get hold of your components easily, but less well, when there are major supply bottlenecks. If you can’t get your chips then the knock-on effect is you order fewer components such as engine components, wheels, etc.

Corporate pricing power = inflation

The rest of the US economy appears under less strain for now and with the ISM new orders component remaining well above 60 the outlook remains very encouraging.

Nonetheless, the inflation threat is never far away with unfilled non-transportation orders continuing to rise sharply. This is also reflected in the ISM report whereby the backlog of orders are rising at record rates with new orders continuing to come in rapidly. At the same time companies know their customer inventories are at record lows. This underscores a point that we repeatedly make – corporate pricing power is back!

Manufacturers have full orders books and know their customers are desperate = higher prices

Jobs market

Meanwhile, jobless claims trended down further to 406k from 444k (consensus 425k) as firms look to hire rather than fire. There is no reason to expect these downward moves to end given the re-opening while the cessation of the Federal unemployment benefit payment in 23 states next month will further incentivise the hunt for jobs. Nonetheless, with many schools still on remote and the summer vacation coming up, meaning parents needing to stay home, the jobs market may not loosen much before September. The implication is that if companies want to expand and hire they are going to have to pay up for workers.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article